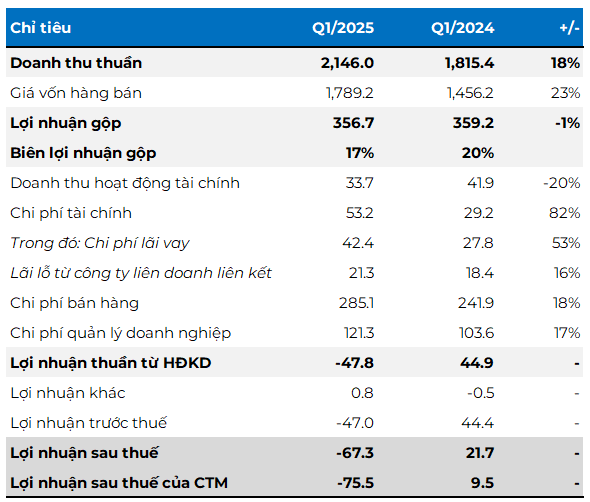

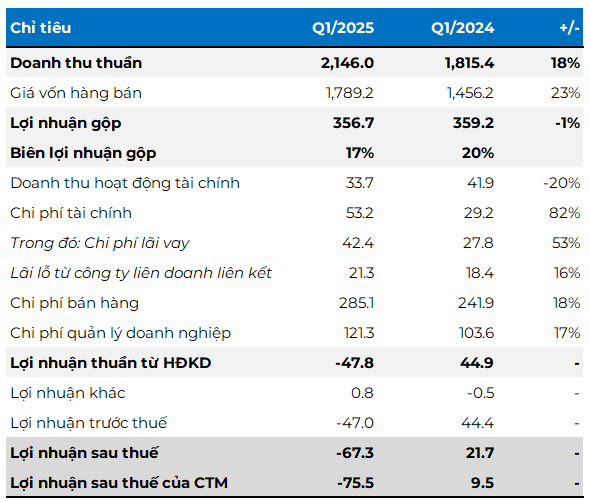

The food industry giant’s recently released financial report reveals impressive growth, with a remarkable 18% year-over-year increase in revenue for the first quarter, totaling VND 2,150 billion.

A deeper look into their performance shows that the cooking oil segment remains their stronghold, contributing VND 1,674 billion, a substantial 78% of their total revenue. The food segment follows closely, accounting for VND 402 billion, equivalent to 19% of the total revenue, with the remaining coming from other business lines.

KIDO’s Q1/2025 Financial Results

Unit: Billion VND

Source: VietstockFinance

|

Despite the significant revenue growth, the company incurred a net loss of nearly VND 76 billion. This was primarily due to a decline in profit margins and a substantial increase in expenses, notably interest and selling expenses.

“Market fluctuations have impacted our business,” the company stated in their quarterly report.

The group has yet to announce their business plan for 2025 and is expected to hold their Annual General Meeting of Shareholders on June 5th in Ho Chi Minh City.

– 6:00 PM, May 7, 2025

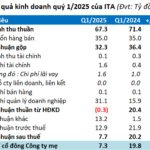

“ITA Turns a Profit with Alternative Income Streams, Points Finger at HOSE and SSC”

In the first quarter of 2025, Tan Tao Investment and Industry Corporation (UPCoM: ITA) managed to escape losses thanks to income from other sources, even as its core business operations continued to lag. This performance underscores the mounting challenge of achieving the company’s full-year profit target of VND 234 billion.

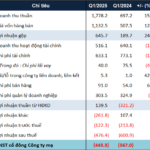

Is FECON’s 200 Billion Profit Goal at Risk Due to Consecutive Losses in the First Quarter?

FECON Corporation (HOSE: FCN) reported a 34% increase in revenue for the first quarter of 2025, however, the company still incurred a loss of VND 7 billion, marking the second consecutive quarter of losses as financial expenses continue to weigh heavily. This puts the company’s target of VND 200 billion in profits for the year at a more challenging position.