Once a promising Vietnamese startup with aspirations of becoming a unicorn, Tiki has now experienced one of the most shocking valuation drops in the history of the country’s e-commerce industry. According to DealStreetAsia, the latest valuation of this e-commerce platform has plummeted to below $10 million, a far cry from its peak of nearly $1 billion and the IPO goals set in 2021.

Founded in 2010 by Tran Ngoc Thai Son with initial capital of just $5,000, Tiki started out in a small rented room in Ho Chi Minh City, focusing on English books for customers who faced challenges in accessing foreign literature. With a commitment to delivering authentic products, fast shipping, and dedicated customer care, Tiki quickly built a loyal customer base, mainly comprising students and office workers.

The name “Tiki,” an acronym for “Tim kiem” (Search) and “Tiet kiem” (Save), reflects the company’s ambition to become a trusted retail platform offering reasonable prices. Expanding from its initial focus on books, Tiki rapidly diversified into electronics, home appliances, mother and baby care, cosmetics, fashion, and more. As its product ecosystem grew, Tiki also invested significantly in logistics and technology.

Between 2014 and 2019, the company consecutively secured investments from prominent organizations such as CyberAgent Ventures, Sumitomo Corporation, and JD.com. The peak came in 2021 when Tiki successfully raised $258 million in its Series E funding round, attracting investors like AIA, UBS, Mirae Asset, and Shinhan Financial Group, pushing its valuation close to the $1 billion mark. During this period, the company also announced its IPO plans in the US, signaling its ambition to expand beyond the domestic market.

The years 2019 to 2021 are considered Tiki’s golden era, when it was among the top three e-commerce platforms in the market, alongside Shopee and Lazada. By mid-2021, Tiki served over 800,000 regular customers and distributed more than 120,000 products across various categories. Despite not being profitable, Tiki’s business model garnered recognition from domestic and international investors.

However, the market dynamics started to shift rapidly after 2021. E-commerce was no longer just a race of products and operations; it evolved into an “entertaining” shopping experience. TikTok Shop emerged with its short-form content and livestreaming strategy, reshaping consumer habits. Shopee solidified its position through price incentives, influencer partnerships, and personalized technology. Meanwhile, Tiki lagged in adapting, lacking engaging content and user retention strategies, resulting in a prolonged downward spiral.

This decline didn’t happen overnight but was the outcome of a prolonged market share erosion since 2021. While competitors like Shopee and TikTok Shop maintained their growth trajectories, Tiki entered a phase of deep decline. Data from YouNet ECI reveals that Tiki’s total transaction value (GMV) plummeted by 57% in Q1 2025 compared to the same period last year.

Most product categories on the platform experienced double-digit declines. Several sectors witnessed GMV decreases of over 50%. Even traditional strongholds of Tiki, such as mother and baby care, technology, and home appliances, saw significant drops of 29.3%, 24.2%, and 69.9%, respectively.

Earlier, YouNet ECI’s 2024 annual report indicated that Tiki’s market share had shrunk to just 0.9%, dwarfed by competitors like Shopee (66.7%), TikTok Shop (26.9%), and Lazada (5.5%). This downward trend extended into 2025.

Additionally, according to Metric, Tiki’s revenue plunged by 66.6% in Q1 2025, the steepest decline among the major platforms, resulting in its market share becoming too insignificant to be displayed on market proportion charts.

As Vietnam’s e-commerce market expands robustly, with total revenue in Q1 2025 reaching VND 101,400 billion (a 42.29% increase year-over-year) and consumption volume reaching 950.7 million products (a 24% rise), Tiki’s downward spiral highlights its struggle to keep pace. The platform’s failure to adapt to emerging consumer trends, such as prioritizing content, entertainment, and personalized experiences, may be a contributing factor to its diminishing competitiveness.

The Retail Giant Captures Market Share on the Precipice of a New Era

The retail landscape is evolving, and with it, a world of opportunity opens up for savvy retailers. With a potentially huge consumer market still largely untapped, retailers are racing to establish their presence and transform the way Vietnamese shop, not just in urban centers but also in the suburbs.

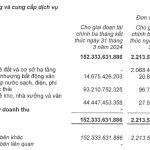

First-Quarter Loss of VND77 Billion, Kinh Bac Still Increases Bank Deposits by VND5.6 Trillion

Despite no revenue from land lease, Kinh Bac still has roughly 5,600 billion dong in short-term bank deposits due to a net loss of $32.67 million in the first three months of 2024.