Revenue Plunges 93% for Kinh Bac Urban Development Corporation in Q1 2024

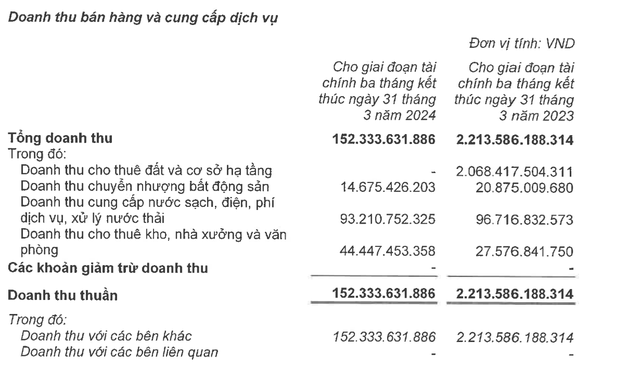

In its Q1 2024 consolidated financial report, Kinh Bac Urban Development Corporation (KBC) reported a 93% decline in revenue to 152.33 billion VND compared to the same period last year. After deducting cost of goods sold, gross profit fell by 95% year-over-year to 74 billion VND.

Kinh Bac clarified that the lower revenue in the first quarter was primarily due to the absence of land rental and infrastructure revenue, which amounted to 2,068.4 billion VND in the same period last year.

Financial revenue decreased by 56% to 68 billion VND, while financial expenses declined by 59% to 54 billion VND. Sales and administration expenses also saw a 53% reduction to 114 billion VND.

The gross profit generated was insufficient to cover various expenses, resulting in an operating loss of 33.4 billion VND for Kinh Bac. Consequently, KBC reported a net loss of 76.7 billion VND for Q1 2024. According to data from SSI Securities’ iBoard, the last time Kinh Bac posted a loss was in Q4 2022, with a value of 558.8 billion VND. As such, Kinh Bac has returned to a loss-making position after four consecutive quarters of profit.

In 2024, Kinh Bac has set a revenue target of 9,000 billion VND and a net profit target of 4,000 billion VND.

As of March 31, 2024, Kinh Bac’s total assets increased by 17.7% from the beginning of the year to 39,337 billion VND. Of this amount, inventory accounted for 12,685 billion VND or 32.2% of total assets, representing a 3.8% increase year-over-year. The Trang Cat Industrial Park and Urban Area project held the largest share at 8,243.6 billion VND.

Short-term accounts receivable amounted to 9,573.3 billion VND, representing 24.3% of total assets. Short-term financial investments skyrocketed by fourfold to 7,515 billion VND, accounting for 19.1% of total assets due to an increase of over 5,600 billion VND in bank deposits.

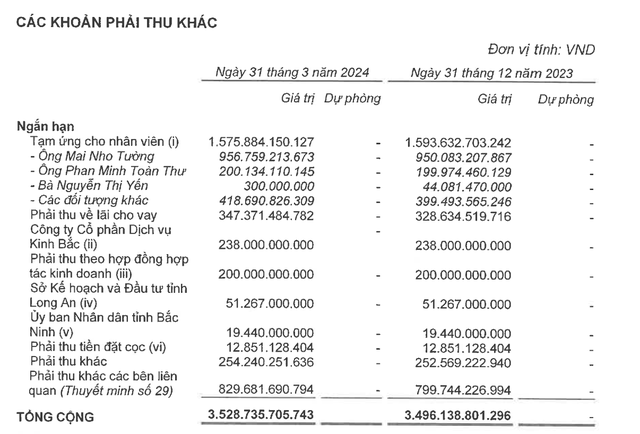

Notably, as of the end of Q1 2024, Kinh Bac disclosed that it had provided advances to employees totaling 1,575.9 billion VND. Of this amount, 956.8 billion VND was advanced to Mr. Mai Nho Truong, 200.1 billion VND to Mr. Phan Minh Toan Thu, and the remaining amount was advanced to other employees.

On the other side of the balance sheet, as of the end of Q1 2024, total short-term and long-term borrowings had increased by 9.4% from the beginning of the year to 4,069 billion VND, representing 20% of shareholders’ equity.