Government Clears Land Fund Payment Obstacles for CII and Dai Quang Minh’s BT Projects in Thu Thiem

According to CII, the company has received questions from shareholders regarding the impact of Decree 91 on their business operations. CII assures that they will be approved as the investor for the real estate projects on the land lots assigned per the contract between CII and HCMC’s People’s Committee on April 9, 2015 (contract 1886/HĐ-UBND).

For the land lots used as payment corresponding to the BT volumes completed by CII in the project of constructing technical infrastructure for the northern residential area and completing the North-South road axis (referred to as BT Thu Thiem), the value of these land lots is determined based on the prices at the time of signing the abbreviated contract, i.e., applying land prices as of April 2015.

For the remaining area stipulated in the contract (after deducting the land area used for payment for the volumes completed by CII in the BT Thu Thiem project), CII will fulfill its obligation to pay land use fees based on the prices determined at the time of signing the contract between HCMC’s People’s Committee and the company (contract 1802/HĐ-UBND), specifically applying land prices as of April 2016, and other related financial obligations (if any). After fulfilling these obligations, CII will proceed with developing real estate projects on the assigned land.

Previously, in the information disclosed on April 28, 2024, CII also assessed that Decree 91 of the Government had helped remove important obstacles for CII to continue implementing the BT project, receiving the land fund as per the signed contract to develop real estate projects.

According to the BT contract between HCMC’s People’s Committee and CII, the company was assigned and leased nine land lots with a total area of nearly 96,132m2 in the new urban area of Thu Thiem. Of these, CII has completed the exploitation of three land lots with a total area of over 35,952m2, known as the trio of projects: Lakeview 1, Lakeview 2, and The River Thu Thiem; and one land lot of nearly 9,474m2, with a commercial name of D’Verano, has been 90% invested.

In addition to the above projects, CII also has several projects in the new urban area of Thu Thiem in the investment preparation phase, including Lakeview 4 (lot 4.8), D’Vernal (lot 3.6), Riverfront Residence (lot 3.13), The River 2 (lot 3.16), and a commercial project on lot 1-18.

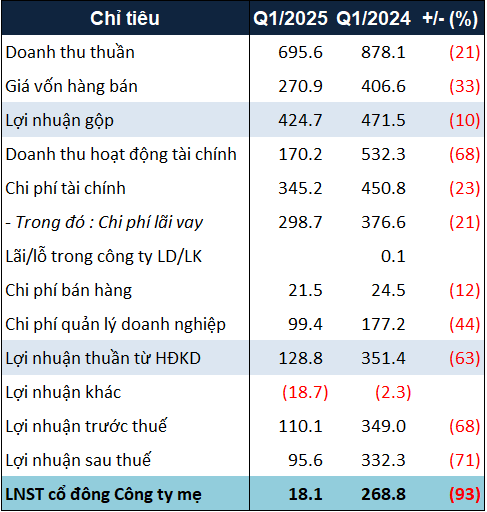

Q1/2025 Net Profit Down by 93%

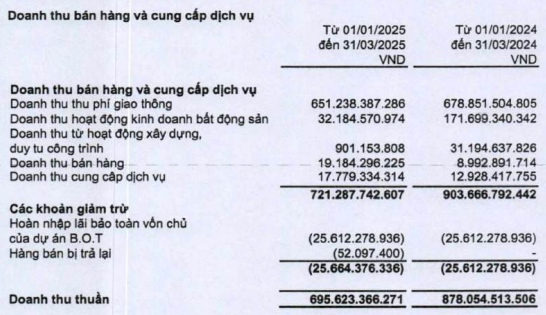

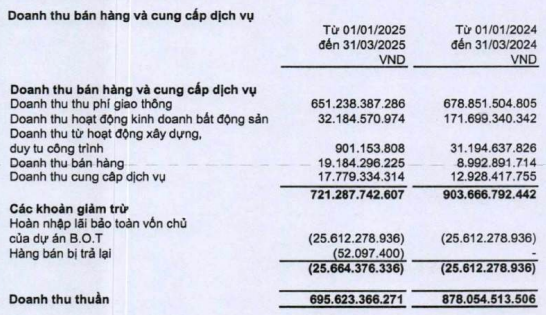

In terms of business results, CII had a lackluster start to 2025, with a 21% year-on-year decrease in Q1/2025 net revenue to VND696 billion. This was mainly due to an over 81% drop in real estate business revenue to just over VND32 billion.

|

Breakdown of CII‘s net revenue in Q1/2025

Source: CII

|

Not only net revenue but financial revenue also decreased by 68% to over VND170 billion. It is known that in Q1/2024, CII recorded a revaluation gain of over VND430 billion from the consolidation of its subsidiary, Nam Bay Bay Investment Joint Stock Company (HOSE: NBB).

A bright spot in this period is that CII reduced financial expenses by 23% and management expenses by 44% thanks to optimizing interest rates on credit amounts and reducing interest expenses on convertible bonds, as well as commercial loss assessment expenses at the subsidiary level recognized in Q1/2024.

Nevertheless, CII posted a net profit of just over VND18 billion in the first quarter of 2025, down 93% year-on-year. This profit level only achieved about 5% of the target of VND335 billion set for 2025.

|

Business results of CII in Q1/2025. Unit: VND billion

Source: VietstockFinance

|

Ha Le

– 7:00 PM, May 7, 2025

“Manufacturer of Pliers Pays 50% Cash Dividend”

Joint Stock Company MEINFA (UPCoM: MEF) has announced a dividend payout for the fiscal year 2024. Shareholders on the record date of May 15, 2025, will be eligible for a cash dividend of 50%, equivalent to VND 5,000 per share.

Coteccons Bags 250 Billion VND Profit in 9 Months of FY 2025, Secures 23 Trillion VND in Contracts

Impacted by the global economic fluctuations, Coteccons Construction Joint Stock Company (HOSE: CTD) witnessed a 46% decline in its profit for the third quarter of the financial year 2025. However, for the first nine months, Coteccons posted a profit of VND 255 billion, a 6% increase compared to the same period last year.

Is FECON’s 200 Billion Profit Goal at Risk Due to Consecutive Losses in the First Quarter?

FECON Corporation (HOSE: FCN) reported a 34% increase in revenue for the first quarter of 2025, however, the company still incurred a loss of VND 7 billion, marking the second consecutive quarter of losses as financial expenses continue to weigh heavily. This puts the company’s target of VND 200 billion in profits for the year at a more challenging position.