According to Dlnews, the second-largest cryptocurrency exchange in the market (according to CoinMarketCap) was recently hacked, resulting in a loss of nearly 1.5 billion USD in Ethereum (ETH). Chain activity indicates that the hackers have been selling the stolen funds over the past hour.

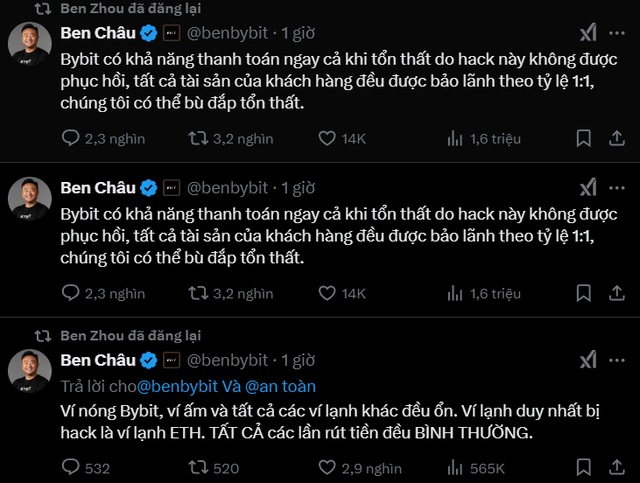

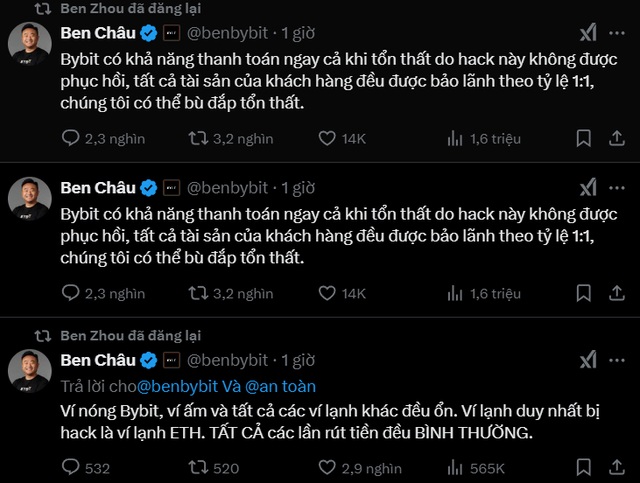

“Rest assured that all other cold wallets are secure. All withdrawals are fine,” said Ben Zhou, CEO of Bybit.

The hackers gained access to the Ether in the exchange’s cold wallet – a secure offline device used to store cryptocurrencies – and transferred the funds to an unknown address.

In a subsequent statement, Zhou assured, “Bybit is solvent even with this hack loss unrecovered. All customer assets are supported at a 1:1 ratio. We can make up for the loss.”

Bybit CEO’s post on X to reassure customers after the hack

|

Ethereum experiences volatility following the Bybit hack

|

Following the news of the hack, the value of ETH dropped by nearly 100 USD/ETH, currently fluctuating around 2,737 USD.

In other Bybit-related news, the exchange’s CEO has refused to list Pi Network, citing past troubles with older users demanding their money back after losses. “Today, many people asked me if I’m participating in Pi. I said, don’t be ridiculous,” Ben Zhou wrote on X on February 12th.

In the post, Zhou mentioned his past experience in forex trading, where he faced challenges in making profits and often had to deal with protests from older individuals demanding their money back. “I really don’t want to get involved in this world of digital currency. Stay away,” he added.

This statement sparked a backlash from the Pi Network community.

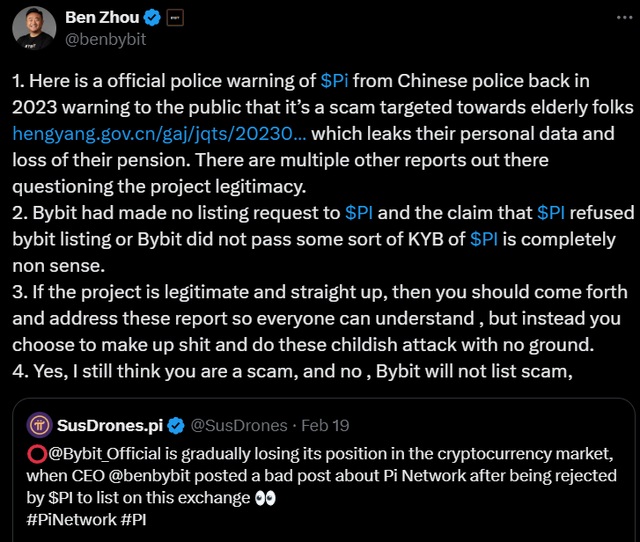

Ben Zhou’s post on X, stating he will not list Pi Network

|

On February 20th, Pi Network officially launched on several exchanges, including Okx, Mexc, and Bitget. A few hours later, Zhou posted on social media platform X in response to criticisms from the Pi Network community, who claimed that Bybit was losing its position by not listing the currency.

In his post on X, Zhou asserted that Bybit never had any intention of listing Pi Network and completely denied rumors that the exchange was rejected or couldn’t meet the requirements for listing.

“Bybit has never requested to list $PI, and the statement that Pi Network rejected Bybit or that Bybit didn’t pass the KYB process is completely meaningless,” Zhou emphasized.

Furthermore, the Bybit CEO quoted an official warning from the Chinese police in 2023, which accused Pi Network of being a scam targeting older individuals, taking advantage of them to collect personal data and seize assets.

Zhou reaffirmed that Bybit will never list Pi Network.

As of February 22nd, the value of Pi Network on exchanges such as OKX, Mexc, and Bitget has significantly dropped compared to its initial listing price, hovering around 0.7 USD/pi, a decrease of about 65% from its 2 USD listing price on February 20th. Notably, this is the third day of consecutive decline for Pi.

According to cryptocurrency experts, it is challenging to predict whether Pi’s price will increase or decrease in the short term due to potential interventions from the team if the currency experiences a sharp decline. However, in the medium term, there is a high risk that Pi’s value will continue to plummet, possibly falling below the 0.xxx USD/pi level.

“Before investing in Pi, now that it is listed on exchanges, people need to thoroughly research the Pi Network project. Getting listed is only good news in the short term. Many coins have been delisted after being launched, which is quite common, and many people lose everything. So, don’t jump into it if you don’t understand the cryptocurrency market; it’s very risky,”

In the cryptocurrency market, prices of major coins are experiencing a slight dip. Bitcoin (BTC) is currently valued at 96,131 USD/BTC, a 2% decrease from the past 24 hours. BNB stands at 649 USD/BNB (down 0.6%), while Ethereum (ETH) is at 2,683 USD/ETH (down 1.8%).

Le Tinh

– 08:18 22/02/2025

The Cryptocurrency Crash: Bitcoin Plunges Below $84,000

The crypto market witnessed a brutal sell-off on February 26, with Bitcoin and Ethereum plunging to multi-month lows as liquidations surpassed $600 million in the past 24 hours.