The annual general meeting of Petrovietnam Fertilizer and Chemicals Corporation (PVFCCo – Stock code: DPM) will be held on March 29th at the company’s conference room in Ba Ria-Vung Tau province.

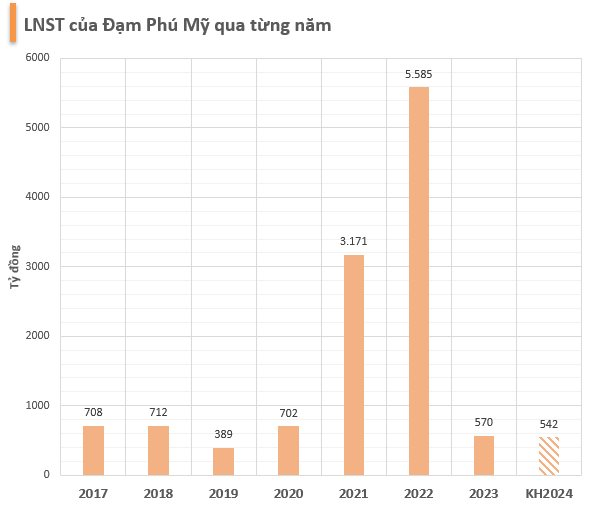

According to the meeting documents, in 2024, PVFCCo aims to achieve a consolidated total revenue of VND 12,755 billion, a decrease of 9% compared to the previous year. The estimated after-tax profit is VND 542 billion, slightly lower than the VND 570 billion recorded in 2023. The company plans to contribute VND 263 billion to the State budget.

The company also sets a dividend payout ratio of 15% in 2024, equal to VND 1,500 per share.

This year, PVFCCo needs more than VND 666 billion for investment, including VND 443 billion for purchasing assets and equipment, and VND 223 billion for construction. The company plans to use its own capital and not take on additional loans.

According to PVFCCo’s leadership, 2024 is expected to face difficulties in the fertilizer market and gas prices, which are impacted by the global political situation. In particular, natural gas supply has entered a challenging period, with cheap gas sources experiencing a decline in production.

This year, PVFCCo will establish a domestic fertilizer distribution system and explore expanding into foreign markets. The company will also engage in raw material trading (PTA & MEG) to serve the production of PSF fiber suitable for the company’s overall needs.

At the same time, PVFCCo will continue to restructure its subsidiary companies and divest from affiliated companies according to approved plans.

In addition, the company will further develop a plan to address the difference between equity capital and charter capital, and increase charter capital in 2024 for reporting to relevant authorities for consideration and approval.

Looking back at 2023, PVFCCo achieved a revenue of VND 11,569 billion and a net profit after tax of VND 569 billion, a decrease of 30% and 90% respectively compared to the same period last year.

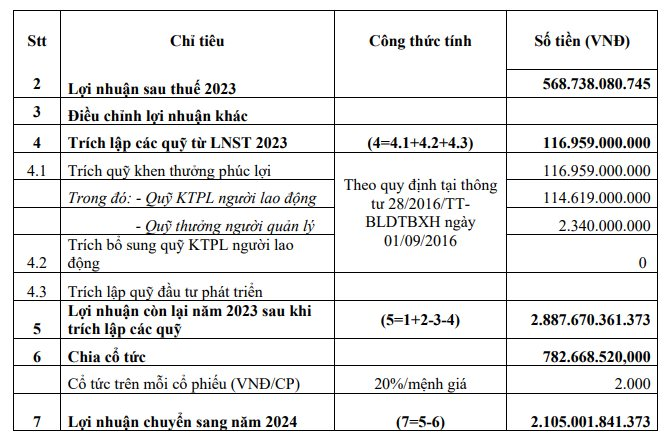

Due to the lower-than-planned business results in 2023 and the company’s failure to implement the plan to issue shares to increase charter capital, the Board of Directors proposes a dividend payout ratio of 20% in cash for 2023, down from the initial plan of 40%.