Q1 2024 Business Results of VPS Securities

_Unit: Billion VND_

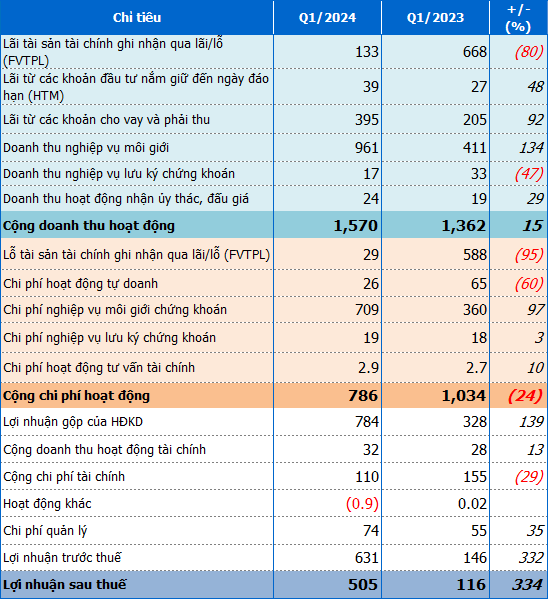

Specifically, the company’s operating revenue in the first quarter was VND 1,570 billion, up 15% year-on-year, with strong growth in core businesses.

With the leading position in the stock brokerage market share on both HOSE (20.29%) and HNX (24.7%) in the first quarter, VPSS brought in revenue of VND 961 billion, more than double the same period. This was also the activity with the largest proportion of operating revenue, accounting for 61%.

In parallel, interest from loans and receivables reached VND 395 billion, up 92%; Conversely, interest from financial assets recognized through fair value of financial instruments (FVTPL) decreased by 80% to VND 133 billion.

In terms of expenses, although brokerage expenses were recorded at VND 709 billion, almost double the same period, FVTPL financial asset losses (VND 29 billion) and proprietary trading expenses (VND 26 billion) were significantly reduced, by 95% and 60%, respectively, compared to the same period, contributed to the decrease of operating expenses to VND 786 billion in the first quarter of 2024, equivalent to a decrease of 24%.

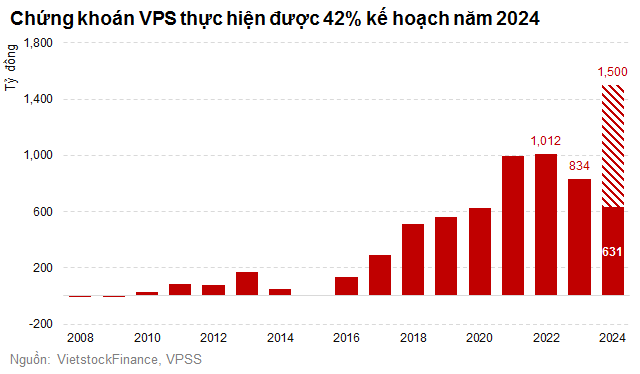

In the first quarter, VPS pre-tax and post-tax profit was VND 631 billion and VND 505 billion, respectively, both more than four times the same period. Compared to the plan submitted to the 2024 General Meeting of Shareholders, the record pre-tax profit target of VND 1,500 billion, after only the first 3 months of the year, the company has achieved 42% of the annual target.

As of March 31, 2024, the company’s total assets were VND 26,575 billion, an increase of 18% compared to the beginning of the year. Notably, cash and cash equivalents more than doubled at the beginning of the year, increasing to VND 6,236 billion.

Financial assets at FVTPL reached VND 6,411 billion, up 14%, with the majority being money market instruments, at VND 5,749 billion; followed by unlisted bonds (VND 343 billion) and listed bonds (VND 286.5 billion).

Held-to-maturity investments (HTM) recorded VND 1,171 billion, a decrease of 30%, entirely in term deposits over 3 months.

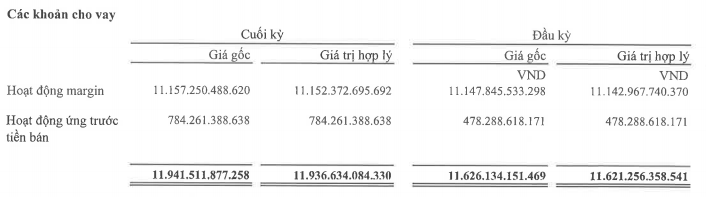

Outstanding margin loans were at VND 11,152 billion, unchanged compared to the beginning of the year.

On the other side of the balance sheet, VPSS‘s payable was recorded at over VND 17,077 billion at the end of the first quarter, up 27% compared to the beginning of the year. In which, the company borrowed VND 16,066 billion in short-term loans, up 28% and over VND 386 billion in long-term loans, unchanged compared to the beginning of the year.