I. VIETNAM STOCK MARKET WEEK 14-18/04/2025

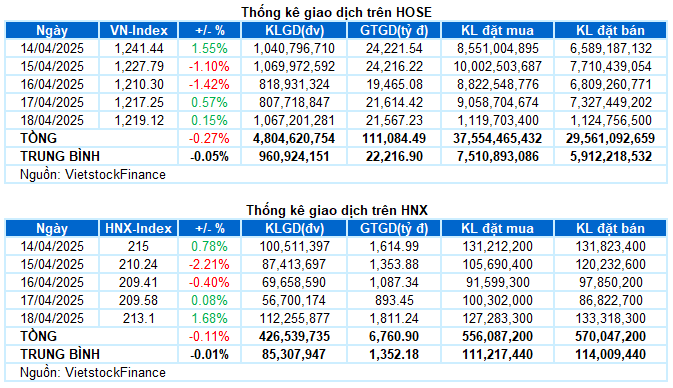

Trading: At the end of the 18/04 session, the VN-Index slightly increased by 0.15% compared to the previous session, closing the week at 1,219.12 points; HNX-Index reached 213.1 points, up 1.68%. For the whole week, VN-Index decreased by a total of 3.34 points (-0.27%), and HNX-Index also slightly decreased by 0.24 points (-0.11%).

The Vietnamese stock market experienced a volatile trading week. After rebounding to the resistance zone around 1,240 points at the beginning of the week, the VN-Index faced adjustment pressure again with a clear differentiation among stock groups. Investor sentiment gradually became more cautious after the previous strong recovery, causing market liquidity to drop significantly. Despite the breakthrough effort in the last session, the VN-Index could not maintain its excitement until the end of the session, closing the week at the threshold of 1,219.12 points, down 0.27% compared to the previous week.

In terms of impact, the massive profit-taking pressure on the duo of VIC and VHM pulled back nearly 6 points of the VN-Index in the last session. Meanwhile, the efforts of SHB, FPT, and VPB helped the general index increase by more than 2 points, while the remaining stocks had an insignificant impact.

Although the index’s gain was significantly narrowed, most sectors still managed to stay in the green in the last session. Information technology and telecommunications led the pack thanks to the strong recovery of FPT (+2.01%), CMG (+3.83%); VGI (+2.99%), CTR (+3.62%), ELC (+2.69%), TTN (+2.56%), and ICT (+4.62%).

The essential consumer goods, energy, and non-essential consumer goods sectors also recorded an increase of more than 1%, notably with significant demand for stocks such as MSN (+1.22%), VNM (+1.07%), VHC (+4.58%), ANV (+2.69%), DBC (+2.29%), SBT (+5.64%), PVS (+2.36%), GEX (+4.56%), GEE (+4.58%), PNJ (+3.87%), and FRT (+2.45%).

In contrast, real estate was the only group dominated by red, losing more than 2% due to heavy pressure from “big guys” such as VIC falling to the floor, VHM (-3.17%), NLG (-1.41%), and PDR (-0.91%). However, industrial real estate stocks still traded positively with green covering KBC (+1.4%), IDC (+2.25%), SIP (+4.11%), SZC (+0.98%), BCM (+0.93%), NTC (+1.77%), LHG (+3.61%),…

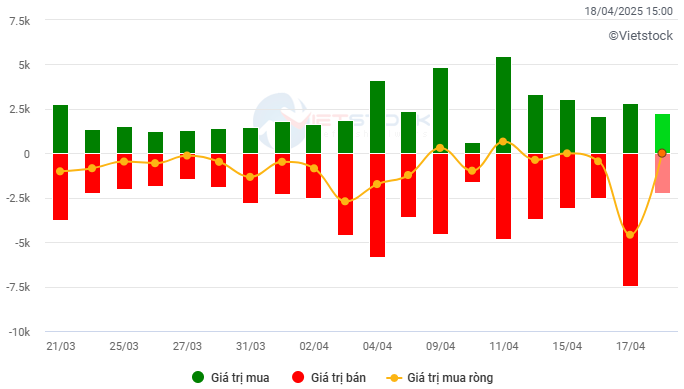

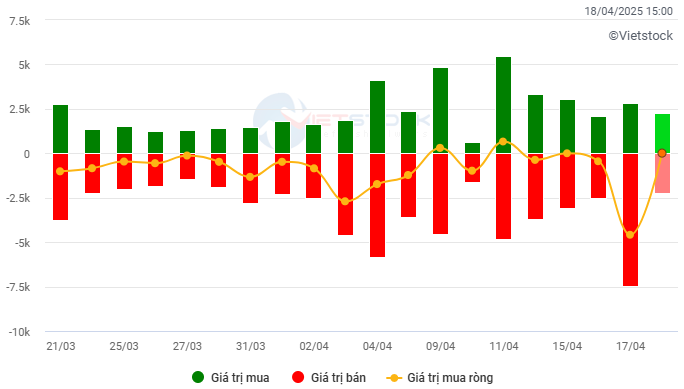

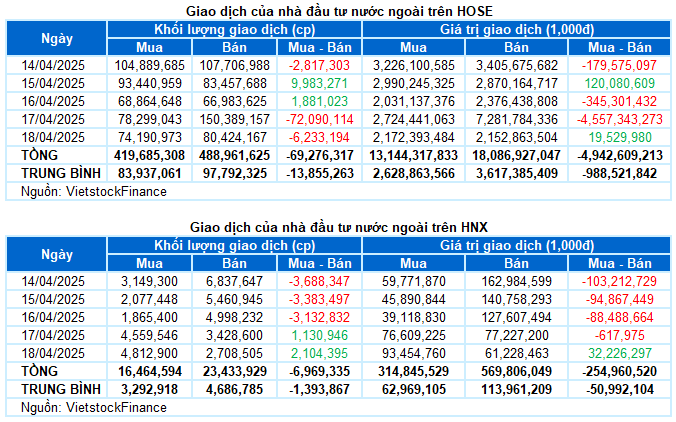

Foreign investors continued to net sell with a value of 5.2 trillion VND on both exchanges last week. Of which, foreign investors net sold nearly 5 trillion VND on the HOSE and 255 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: Billion VND

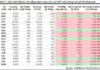

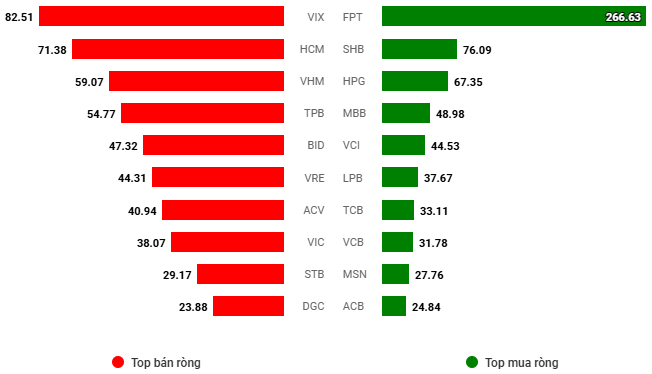

Net trading value by stock code. Unit: Billion VND

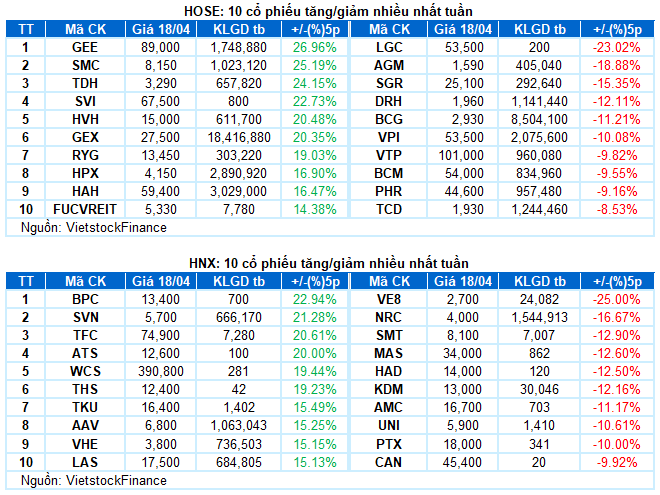

Stocks with outstanding performance last week: GEE

GEE increased by 26.96%: GEE recorded a brilliant trading week with a gain of 26.96%. The stock has mostly surged positively since breaking out of the resistance zone continuously formed in March 2025 (equivalent to the 71,500-75,000 range). At the same time, the trading volume surpassed the 20-day average, indicating strong participation from investors.

However, the Stochastic Oscillator indicator is now deep into the overbought zone. Investors should be cautious if the indicator shows a sell signal again in the future.

Stock with a significant decrease last week: AGM

AGM decreased by 18.88%: AGM stock continued to face strong selling pressure last week with 4/5 sessions in the red. Although it recorded a significant recovery in the last session, the increase was not enough to prevent AGM from having a negative trading week. Moreover, the fact that the stock price continued to plunge to the lowest level since its listing indicates that investor sentiment is becoming very pessimistic.

Currently, the MACD indicator continues to decline after giving a sell signal, suggesting that the short-term adjustment risk remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic & Market Strategy Analysis Division, Vietstock Consulting Department

The Hunt for Shark Money: Proprietary and Foreign Institutions Unite in Buying Spree, but Diverge on VIX

The April 18th session concluded with a net buying consensus from both proprietary securities companies and foreign investors, with respective figures of over VND 261 billion and VND 11 billion. VIX attracted attention as it was the top net buying stock for proprietary firms but led in foreign net selling.

Technical Analysis for the Session on April 21st: Mixed Signals Start to Emerge

The VN-Index and HNX-Index both witnessed declines, alongside a significant dip in trading liquidity during the morning session. This indicates that investors are exercising caution in their transactions.

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).

Market Beat 24/02: VN-Index Surges Past 1,300 Points as Trading Volume Improves

The market closed with strong gains, seeing the VN-Index climb 7.81 points (+0.6%), to finish at 1,304.56; while the HNX-Index rose 0.92 points (+0.39%) to 238.49. It was a relatively balanced session, with 377 advancing stocks against 373 declining ones. The large-cap VN30 basket tilted positively, as 21 stocks added value, 6 declined, and 3 were unchanged, ending the day in the green.