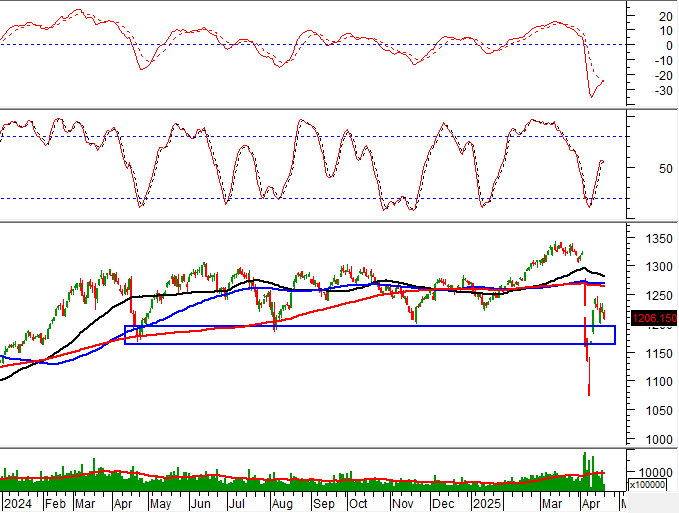

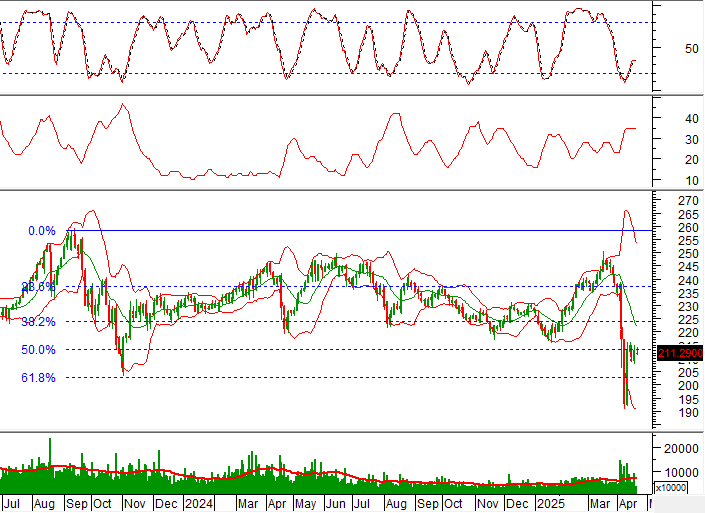

Technical Signals for the VN-Index

During the trading session on the morning of April 21, 2025, the VN-Index witnessed a decline, accompanied by a slight drop in trading volume. This cautious sentiment among investors is reflected in the modest decrease in trading activity.

Additionally, the Stochastic Oscillator indicator has turned bearish again, suggesting a potential deterioration in market conditions.

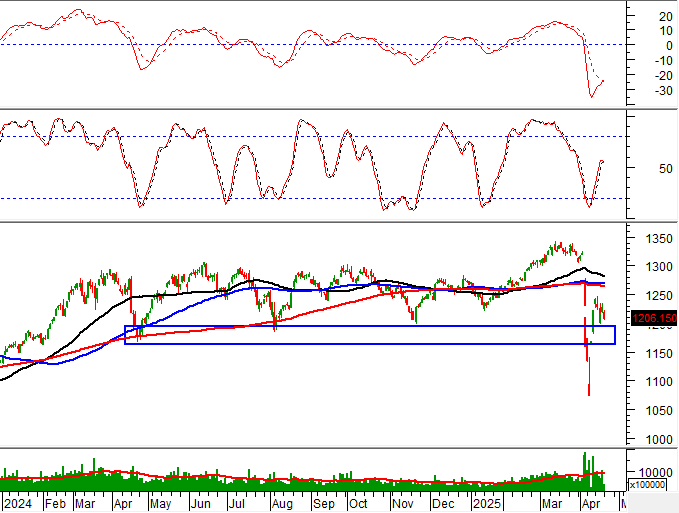

Technical Signals for the HNX-Index

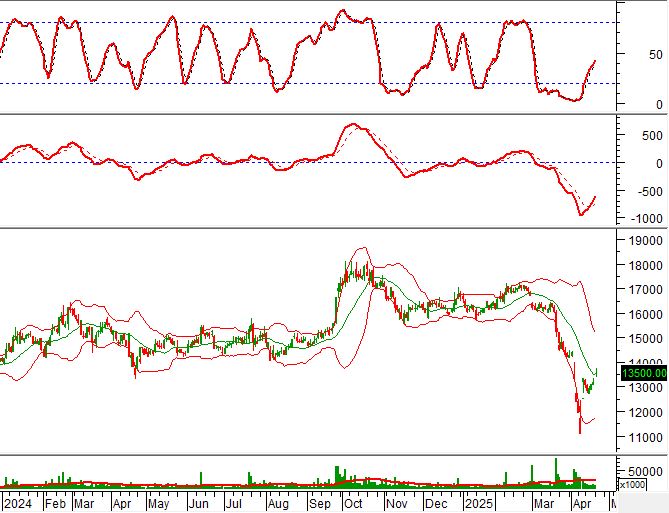

On April 21, 2025, the HNX-Index experienced a decrease in points, along with a significant drop in liquidity during the morning session. This indicates that investors are exercising caution in their transactions.

At present, the HNX-Index is retesting the Fibonacci Retracement 50% threshold (equivalent to the 210-215-point region) while the MACD indicator is gradually narrowing its gap with the signal line after previously giving a sell signal. Should a buy signal emerge, and the index successfully surpasses this resistance level, the recovery momentum could persist in subsequent sessions.

NVL – No Va Real Estate Investment Group Joint Stock Company

On the morning of April 21, 2025, NVL witnessed a price increase, forming a candle pattern resembling a White Marubozu, accompanied by a significant surge in trading volume that exceeded the 20-session average. This indicates heightened investor participation.

Presently, the stock price is retesting the group of SMA 50 and SMA 100-day moving averages, while the MACD indicator continues to widen its gap with the signal line after previously giving a buy signal. Should the stock price successfully breach this resistance level, a recovery scenario could unfold in the upcoming sessions.

TPB – Tien Phong Commercial Joint Stock Bank

During the morning session of April 21, 2025, TPB witnessed a price increase, forming a Rising Window candlestick pattern, along with a notable surge in trading volume, expected to surpass the 20-day average by the session’s end. This improvement in investor sentiment is reflected in the increasing trading activity.

Furthermore, the stock price is testing the Middle Band of the Bollinger Bands indicator, while the Stochastic Oscillator continues its upward trajectory after providing a buy signal previously. Should the stock price successfully breach this resistance level, the recovery trend may extend into the following sessions.

Technical Analysis Team, Vietstock Consulting Department

– 12:05, April 21, 2025

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.

The Heir Apparent’s New Move

“In a recent development, Bui Cao Nhat Quan, the son of Novaland’s Chairman Bui Thanh Nhon, has registered to sell over 2.9 million NVL shares for personal reasons. This news comes as Novaland faces the task of repaying two bond batches, totaling over VND 1,200 billion in principal and interest. As the company navigates these financial obligations, the sale of a significant number of shares by a key insider has sparked interest within the investment community.”

Market Beat: Foreign Investors Exit FPT, Leaving the Market in the Red

The market closed with the VN-Index down 6.34 points (-0.48%) to 1,324.63, while the HNX-Index fell 1.75 points (-0.71%) to 245.28. The market breadth tilted towards decliners with 466 losers and 300 gainers. The large-cap stocks in the VN30 basket painted a similar picture, with 20 stocks declining, 8 advancing, and 2 unchanged.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)