An Cuong Wood Joint Stock Company’s 2025 Annual General Meeting: Embracing Growth and Optimism

An Cuong Wood Joint Stock Company (stock code ACG) held its 2025 Annual General Meeting, approving plans for revenue of VND 4,050 billion and after-tax profit of VND 450 billion, reflecting a 2% and 7% increase respectively from the previous year.

Rushing to Fulfill Orders for the US Market

As a significant exporter to the US, Chairman of the Board of Directors, Le Duc Nghia, expressed optimism about the ongoing negotiations between Vietnam and the US. He anticipates a lower tariff rate for exports to the world’s largest economy. In the event of excessively high tariffs leading to a loss of market access, he assured that alternative markets exist, including Canada, Japan, the UAE, and Southeast Asian countries.

Currently, the US market contributes 12% to An Cuong’s total revenue. Mr. Nghia shared that the company is rushing to fulfill orders for the US market while the retaliatory tariff is temporarily suspended.

“Rest assured, don’t be too worried because the US market still needs us,” Mr. Nghia assured the shareholders.

Novareal Debt: “Only a Small Loss, Not a Total Loss, Unless They Go Bankrupt”

Notably, regarding the receivable from Novareal (a subsidiary of Novaland), Mr. Nghia revealed that he met with Novaland’s senior leadership the previous week. They agreed to pay the interest with 13 shophouses at Nova World Phan Thiet, valued at approximately VND 150-200 billion. The principal amount will be repaid later.

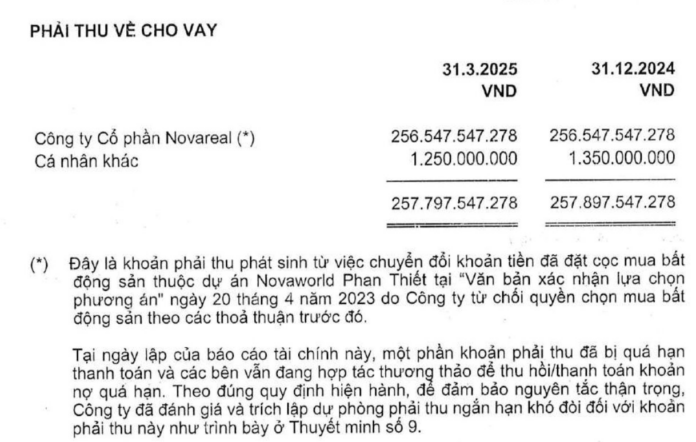

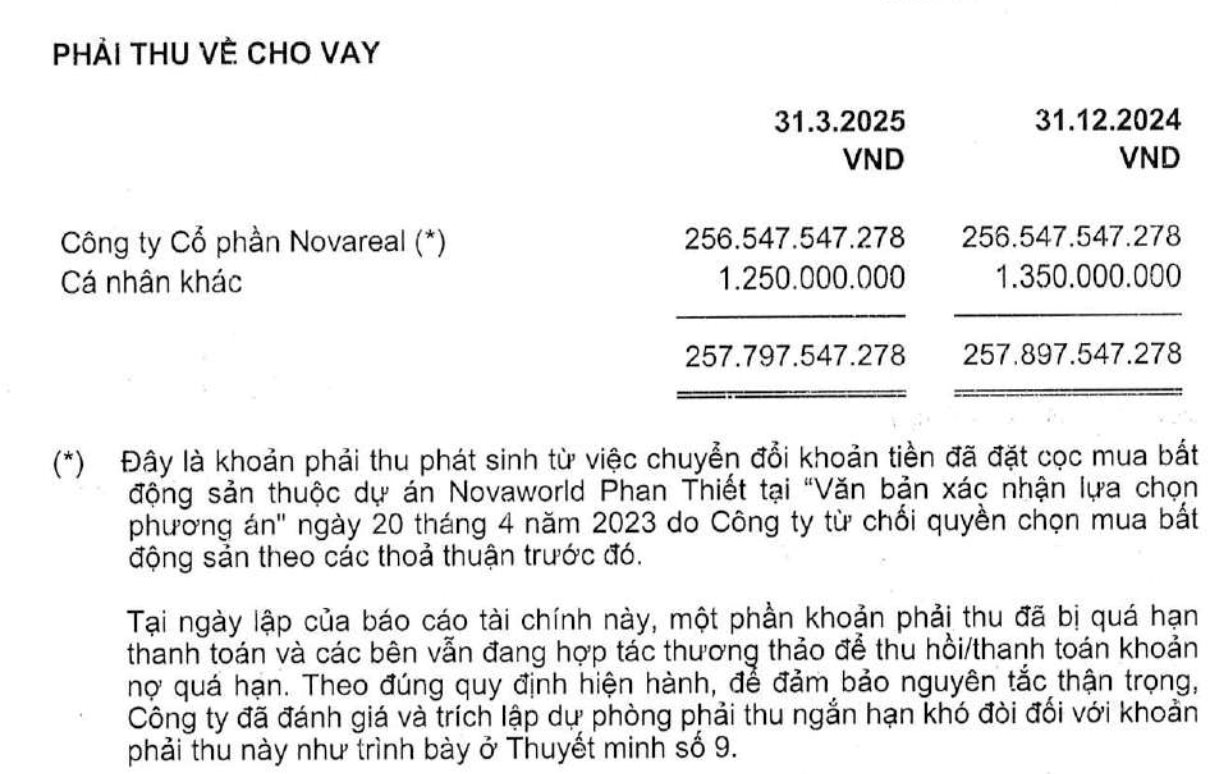

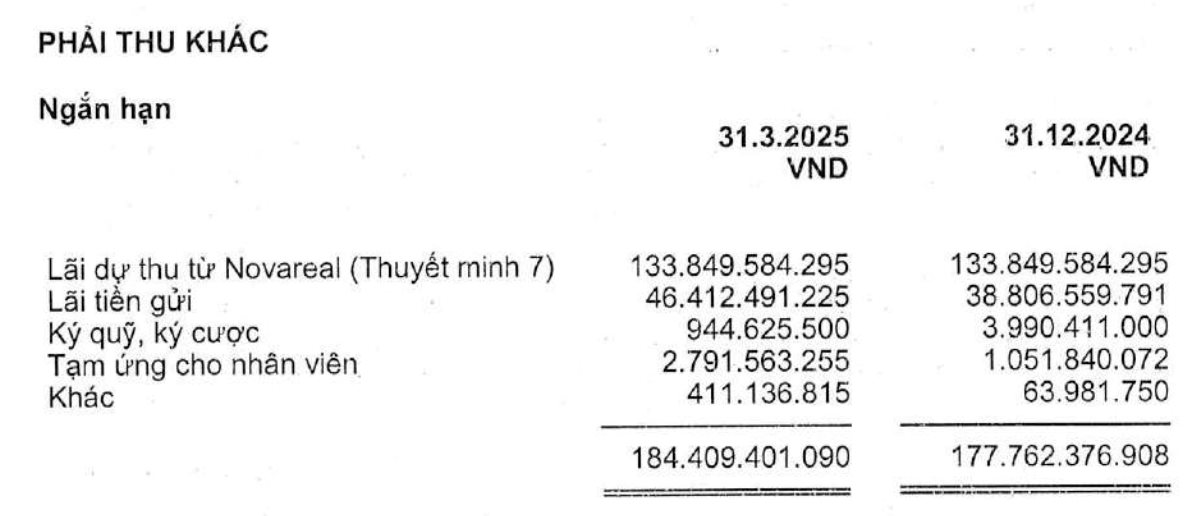

As per the consolidated financial statements for the first quarter of 2025, Novareal owes An Cuong more than VND 256 billion, along with accrued interest of over VND 133 billion.

Novareal’s debt breakdown as of Q1 2025

An Cuong Wood Joint Stock Company’s investments and receivables

Regarding the principal amount, An Cuong has agreed to a debt rescheduling, and Novareal will make gradual repayments over the next 2-3 years.

“I am confident that we can recover this money, and we will only incur a small loss, not a total loss, unless they go bankrupt,” Mr. Nghia assured.

“The past few years have been challenging, but we have essentially resolved the bad/difficult debts. I have worked directly with the chairmen of the corporations and proposed solutions, so the situation is basically stable,” he added.

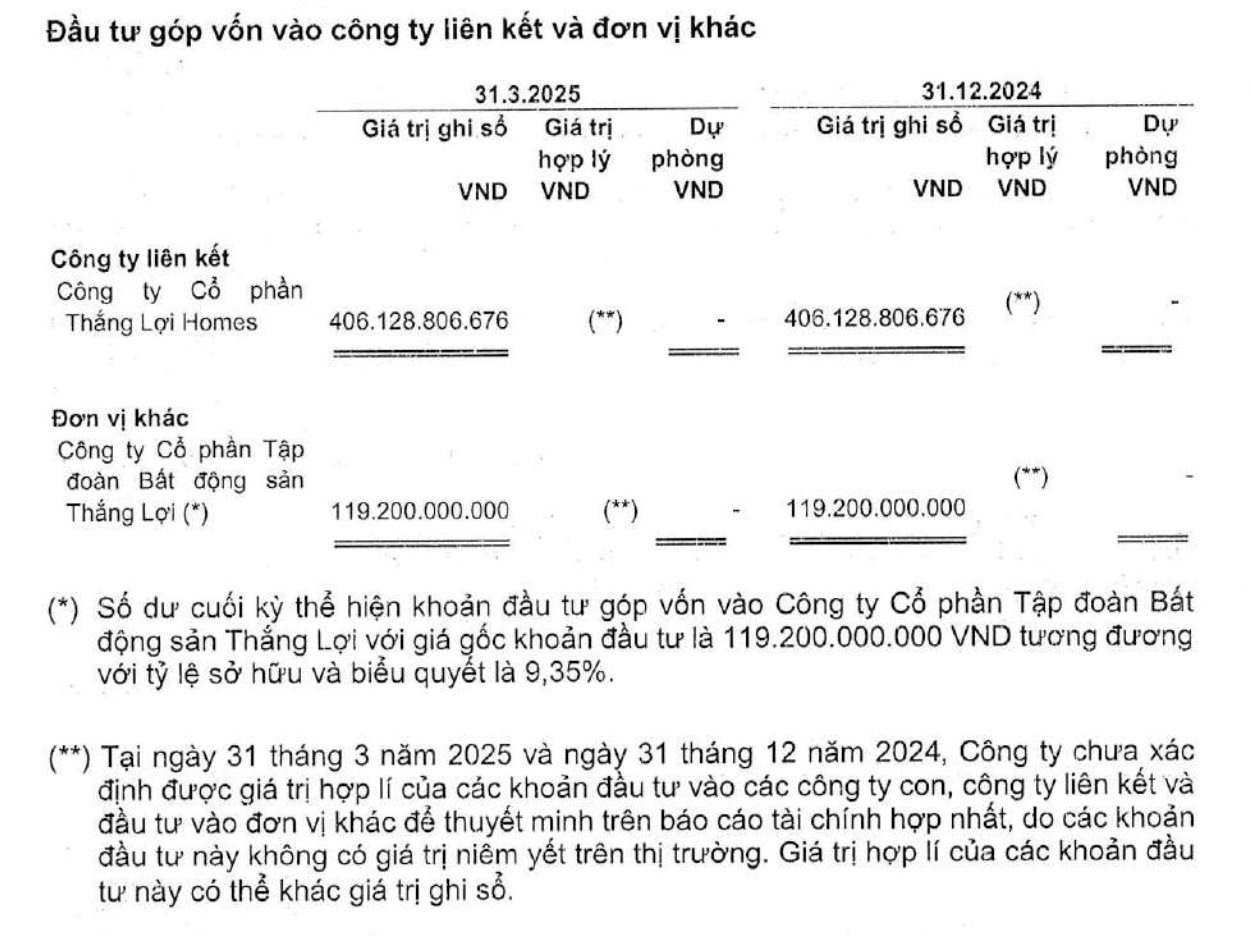

Potential VND 37 Billion Profit from Selling 5% of Thang Loi Homes’ Shares

Another area of interest is the investment in Thang Loi Group and Thang Loi Homes, totaling approximately VND 520 billion. An Cuong became a major shareholder of Thang Loi Group in 2021, investing VND 119.2 billion in the group of companies and over VND 400 billion to acquire a 30% stake in Thang Loi Homes.

One of the most significant collaborations between the two parties is the Binh An Duc Hoa urban area project in Long An province, with a total investment of up to VND 9,300 billion.

The Chairman of An Cuong shared that the company has sold approximately 5% of Thang Loi Homes’ shares and could recognize a profit of VND 37 billion from this transaction.

The Binh An Duc Hoa project has recently been approved by the Long An provincial government and is set to commence in September. The project plans to construct 6,000 apartments, with an expected profit of VND 2,000 billion. An Cuong, with its 30% stake, could receive up to VND 750 billion in profits.

Binh An Duc Hoa urban area project in Long An province

Moving forward, An Cuong will focus on its core business of wood, adopting a sustainable long-term development strategy. Mr. Nghia predicts that the turning point for An Cuong’s furniture business will come towards the end of 2025 or the end of 2026-2027, coinciding with a brightening real estate market.

Specifically, according to Mr. Nghia, the company’s bids for real estate projects in Vietnam have quadrupled compared to the previous year.

With the country undergoing rapid changes, the Chairman of An Cuong is confident that the unblocking of real estate projects presents a significant opportunity for furniture companies, despite the billions of USD currently stagnant in these projects.