According to the report, the number of PGB shares issued by the bank to increase its capital stock is 120 million units. SSI proposes that the bank contact the Vietnam Securities Depository and Trading Corporation (VSD) and the Hanoi Stock Exchange (HNX) to complete the registration, depository, and additional trading procedures as required by law.

On March 5th, PGB completed the distribution of 120 million bonus shares to shareholders at a 40% rate (shareholders owning 10 shares will receive 4 new shares).

The capital raised comes from accumulated undistributed after-tax profits and additional reserve funds, as stated in the 2022 audited financial statements, amounting to 1.2 trillion VND.

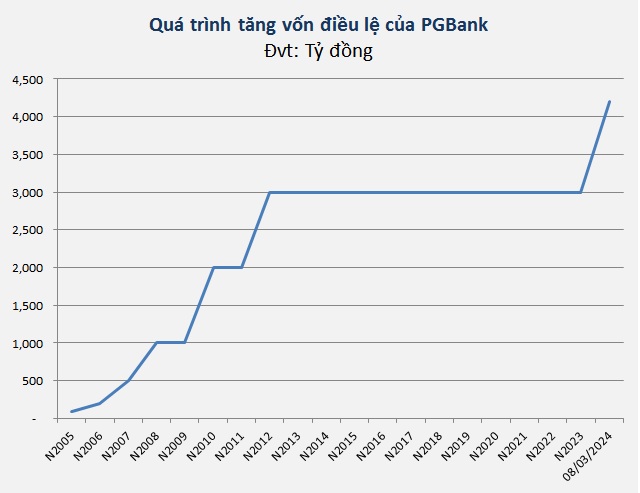

After the issuance of the bonus shares is completed, PGBank’s charter capital will increase from 3 trillion VND to 4.2 trillion VND.

Prior to the extraordinary shareholders meeting on October 23rd, 2023, PGB shareholders approved the additional capital increase of 2 trillion VND, from 3 trillion VND to 5 trillion VND, according to two options.

Specifically, issuing shares from capital sources at a rate of 40%, corresponding to an additional charter capital of 1.2 trillion VND, and offering shares to existing shareholders at a rate of 26.67%, corresponding to an additional charter capital of 800 billion VND.

For the offering plan, PGBank plans to offer a maximum of 80 million shares at a price not lower than the face value.

PGBank announced that the expected amount to be raised is 2 trillion VND, and the bank will use 30 billion VND for capital supplementation; 300 billion VND for software upgrade, IT infrastructure, and computer equipment and bank conversion projects; 300 billion VND for government bonds and bonds issued by other credit institutions; and the remaining 1.37 trillion VND for lending to meet the capital needs of customers.

Source: Vietstock Finance

|

In recent years, PGBank’s business activities have been struggling, as the bank has gone through a relatively long restructuring process. Since 2012, the bank has not increased its charter capital, maintaining it at 3 trillion VND and a network of 79 branches.

The capital increase plan is the latest move by PGBank after completing the procedures for changing its name and brand identity due to the divestment of major shareholder Petrolimex.

This is also the first time PGBank has increased its capital in nearly 13 years and the first time the bank has distributed dividends/bonus shares to shareholders in nearly 12 years.

| Price performance of PGB shares from the beginning of 2023 to March 13th, 2024 |

Prior to the announcement of bonus share distribution to increase capital, the price of PGB shares rose for 9 consecutive sessions (01-20/02/2024). At the close on February 22nd, the price of PGB shares reached a peak of 22,700 VND/share, an increase of over 15% compared to the beginning of 2024. After reaching the peak, the PGB share price corrected down by 14% to 19,400 VND/share (morning session on March 13th).

Khang Di