## REE’s Q1 2025 Financial Results: A Strong Start to the Year

|

A snapshot of REE’s Q1 2025 performance

Source: VietstockFinance

|

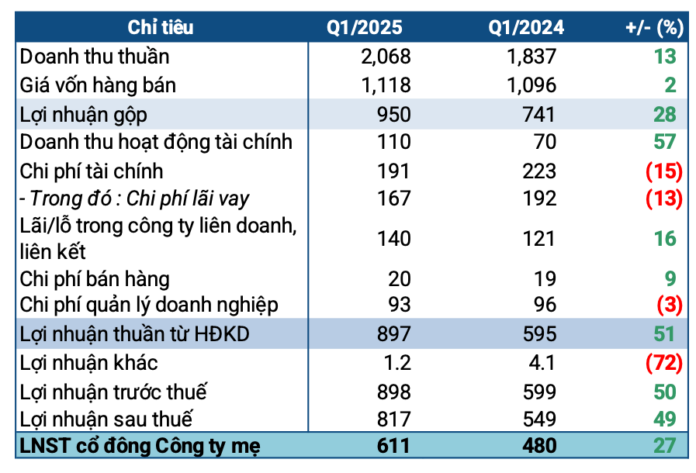

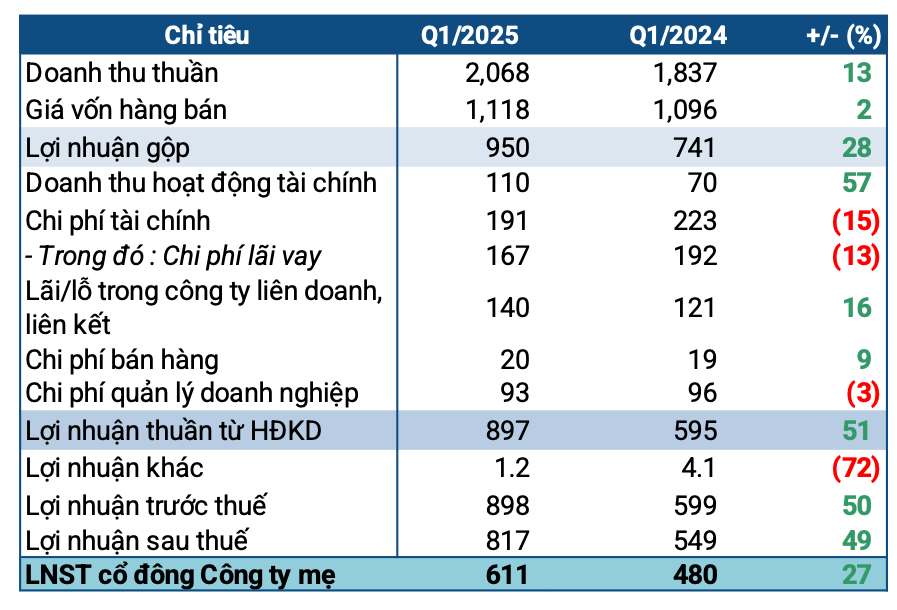

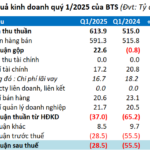

For the first quarter, REE recorded impressive figures with consolidated revenue reaching nearly VND 2,070 billion, a 13% increase compared to the same period last year. Meanwhile, cost of goods sold only rose by 2%, resulting in a substantial 208% surge in gross profit to VND 950 billion.

Other key indicators also showcased positive trends, as financial revenue climbed by 57% to VND 110 billion, and financial expenses decreased by 15% to VND 191 billion. Profit from associated companies witnessed a healthy 16% increase to VND 140 billion.

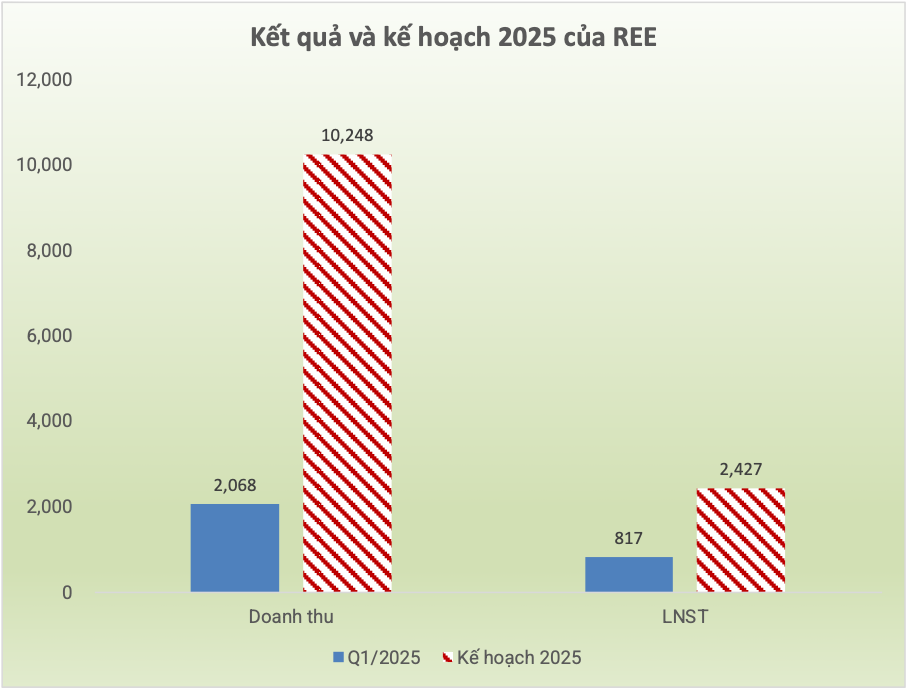

Ultimately, the company posted a net profit of VND 611 billion, reflecting a notable 27% improvement year-on-year. In relation to the targets approved at the 2025 Annual General Meeting of Shareholders, REE has accomplished 20% of its revenue goal and nearly 34% of its after-tax profit plan.

Source: VietstockFinance

|

According to REE, the robust profit growth was predominantly driven by the electricity sector, largely attributed to the performance of subsidiary companies such as Vinh Son – Song Hinh Hydropower Joint Stock Company (HOSE: VSH) and Thuy Dien Mien Trung Joint Stock Company (HOSE: CHP). A closer look at the numbers reveals that REE’s electricity infrastructure segment contributed VND 413 billion in net profit for the quarter, marking a significant 73% jump compared to the previous year.

In the real estate sector, REE reported a setback in the rental property segment during the period, mainly due to the operation of the e.town 6 building, where operating costs exceeded revenue as it is still in the process of filling up.

As of the end of the first quarter, REE’s total assets stood at nearly VND 36,900 billion, a slight increase from the beginning of the year. Short-term assets accounted for nearly VND 12,000 billion, a 5% rise, while cash and cash equivalents remained stable at nearly VND 6,000 billion. Inventories increased by 8% to nearly VND 1,400 billion, mostly comprising production and business costs in progress.

On the liabilities side, total liabilities decreased slightly to nearly VND 13,700 billion, the majority of which were long-term liabilities. Short-term liabilities also witnessed a minor decline to nearly VND 4,000 billion, including over VND 1,260 billion in bank loans. With cash holdings surpassing short-term liabilities, there are no concerns regarding the company’s debt repayment capability.

Chau An

– 08:59 01/05/2025

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

Unveiling Vinhomes Wonder City: Vinhomes’ Q1 Net Profit Triples Year-on-Year

The launch of Vinhomes Wonder City in Hanoi’s west has seen Vinhomes Joint Stock Company (HOSE: VHM) kick off 2025 with a bang, posting a impressive net profit of nearly VND 2.7 trillion.

The Power of Persuasive Writing: Crafting Captivating Content for the Win

At the recent 2025 Annual General Meeting (for the 2024 financial year), held on the morning of April 29th, Gia Lai Electricity Joint Stock Company (HOSE: GEG) revealed ambitious growth plans. The company also announced its first-quarter financial statements for 2025, showcasing a significant improvement. This impressive performance is attributed to successful electricity price negotiations, with an astounding 89% of the annual profit plan achieved in just one quarter.

The Art of Crafting Profitable Headlines: “Unraveling the Mystery Behind Vinaconex’s Narrow Gross Profit Margin in Construction”

On the morning of April 21, Vinaconex, a leading Vietnamese construction and trading company listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol VCG, held its annual general meeting for the year 2025. The key agenda items included discussing the company’s business plan, dividend distribution, capital increase, and the election of additional members to the board of directors.