Online balance updates provide many benefits to customers

Recently, some banks have implemented new SMS Banking fees with individual customers. OCB Bank has also quickly announced new SMS fees, as well as announced the cessation of sending balance change notifications for transactions under 50,000 VND to maximize customer experience and cost savings.

The new SMS fee for balance change notifications will change based on the number of SMS messages that customers use in one month, specifically: in one month, the number of SMS messages customers use from 01 to 10 SMS will have a fee of 5,000 VND, from 11 to 30 SMS a fee of 15,000 VND, from 31 to 50 SMS a fee of 25,000 VND, from 50 to 100 SMS a fee of 50,000 VND, and from 101 SMS onwards there will be a fee of 70,000 VND (This fee does not include VAT).

OCB also encourages customers to track balance changes online through the OCB OMNI digital banking application. Users can receive free notifications from the bank anytime, anywhere, including: balance changes, deposit account notifications, current promotions… without having to worry about monthly SMS Banking service fees.

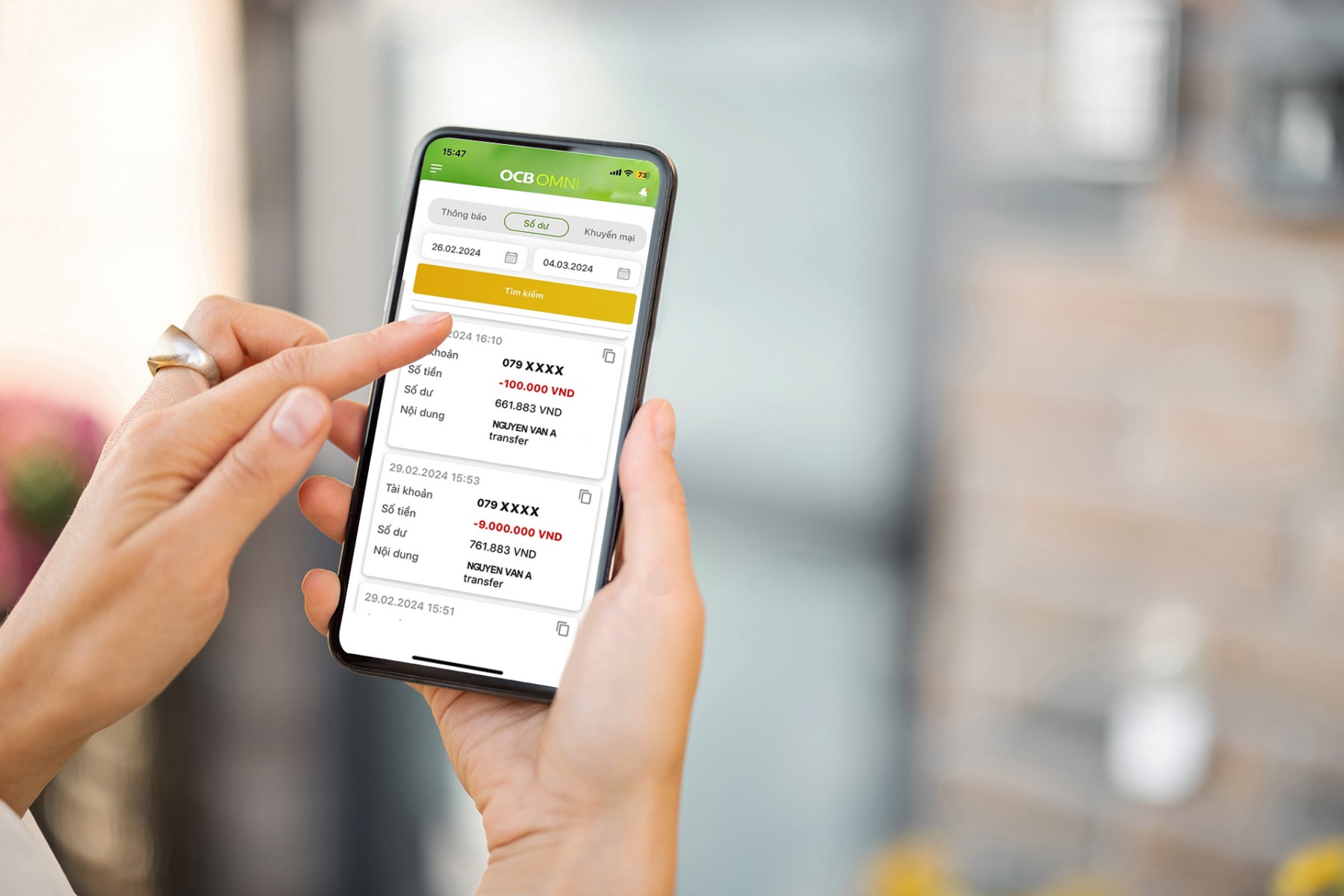

Especially, free balance change updates via the OCB OMNI digital banking application will provide complete transaction information on the payment account in a clear and understandable way, including: transaction time, transaction amount, final balance, and transaction details. When displayed on the OCB OMNI application, for debit transactions (money transferred out of the account) it will be displayed in black, for credit transactions (money transferred into the account) it will be displayed in blue. This helps users easily distinguish and monitor balance changes quickly and easily.

Not stopping there, the OCB OMNI app also allows customers to proactively share balance changes of each account with others in a flexible and completely free way with just a few simple steps: Access the app, select the “Share balance change” feature, and easily create new shared accounts. This feature allows one account to share balance changes with multiple recipients simultaneously on any device without revealing the balance information of the account holder.

These features have attracted a lot of interest from customers, especially those managing businesses with a need to share with store employees at payment counters, ensuring transparent revenue sources and efficient business management. At the same time, through these features, employees or store managers can conveniently reconcile and control transaction statuses, avoid fake transactions, and save monthly SMS fees for balance notifications.

With the trend of digital technology development, financial solutions on the technology platform are becoming familiar to customers

“Digital banking transactions are a growing trend for banks throughout the system to save time, costs, and most importantly, ensure customer information security. Because they do not go through a third-party service, OTT messages are particularly accurate and secure, minimizing the risk of users receiving fake messages, scams, or counterfeit bank brandname SMS. This is a sophisticated form of fraud that has caused many people to lose money in their accounts. Therefore, we constantly encourage users to update balance changes for free through the OCB OMNI digital banking application.” OCB representative said.

For customers who no longer need to use SMS Banking services, they can proactively cancel the service directly on the OCB OMNI digital banking application with simple steps such as: Go to the “SMS Settings” section, select “Receive balance changes via SMS” and click “Cancel service” or contact OCB Branches nationwide or the customer care hotline 1800 6678 for support.