The F&B market in Vietnam, particularly the coffee industry, is entering an exciting and potential development phase. Strategic moves such as expanding store chains, investing in manufacturing plants, and developing experiential store models demonstrate the efforts of domestic and foreign brands to capture market share and make their mark in one of the region’s most dynamic markets.

The number of F&B stores in Vietnam is estimated to reach 323,010 by the end of 2024, a 1.8% increase compared to the previous year. Revenue in the sector is expected to reach VND 688,800 billion, a 16.6% increase from 2023. This growth is reflected in the “Vietnam Food and Beverage Market 2024” report by iPOS.vn in collaboration with Nestlé Vietnam. The report also highlights that although consumer spending has not decreased, there is a growing preference for high-quality options at reasonable prices.

One notable trend is the rise in popularity of matcha drinks among young consumers. According to the report, matcha-based beverages dominate the list of popular drinks. Another survey by Q&Me reveals that Vietnamese frequently visit coffee shops to meet friends (62%), work or study (45%), and relax (38%). The most consumed drinks include iced black coffee, iced milk coffee, and machine-brewed coffee such as latte and cappuccino.

The coffee shop market in Vietnam is highly competitive, with both domestic and international brands vying for a share. Highlands Coffee, with 815 stores in Vietnam and the Philippines, is currently a market leader. Starbucks, which opened its first store in Vietnam in February 2013, now has over 120 stores across 16 provinces and cities. Local brand Trung Nguyên has also experienced significant growth, with 660 stores, including Trung Nguyên E-Coffee and Trung Nguyên Legend Café.

The market has also witnessed the rapid growth of the Katinat chain, expanding from 10 stores in 2021 to nearly 100 stores by the end of 2024, mainly in Ho Chi Minh City and other provinces.

The Vietnamese coffee market, valued at approximately $652.9 million in 2023, is expected to reach $1.1 billion by 2030, growing at a rate of over 8% annually. This, coupled with urban population growth and changing consumer behavior, makes it a lucrative opportunity for large coffee chains, independent coffee shops, and manufacturing businesses. A series of modern factories are being invested in to meet the increasing market demand.

Starbucks is also expanding its presence in Vietnam, with plans to open 10 new stores by June 2025, bringing the total to 135 stores in 19 provinces and cities. Their recent opening of Starbucks Reserve Bitexco in Ho Chi Minh City, a two-story store in the iconic Bitexco Financial Tower, offers a unique coffee experience with a dedicated Reserve coffee bar and a Mixology bar.

Highlands Coffee also inaugurated its new coffee roasting and grinding factory in Ba Ria-Vung Tau province, with an investment of nearly VND 500 billion and an area of nearly 24,000 m2. On the other hand, in March 2025, Trung Nguyên Legend laid the foundation stone for the largest coffee factory in Southeast Asia in Buon Ma Thuot city, marking a significant step forward for the Vietnamese coffee industry.

The New Proposal: A Comprehensive Review of Water Usage and Extraction Fees

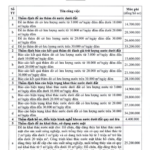

A proposal to increase fees for six water-related services, including extraction and usage, by a significant margin of 40-102%.

The six revenue-enhancing adjustments: Appraisal of groundwater exploration proposals; evaluation of exploration results and groundwater reserve estimates; assessment of current groundwater extraction practices; evaluation of large-scale groundwater drilling qualifications and credentials; appraisal of surface water extraction and utilization proposals; and finally, the appraisal of seawater extraction and utilization plans.

“Looking Back and Leaving a Legacy: A Journey Through TA’s Emotional Storytelling”

“TA nhìn lại & để lại” offers a glimpse into the life and legacy of Trần Mộng Hùng, the founder of ACB Bank. This exhibition is not just a showcase of artifacts and memories; it is an emotional journey that brings to life the stories, priceless possessions, and enduring legacies that shaped the bank’s growth and development.

The US Retaliates with a 46% Tariff: What Does This Mean for Vietnam’s Inflation, Exchange Rates, Interest Rates, and Banking Sector?

I predict that inflation will remain within the government’s target and that it will be manageable. This provides a solid foundation and opportunity for the State Bank to harmonize its control tools.