Market Outlook: Navigating Trade Tensions and Monetary Policy

According to SGI Capital’s April market outlook, the US’s temporary 90-day tariff suspension (excluding China) helped stabilize financial markets. The subsequent negotiations have instilled confidence in the market regarding a more reasonable tariff outcome.

As a result, businesses and consumers will adjust their investment and consumption plans, adapting to the new order. Financial markets will also be able to quantify the impact of tariffs on different groups of enterprises.

SGI Capital maintains its base scenario with significantly lower average tariff rates than initially announced. The frequent updates on social media by the US President and Treasury Secretary about trade negotiations with key partners indicate pressure to finalize deals soon. Vietnam is among the six countries prioritized for negotiations and could conclude agreements within the next one to two months.

To neutralize the impact of US tariffs and remain steadfast in its 8% GDP growth target, the Vietnamese government continues to focus on fiscal policy. This includes accelerating infrastructure project disbursements, tax exemptions and reductions, and vigorously implementing legal and institutional reforms to remove obstacles and support all resources for growth, especially in the private sector.

Resolution No. 68-TW on private economic development marks a significant shift in economic governance and policy orientation. SGI Capital considers this a correct and crucial change for Vietnam’s economy in recent years, elevating the private sector (the most dynamic and efficient growth driver) to the most important force.

Easing Currency Pressure and Reduced Foreign Selling

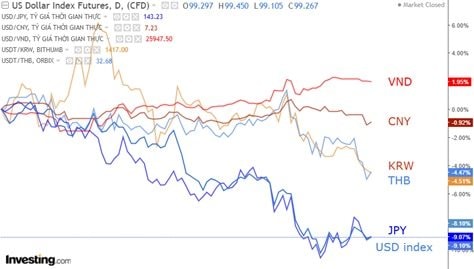

As observed by SGI Capital, the Dollar Index has declined by 10% from its peak in early 2025, ending a four-year upward trend that began in 2021. This period witnessed surging inflation, prompting the Fed to tighten monetary policy and maintain high-interest rates. With the Fed ending QT and moving towards lower interest rates, we could be witnessing the beginning of a weaker USD cycle and a shift in global capital flows away from a strong preference for US financial assets.

This was a key factor behind the capital outflows from emerging markets, with Vietnam experiencing record net selling of $8 billion since 2021. SGI Capital believes that lower interest rates and a weaker USD are essential for central banks to proactively manage their monetary policies. It also paves the way for the return of FII capital to emerging markets, ushering in a phase of improved growth for both global financial markets and economies, including Vietnam.

In its operations, the State Bank of Vietnam (SBV) has been proactive in adjusting exchange rates early on to mitigate the impact of tariff risks while maintaining low-interest rate stability. Since the beginning of the year, the VND has depreciated relatively against most major and regional currencies.

This dual approach has eased upcoming exchange rate pressures and enhanced the competitiveness of Vietnamese exports amid trade disruptions caused by tariffs. The recent appreciation of regional currencies against the USD indicates that the pressure on the VND may have passed its most intense phase, providing SBV with additional monetary policy maneuvering space once the Fed officially cuts rates in the second half of the year.

In April, foreign investors continued net selling, totaling nearly VND 14,500 billion, the strongest monthly selling since the beginning of the year. However, in the final days of April and early May, foreign investors returned to net buying.

SGI Capital also observed strong net contributions from domestic investors, who actively participated in buying during the market’s panic sell-off and margin calls triggered by tariff concerns. The declining trend of the Dollar Index has eased foreign capital outflow pressure, and undervalued stocks are beginning to attract both domestic and foreign investment flows.

The Market is Significantly Cheaper Than Historical 1200 Levels

According to SGI Capital, a comprehensive review of investment channels over the past three years reveals that real estate has recovered and appreciated in many areas, gold has consistently reached new historical highs, and digital currencies have also surged multiple times. Only the stock market, under intense selling pressure from foreign investors, remains far below its 2022 peak.

“The 1200 mark of the VN-Index has been like a curse for loyal stock investors for the past 18 years, leaving many, including professional investors, feeling discouraged. Experience shows that this is the time for us to be optimistic”, states the SGI Capital report.

After three years, many listed companies continue to grow their profits and accumulate intrinsic value, yet their stock prices do not reflect these changes. Consequently, P/E and especially P/B ratios have declined to historically low levels. The market valuation is significantly cheaper than in previous instances of the VN-Index reaching 1200.

SGI Capital assesses that, in investing, low valuation is a prerequisite for ensuring low risk and high returns. The psychologically daunting 1200 mark of the VN-Index has now become a robust support level. Compared to other asset classes, stocks are regaining their appeal as an investment channel with an attractive risk/return correlation.

In conclusion, while tariff-related risks remain, the current low valuations, especially for directly impacted stocks, largely reflect these risks. This dynamic ensures that buying and holding a diverse range of stocks for the long term will likely lead to high returns.

Market Pulse May 5: Real Estate Sector Leads, VN-Index Surges Over 12 Points

The market closed with positive gains, seeing the VN-Index rise by 12.32 points (+1%), finishing at 1,238.62. Likewise, the HNX-Index climbed 0.87 points (+0.41%), ending the day at 212.81. It was a predominantly green market with 476 gainers compared to 247 losers. Within the VN30 basket, bulls held sway with 19 gainers, 7 losers, and 4 stocks closing flat.

Market Beat: VHM Sees Foreign Sell-Off of $5 Million, VN-Index in a Tug-of-War

The market closed with the VN-Index down 2.43 points (-0.2%), settling at 1,226.8 points. The HNX-Index also witnessed a decline of 0.27 points (-0.13%), ending the day at 211.45. The market breadth tilted slightly towards the bullish side, with 396 gainers outweighing 353 losers. Within the VN30 basket, bulls held a slight edge, as evidenced by 15 advancing stocks, 13 declining stocks, and 2 stocks remaining unchanged.

Market Beat: VN-Index Recovers from 70-Point Loss to Close Down Just Under 10 Points

The market seemed poised for a major correction at the start of the afternoon session, but buyers quickly stepped in as the index touched the strong support level of 1,140 points. This swift response from buyers fueled a continuous recovery for the remainder of the trading day.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)