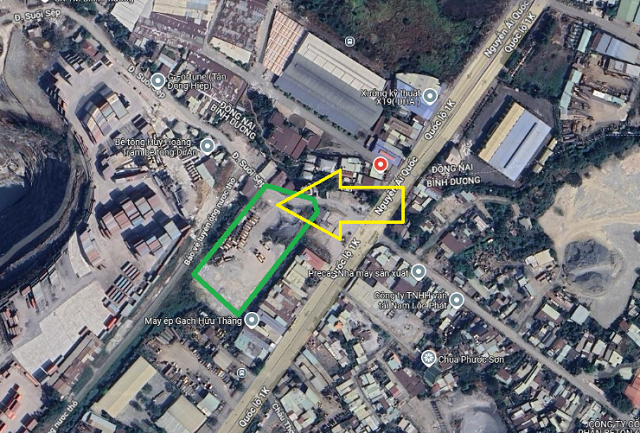

In early 2025, the Binh Duong People’s Committee approved the Hoa An commercial and service apartment project for SH Dong An Company Limited. The total investment capital for the Hoa An commercial and service apartment project (commercial name The An) is nearly VND 2,439 billion. According to the plan for residential land in 2025 of Di An city, Binh Duong province: The An project has a land area of 1.4ha. According to our research, the project scale corresponds to two land plots with an area of 5,845m2 and 8,251.2m2, respectively, in Tan Dong Hiep ward.

In July 2024, SH Dong An mortgaged a land plot in Tan Dong Hiep ward, Di An city, to Nam A Commercial Joint Stock Bank – Ham Nghi Branch. The company mortgaged a land area of 4,944m2, with the purpose of commercial and service land use (over 361m2) and non-agricultural production facilities land (nearly 4,583m2).

SH Dong An’s mortgaged land to the bank is indicated by the yellow arrow. The 1.4ha land plot for the construction of The An project is outlined in green. Source: Binh Duong Planning Information

|

Mr. Bui Ba Nghiep (holding flowers, front row) received the investment approval decision for The An project in early January 2025

|

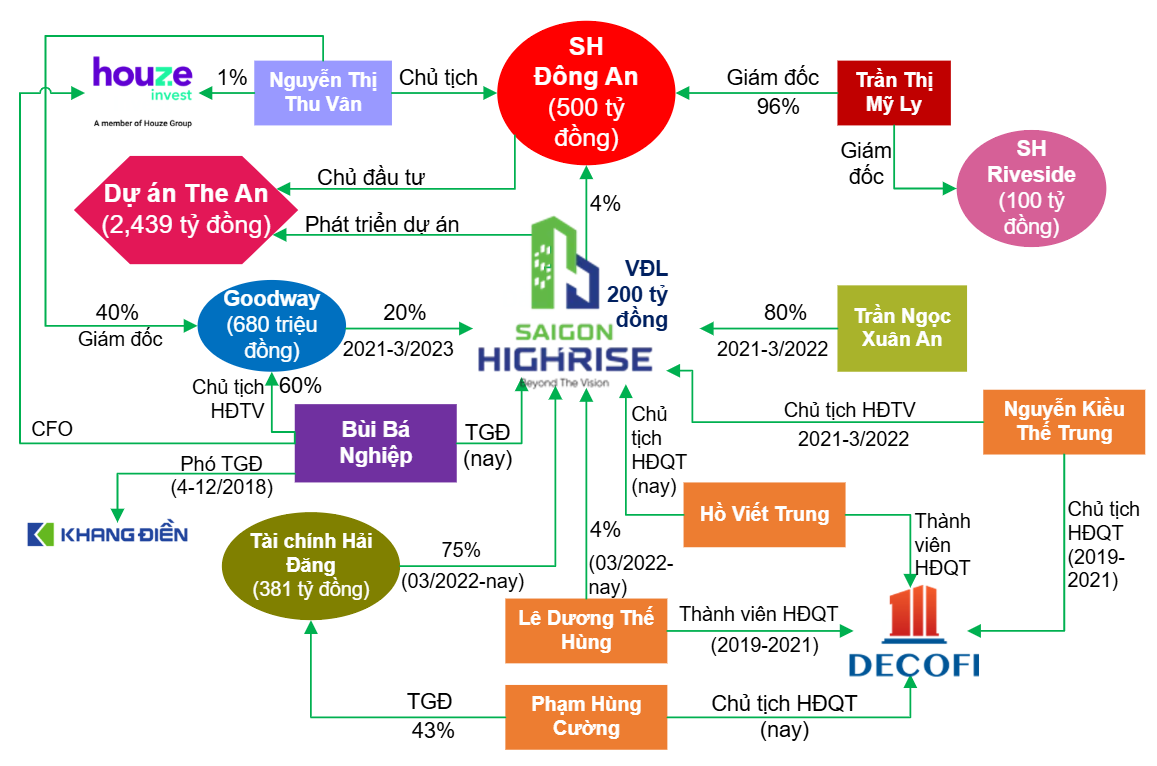

SH Dong An Company Limited was established in December 2023, with its head office located at 36 DT743B, Tan An ward, Tan Dong Hiep ward, Di An city, Binh Duong province. Its main business lines include real estate business and ownership, usufruct, or lease of land use rights. The company has a charter capital of VND 100 billion, with Ms. Tran Thi My Ly (born in 1992) as its director, and only one registered employee.

| Sai Gon High Rise Investment is currently the developer of The An project, along with projects of Kien A Group. |

In mid-September 2024, Ms. Ly became the Chairman of the Board of Directors, and Ms. Nguyen Thi Thu Van was appointed as the Director, with both serving as legal representatives of the company. The charter capital at this time increased to VND 500 billion, of which Sai Gon High Rise Investment Joint Stock Company contributed 4%, and Ms. Ly contributed 96%.

Regarding Sai Gon High Rise Investment Joint Stock Company, it is headquartered in District 1, Ho Chi Minh City, and was established in early 2021, initially as a limited liability company. Its charter capital is VND 200 billion, of which Ms. Tran Ngoc Xuan An holds 80%, and Goodway Investment Development Company Limited holds 20%. The company is directed by Mr. Bui Ba Nghiep as General Director and Mr. Nguyen Kieu The Trung as Chairman of the Board of Directors.

|

Goodway’s main business line is management consulting. It was established in early 2020 with a capital of VND 680 million, of which Mr. Nghiep (Chairman of the Board of Directors) contributed 60%, and Ms. Van (Director) contributed 40%. Mr. Bui Ba Nghiep used to be the Deputy General Director of Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) from April to December 2018. |

In March 2022, Ms. An transferred her entire capital contribution to Finance and Financial Services Joint Stock Company. In March 2023, the company was transformed into a joint-stock company, Goodway withdrew its capital, and Finance and Financial Services Joint Stock Company reduced its ownership to 75%, with the appearance of Mr. Le Duong The Hung holding 5%, and Mr. Ho Viet Trung becoming the Chairman of the Board of Directors, replacing Mr. The Trung.

Notably, the shareholders of Sai Gon High Rise Investment Joint Stock Company mostly have connections with Construction and Design No. 1 Joint Stock Company (Decofi, UPCoM: DCF). Mr. Nguyen Kieu The Trung served as the Chairman of the Board of Directors of DCF for the term 2019-2024 but resigned in April 2021 for personal reasons. Similarly, Mr. Le Duong The Hung was also a member of the Board of Directors of DCF for the term 2019-2024 and resigned in April 2021 for personal reasons. Mr. Ho Viet Trung is currently an independent member of the Board of Directors of DCF, appointed in April 2023.

|

Ms. Nguyen Thi Thu Van is also a founding shareholder of Houseinvest Joint Stock Company in 2020, along with Housegroup Joint Stock Company. Houseinvest has since changed its name to Houze Invest Joint Stock Company, a business that owns a real estate investment platform. |

Finance and Financial Services Joint Stock Company, formerly known as Eras Financial Services Joint Stock Company, was established in Binh Thuan province in 2020. The company currently has a charter capital of VND 381 billion, in which Mr. Pham Hung Cuong (General Director) holds 43%, Ms. Nguyen Ngoc Anh Thu holds 54.9%, and Mr. Dong Viet Hung holds 2.1%. Mr. Cuong is currently the Chairman of the Board of Directors of DCF.

Mr. Bui Ba Nghiep is also a co-founder, Board member, and CFO of Houze

|

Source: Compiled by the author

|

How is DCF performing? DCF, formerly a state-owned enterprise, was directly under the Ministry of Agriculture and Rural Development, formed in 1990, and equitized in 2003. The company specializes in designing and constructing civil and industrial works as a general contractor, including construction, steel structures, refrigeration engineering, water supply and drainage, fire protection, and interior decoration. DCF undertakes all tasks from consulting and design to obtaining construction permits, construction, and completion for the works.

The civil works constructed by DCF are mainly located in Binh Duong, Ba Ria – Vung Tau, and Binh Thuan, such as Charm Diamond Di An, Picity Sky Park, The Aspira, Thien Binh Minh tourist area, Lang Hang tourist area, and Hill Villas luxury villa area.

As of the third quarter of 2024, DCF had total assets of VND 831 billion. Except for the years 2018-2019 when the company incurred losses, DCF has been profitable in the remaining years, with profits of several billion VND. The peak period was from 2008 and earlier, with revenue in the hundreds of billions of VND and profits in the tens of billions of VND.

Some financial indicators of DCF in the period of 2014-2023

The New Face of Binh Duong Apartments: Unveiling the Province’s Latest Price Revolution with Rates Climbing to Nearly VND 70 Million per Square Meter

The ripple effect of rising prices in the Eastern area of Ho Chi Minh City is being felt in neighboring regions. While properties in Thu Duc City are priced at 75 – 120 million VND per square meter, just across the border in Binh Duong, prices are currently 30-50% lower. However, this price gap is expected to close in the near future, with Binh Duong potentially catching up.

The Rise of Bình Dương’s First Metro Line

The first-ever Binh Duong metro line will connect the city of Binh Duong with Suoi Tien in Ho Chi Minh City. With a length of 32.43km, a maximum speed of 120 km/h, and a total investment of VND 64,370 billion, this project is set to revolutionize transportation in the area. Construction is expected to commence in 2027, with the metro line operational by 2031.

Bình Dương’s Thirst for Luxury Condos: Owning a Unit at 45-50 Million VND per Square Meter, or Renting a 2-Bedroom Apartment for 15 Million VND per Month, Still Results in an Impressive 90% Occupancy Rate.

In Binh Duong, apartments priced at 45 – 50 million VND per square meter are now considered luxury, with an impressive 80-90% occupancy rate for rentals. These apartments command a monthly rental price of approximately 15 million VND for a two-bedroom unit, offering a compelling proposition for investors and renters alike.

The Dynamic Duo: BCM, BCMC, Deo Ca, and IJC Collaborate on the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Expressway

The People’s Committee of Binh Duong province has given the green light to the selection of investors for the construction of the Ho Chi Minh City – Thu Dau Mot – Chon Thanh expressway, specifically for the section passing through Binh Duong province. This significant development will be undertaken through a public-private partnership (PPP) model, marking a strategic step forward in the region’s infrastructure advancement.

Where Do Binh Duong Province’s Property Buyers Come From?

The real estate market in Binh Duong Province has experienced a robust recovery in 2024 compared to 2023, with significant growth across all areas and most property types. In particular, Di An and Thuan An continue to stand out, attracting considerable investor attention due to their proximity to Ho Chi Minh City and their strong development potential in the future, according to Batdongsan.