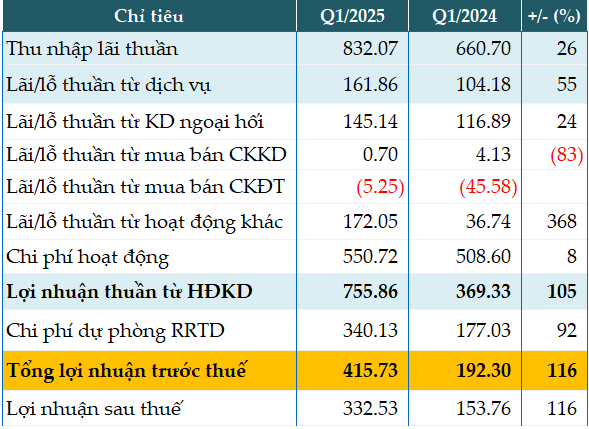

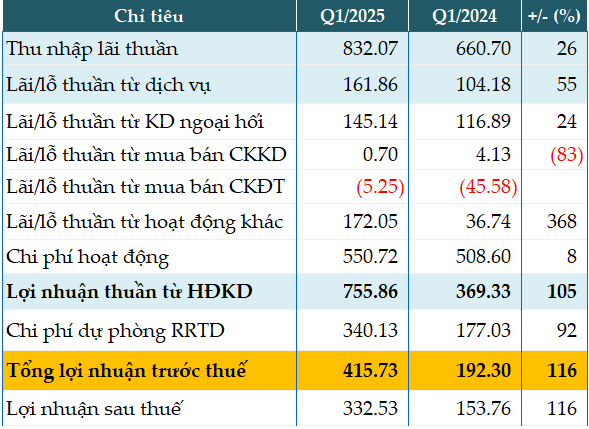

ABBank’s main source of revenue for the first quarter increased by 26% year-on-year, with net interest income reaching over VND 832 billion.

Non-interest income also grew, including service income (+55%), foreign exchange trading income (+24%), and other operating income, which quadrupled.

Additionally, operating expenses rose by only 8% to VND 551 billion, resulting in a net profit from business operations of nearly VND 756 billion, double that of the previous year.

In the first quarter, the bank set aside more than VND 340 billion for credit risk provisions and debt purchases from VAMC, a 92% increase. Despite this, ABBank still reported a pre-tax profit of nearly VND 416 billion, more than double that of the same period last year.

Compared to the full-year target of VND 1,800 billion in pre-tax profit, ABBank has achieved over 23% of its goal in just three months.

Pham Duy Hieu, CEO of ABBank, shared: “The first quarter of 2025 showed a positive improvement for ABBank compared to the previous year. The bank continues to maintain a stable and sustainable development orientation, and the pace of business results growth will be promoted in the following quarters.”

|

ABBank’s Q1/2025 business results. Unit: VND billion

Source: VietstockFinance

|

Total assets as of the end of Q1 increased by 4% from the beginning of the year to VND 183,753 billion. Specifically, deposits at the SBV increased by 49% (VND 3,967 billion), and deposits at other credit institutions rose by 11% (VND 48,630 billion). Customer loans and deposits remained stable at approximately VND 98,044 billion and VND 89,748 billion, respectively. The capital adequacy ratio (CAR) stood at 10.46%.

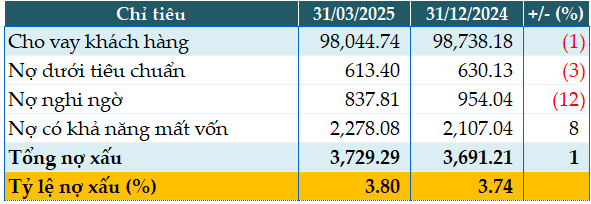

As of March 31, 2025, ABBank’s total bad debt was VND 3,729 billion, a slight increase of 1% from the beginning of the year. The bad debt ratio increased from 3.74% to 3.8%, while the bank’s bad debt ratio was 2.44%.

|

ABBank’s loan quality as of March 31, 2025. Unit: VND billion

Source: VietstockFinance

|

– 12:07 01/05/2025

The Pen Is Mightier: Crafting a Compelling Headline

“DIG Uncovers a Hole in Q1”

After incurring a record loss of over VND 117 billion in Q1 2024, the Construction Development Investment Corporation (DIC Corp, HOSE: DIG) reported another quarterly loss in the first quarter of 2025, despite a significant improvement in revenue.

Coteccons Bags 250 Billion VND Profit in 9 Months of FY 2025, Secures 23 Trillion VND in Contracts

Impacted by the global economic fluctuations, Coteccons Construction Joint Stock Company (HOSE: CTD) witnessed a 46% decline in its profit for the third quarter of the financial year 2025. However, for the first nine months, Coteccons posted a profit of VND 255 billion, a 6% increase compared to the same period last year.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)