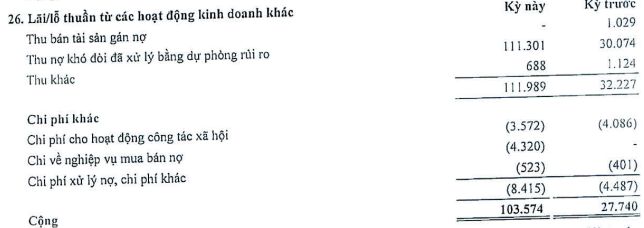

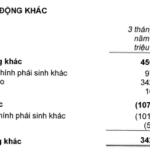

KienlongBank reported impressive financial results for the first quarter, with net interest income surpassing 849 billion VND, marking a remarkable 39% increase year-over-year.

The bank experienced growth in non-interest income streams as well. Service income rose by 41% to nearly 160 billion VND, attributed to higher revenue from payment services, office rentals, and insurance-related activities.

Foreign exchange operations also contributed to the bank’s success, with profits surging by 87% to almost 21 billion VND due to increased spot transactions and cost-saving measures.

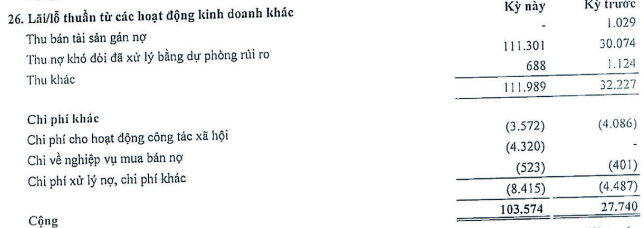

Notably, other operations yielded a profit of nearly 104 billion VND, a significant 3.7 times higher than the previous year. This remarkable improvement was a result of recovering over 111 billion VND in non-performing loans through prudent risk management strategies.

Operating expenses increased by 30% to 579 billion VND, mainly due to a near 50% rise in staff costs.

Consequently, the bank’s profit from business operations climbed by 70% to 555 billion VND. Despite a 78% increase in credit risk provisions, amounting to 198 billion VND, KienlongBank recorded a remarkable pre-tax profit of nearly 357 billion VND, reflecting a 67% year-over-year growth.

With regards to annual targets, the bank has accomplished nearly 26% of its full-year profit goal of 1,379 billion VND after the first quarter.

|

KLB’s Q1 2025 Financial Performance. In VND billion

Source: VietstockFinance

|

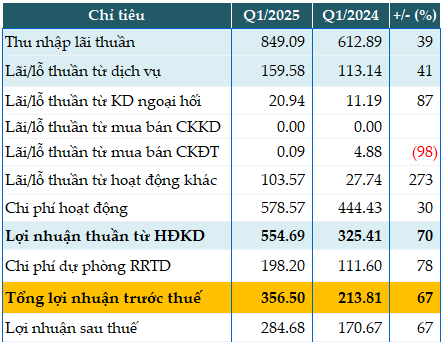

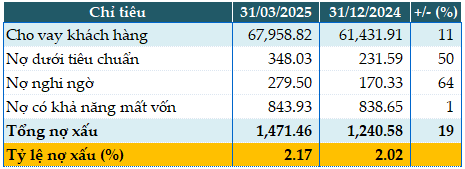

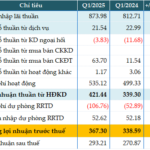

As of the first quarter’s end, KienlongBank’s total assets grew by 5% from the beginning of the year to reach 97,164 billion VND. Notably, the bank’s deposits at the State Bank of Vietnam increased by 31% to 5,495 billion VND, while deposits at other credit institutions decreased by 20% to 12,301 billion VND. Customer lending, a key indicator of the bank’s core business, rose by 11% to 67,958 billion VND.

On the funding side, deposits from other credit institutions also declined by 19% to 12,2259 billion VND, while customer deposits demonstrated a healthy increase of 12% to 70,989 billion VND.

As of March 31, 2025, KienlongBank’s non-performing loan ratio witnessed a slight increase, standing at 2.17% compared to 2.02% at the beginning of the year. The total non-performing loans amounted to 1,471 billion VND, representing a 19% rise during the period.

|

KLB’s Loan Quality as of March 31, 2025. In VND billion

Source: VietstockFinance

|

Hàn Đông

– 1:28 PM, April 29, 2025

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

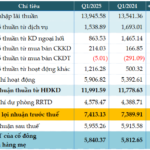

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

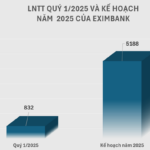

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.