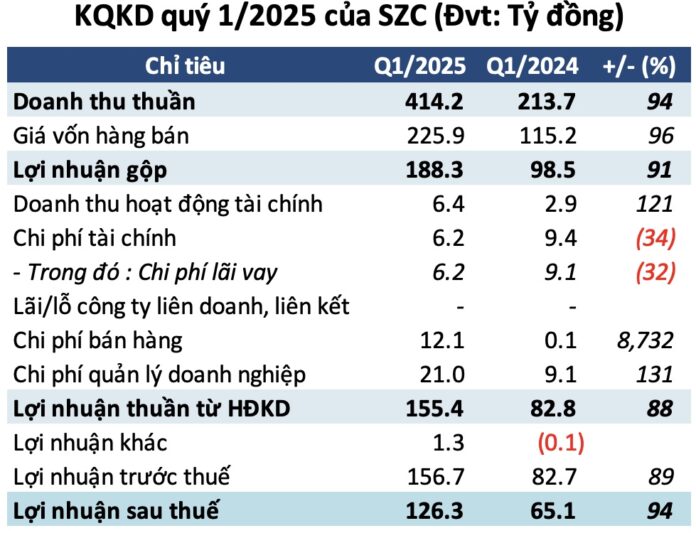

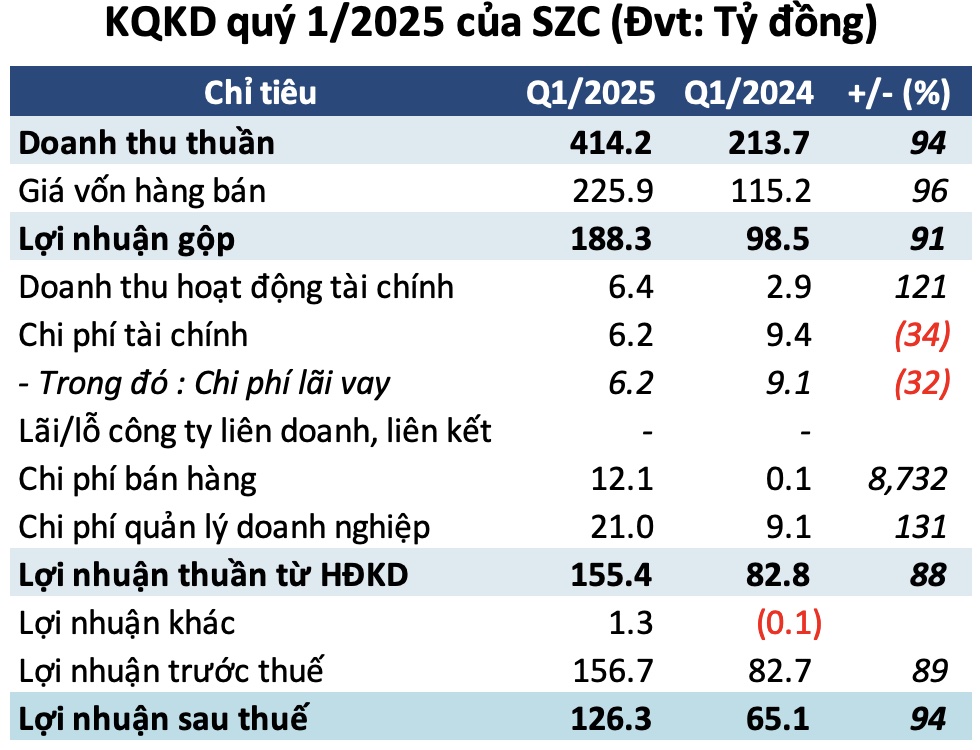

**Sonadezi Chau Duc: Strong Revenue Growth from Land Leasing and Management Fees**

The company reported robust business performance with revenue growth attributed to land leasing and management fees totaling over VND 394 billion, double that of the previous year. This stream also serves as the primary revenue source for SZC.

Despite a significant increase in total expenses, exceeding VND 39 billion, more than double that of the same period last year, the gross profit remained impressive at over VND 188 billion for SZC.

Source: VietstockFinance

|

For 2025, the company aims for a revenue target of nearly VND 931 billion, a 2% increase over the 2024 performance. Meanwhile, the after-tax profit goal remains unchanged from the previous year at over VND 302 billion. The industrial land leasing segment continues to be the mainstay, with expected revenue of over VND 748 billion. The domestic real estate business is estimated to bring in VND 78 billion, with the remainder coming from other business activities.

SZC has already achieved 44% and 42% of these targets, respectively, in the first three months of the year.

The company plans to invest nearly VND 438 billion in construction this year. Of this, VND 167 billion will be allocated to upgrade and develop industrial park infrastructure. In the field of urban real estate, SZC will spend approximately VND 271 billion to continue improving technical infrastructure in the Sonadezi Huu Phuoc residential area.

As of the first quarter, SZC’s total assets exceeded VND 8,012 billion, a 3% decrease from the beginning of the year. Notably, cash and cash equivalents experienced a deep decline of 47%, settling at over VND 371 billion. Inventories amounted to over VND 1,758 billion, a 1% increase, mainly comprising production and business costs in progress in the Chau Duc urban area, totaling over VND 1,518 billion, and the Huu Phuoc residential area, with over VND 182 billion.

Construction work in progress stood at over VND 3,276 billion, a 4% increase, mainly attributed to the Chau Duc industrial park project, amounting to over VND 3,227 billion, encompassing compensation costs for site clearance, construction consulting fees, and construction investment project execution costs.

Payables stood at over VND 4,780 billion, a 7% decrease from the beginning of the year. Financial debt accounted for VND 2,039 billion, a 13% reduction, representing 43% of total debt. The amount received from customers in advance and unearned revenue exceeded VND 763 billion, a 22% decrease, making up 16% of total debt.

– 19:00 21/04/2025

VIX Securities Reports Q1 Profits, Surging 230% Year-over-Year

The VIX Joint Stock Securities Company (VIX) has released its Q1/2025 financial report, showcasing impressive performance and positive highlights.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The Ultimate Guide to SCIC’s Upcoming Divestment Auction of Duoc Khoa Pharmacy Chain

On December 6, the State Capital Investment Corporation (SCIC) announced its decision to approve the sale of its shares in DK Pharma, a leading pharmaceutical company in Vietnam.