SSI Research has provided an update on the outlook for Vietnam’s banking sector, highlighting the potential impact of escalating trade tensions on foreign direct investment (FDI). This segment has been a stronghold for state-owned commercial banks, offering a robust low-cost current account and savings account (CASA) base, as well as a source of USD funding.

NON-PERFORMING LOAN RATIO PEAKS IN THE FIRST HALF OF 2025 BEFORE SUBSIDING

With the government targeting an ambitious 8% GDP growth rate for 2025, banks have accelerated credit disbursements since the beginning of the year. Notably, state-owned commercial banks recorded impressive credit growth of +3.3% compared to the end of 2024, representing an 18% year-over-year increase. This contrasts sharply with the relatively slow growth observed in the previous year (+1% from the beginning of the year, +11% year-over-year). This expansion is partly attributed to their increased market share in the retail segment.

Meanwhile, joint-stock commercial banks witnessed a 3.6% growth from the start of the year, translating to a 21% year-over-year increase. Their credit growth was primarily driven by working capital demands from businesses in the real estate, manufacturing, logistics, and automotive sales and repair sectors, as well as the securities industry.

Specifically, loans to real estate investors have increased by over 10% at several banks, including TCB (+14.8%), MBB (+12.2%), HDB (+12.3%), and MSB (+10%). There has also been a significant rise in lending to securities companies, with TPB, VIB, VPB, MSB, and MBB collectively disbursing VND 20.5 trillion in Q1/2025, compared to VND 18.8 trillion in the previous quarter.

Among the banks involved in mandatory transfers, credit growth before selling off loans to weaker banks was relatively high in Q1/2025: VCB (+4.7% from the beginning of the year), MBB (+6.4%), and VPB (+8%). However, HDB’s credit growth fell short of expectations, reaching only +1.2% from the start of the year, mainly due to a decline in UPAS LC (-61%).

Asset quality remains under pressure due to the lack of significant progress in resolving legal issues surrounding unfinished real estate projects and the subdued liquidity in Ho Chi Minh City’s real estate market during Q1/2025.

Consequently, some real estate buyer loans have been reclassified as non-performing at a few joint-stock commercial banks. This reflects buyers’ reluctance to repay loans when project delivery timelines remain uncertain, and investors’ challenges in selling their properties amid subdued market liquidity, particularly in Ho Chi Minh City.

State-owned commercial banks, on the other hand, faced challenges with loan restructuring for businesses in the construction materials sector.

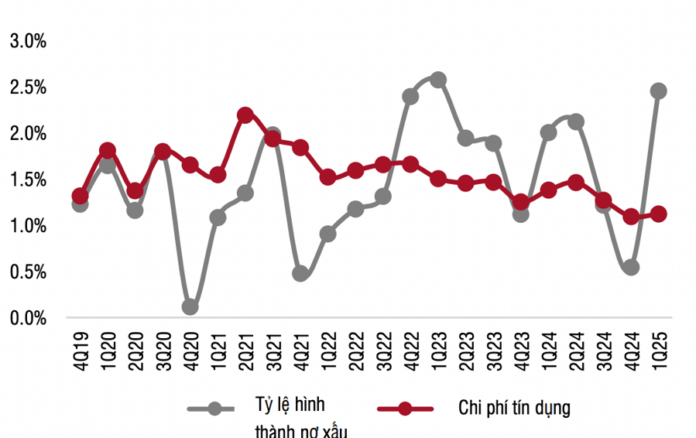

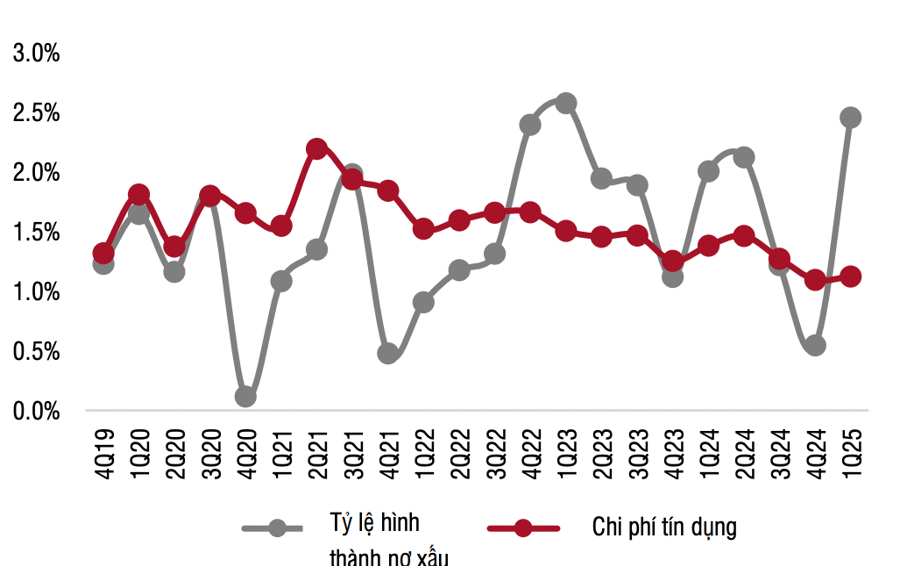

As a result, the non-performing loan ratio for the banks under review increased to 2.46% (compared to 0.55% in Q4/2024), approaching the peak of 2.58% in Q1/2023. Overdue loans rose by 11.6% from the previous quarter, driven by increases in both Group 2 (+2.8%) and non-performing loans (+20.4%). ACB (-1 basis point compared to the previous quarter) and MSB (-8 basis points) were exceptions, as they witnessed slight improvements in asset quality.

Notably, banks were not overly proactive in making provisions for bad debts during the quarter, despite the decline in asset quality, as reflected by the disconnect between the pace of non-performing loan formation and credit costs.

Typically, non-performing loan formation ratios increase in the first quarter after improving in the fourth quarter. However, given the low-interest-rate environment and customer support initiatives implemented by banks, SSI Research anticipates that the non-performing loan ratio will peak in the first half of 2025 before improving in the latter half of the year.

NET INTEREST MARGIN UNDER PRESSURE FOR STATE-OWNED COMMERCIAL BANKS

Net interest margin (NIM) is under pressure due to intense competition in the market. NIM declined to 3.16% (-44 basis points year-over-year, -22 basis points quarter-over-quarter) – the lowest level since 2016-2017. Since the end of 2023, state-owned commercial banks and foreign banks have introduced multiple lending packages with attractive interest rates, forcing joint-stock commercial banks to follow suit to remain competitive in lending rates.

Consequently, the average asset yield for the banks under review decreased to 6.27% in Q1/2025 (-71 basis points year-over-year, -27 basis points quarter-over-quarter).

State-owned commercial banks, benefiting from their strong foundations and capital structures, were less affected by the interest rate competition compared to medium-sized joint-stock commercial banks. While initially impacted, large-scale joint-stock commercial banks optimized their cost of funds (CoF) by leveraging their solid customer base and introducing attractive deposit products with competitive interest rates.

As a result, the decline in NIM in Q1/2025 was less pronounced between state-owned commercial banks (-46 basis points year-over-year) and large-scale joint-stock commercial banks (-40 basis points), while medium-sized joint-stock commercial banks experienced a more significant drop (-61 basis points).

Moving forward, SSI Research identifies two key factors that will influence the NIM trajectory for banks: First, a shift in the competitive landscape in the event of escalating trade tensions. Should trade tensions rise, the FDI segment, which has been a stronghold for state-owned commercial banks due to their CASA and USD funding advantages, may come under pressure.

In this scenario, the capital advantage of state-owned commercial banks would be partially offset, potentially narrowing the cost of capital gap between these banks and large-scale joint-stock commercial banks.

Second, the expiration of promotional interest rates on home loans: A wave of home lending with attractive interest rates began around Q3/2023 and peaked in mid-2024. These loans typically offer promotional interest rates for 1-3 years.

As a result, many of these loans are expected to transition from promotional interest rates to floating rates towards the end of 2025. This could provide support for NIM recovery, particularly for banks like BID, CTG, TCB, MBB, and ACB, as loans move from the promotional rate period to floating rate periods.

Escalating trade tensions could reshape the business environment and alter the competitive landscape in the industry. SSI mentions the possibility of adjusting certain assumptions, including lowering NIM (for most banks, except MBB, VPB, and TPB), increasing credit costs (for CTG), reducing fee income assumptions for state-owned commercial banks, and reducing operating cost forecasts for joint-stock commercial banks.

In this context, SSI Research maintains a preference for banks with strong capital buffers, stable funding sources, and diverse income structures – particularly those with moderate exposure to import-export lending. TCB, MBB, and CTG are the top picks for the second half of 2025.

The Fed’s Rate Cut: A Catalyst for Vietnam’s Monetary Policy Shift?

If the Fed cuts interest rates two to three times this year, the State Bank could reduce its operating interest rates by 25 basis points in Q3 2025 to stimulate credit growth and support the GDP growth target.

The Race for Industrial Land: Vietnam’s $30 Billion FDI Attraction by 2025

The Ministry of Finance’s Statistics Bureau has revealed that foreign investment (FDI) into Vietnam reached an impressive $6.9 billion in the first two months of 2025, a 35.5% increase compared to the same period last year. This surge in FDI not only fosters sustainable economic growth but also positions Vietnam as a powerhouse for high-tech manufacturing in the region.