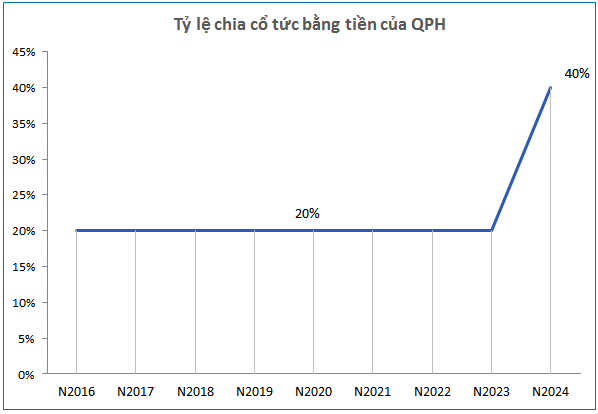

Specifically, the ex-dividend date is set as May 27. With nearly 18.9 million shares outstanding, QPH is expected to spend over VND 75 billion on dividend payments for the fiscal year 2024. The payment will be made starting from June 10.

Source: VietstockFinance

|

| QPH’s Financial Performance Over the Years |

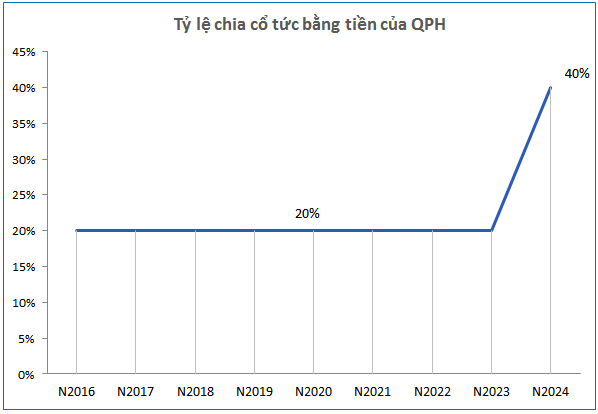

Notably, despite a slight decrease in net profit for the fiscal year 2024 compared to 2023, the company has decided to significantly increase the dividend payout ratio compared to previous years.

Source: VietstockFinance

|

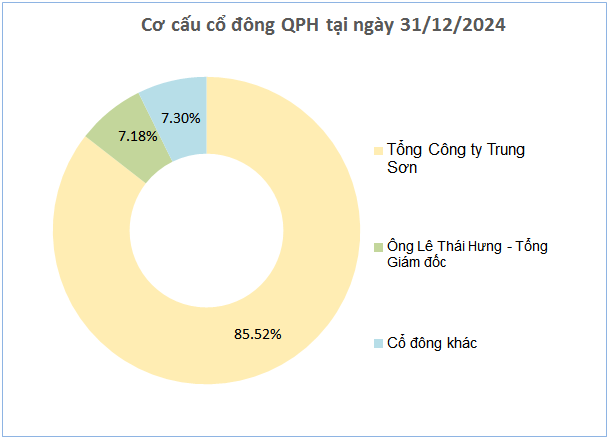

As of the end of 2024, QPH‘s major shareholders include its parent company, Trung Son Corporation, holding 85.52% of the shares, and Mr. Le Thai Hung, a member of the Board of Directors and General Director, holding 7.18%. Accordingly, these two shareholders are expected to receive approximately VND 64 billion and VND 5.4 billion, respectively.

For the fiscal year 2025, QPH targets revenue of over VND 128 billion, a 32% increase from the previous year. However, net profit is estimated to reach VND 59 billion, a 17% decrease. Therefore, the company plans to return to the previous dividend payout ratio of 20%.

| QPH’s First-Quarter Financial Performance Over the Years |

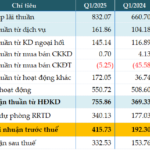

In the first quarter of 2025, QPH recorded a revenue of over VND 22 billion, a 10% decrease compared to the same period last year. The cost of goods sold decreased at a slower rate (8%), resulting in a 11% decline in gross profit to over VND 13 billion. Net income for the quarter reached nearly VND 15 billion, a 15% decrease from the previous year, achieving 25% of the annual profit plan.

– 3:24 PM, May 8, 2025

SIP Posts Highest Q1 Profit in 4 Years, Reaching Nearly 50% of Annual Target

Saigon VRG Joint Stock Company (HOSE: SIP) has announced its Q1 2025 financial results, reporting a net profit of over VND 351 billion, a remarkable 43% increase from the same period last year and the highest since Q1 2021. This achievement marks a strong start to the year, with the company already nearing 50% of its annual profit plan.

The Pen Is Mightier: Crafting a Compelling Headline

“DIG Uncovers a Hole in Q1”

After incurring a record loss of over VND 117 billion in Q1 2024, the Construction Development Investment Corporation (DIC Corp, HOSE: DIG) reported another quarterly loss in the first quarter of 2025, despite a significant improvement in revenue.

Coteccons Bags 250 Billion VND Profit in 9 Months of FY 2025, Secures 23 Trillion VND in Contracts

Impacted by the global economic fluctuations, Coteccons Construction Joint Stock Company (HOSE: CTD) witnessed a 46% decline in its profit for the third quarter of the financial year 2025. However, for the first nine months, Coteccons posted a profit of VND 255 billion, a 6% increase compared to the same period last year.