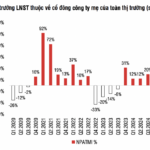

The Vietnam Asset Management Group Joint Stock Company (stock code: TVC) has released its consolidated financial statements for Q1 2025, revealing an 88% decline in revenue to just over VND 10.4 billion. The company attributes this drop to an increased focus on equity holdings and a lack of profit-taking activities during this period. In contrast, in Q1 2024, TVC had realized profits by selling mid-term holdings.

This quarter also saw a significant 91% decrease in financial income, amounting to VND 6.07 billion, due to reduced gains from trading securities. Conversely, financial expenses surged by VND 85.6 billion, rising from VND -42.7 billion in Q1 2024 to VND 42.9 billion in Q1 2025.

As a result, TVC posted an after-tax loss of VND 42.3 billion, a stark contrast to the VND 158 billion profit recorded in the same period last year. The company explained that this loss was due to a VND 41.3 billion provision for declining securities values and the sale of a portion of its short-term equity investments at a loss.

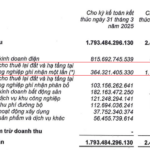

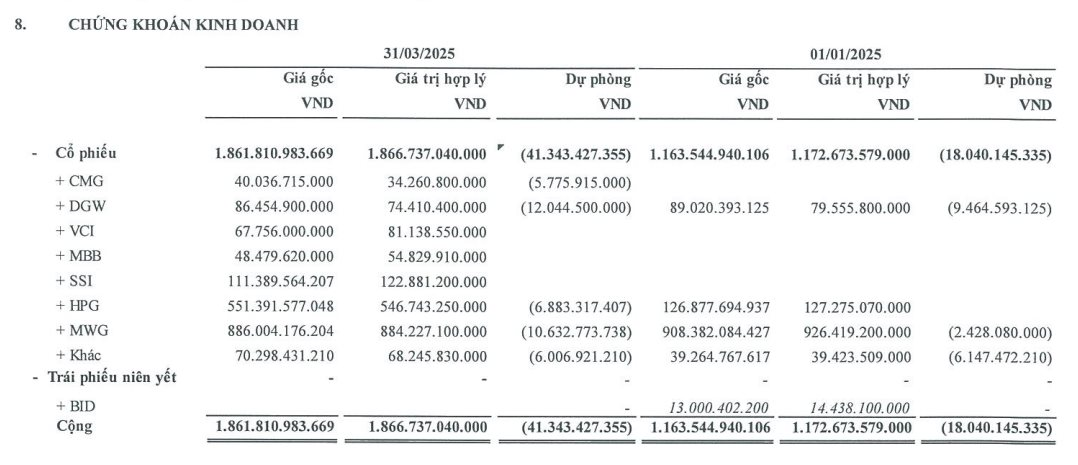

As of the end of Q1, TVC’s total assets stood at nearly VND 2,561 billion. Notably, over 70% of these assets were invested in securities. Specifically, the company has invested almost VND 1,862 billion in stocks, marking an increase of VND 698 billion since the beginning of the year.

Breaking down TVC’s stock investments, the company has allocated VND 886 billion to MWG, over VND 551 billion to HPG, more than VND 111 billion to SSI, exceeding VND 86 billion to DGW, nearly VND 68 billion to VCI, and over VND 48 billion to MBB. Additional investments include VND 40 billion in CMG and other stocks.

Comparing this to the company’s investment portfolio at the start of the year, TVC has increased its investment in HPG by nearly VND 425 billion. The company has also purchased additional shares of CMG, VCI, MBB, and SSI, while reducing its holdings in DGW and MWG by approximately VND 3 billion and VND 22 billion, respectively.

As of March 31, TVC has set aside VND 41.3 billion in provisions, including VND 12 billion for DGW, VND 10.6 billion for MWG, nearly VND 7 billion for HPG, and VND 6 billion for CMG.

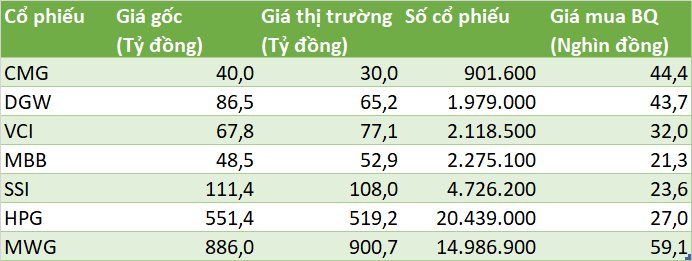

Based on the closing stock prices on March 31, TVC held over 20.4 million shares of HPG, close to 15 million shares of MWG, more than 4.7 million shares of SSI, and approximately 2.3 million shares of MBB. Notably, the number of HPG shares in TVC’s possession increased by 15.66 million compared to the beginning of the year.

Share prices as of May 7, 2025

If TVC were to maintain its current HPG holdings, the value of these shares would exceed VND 519 billion. According to current accounting standards, unrealized gains on investments are not recognized in the income statement, but losses must be accounted for through provisions.

Listed Companies Aim for a 13.6% Revenue Increase in 2025

Based on the 2025 statistical plan of 104 large-cap listed companies, which account for approximately 70% of market capitalization, the total revenue plan for 2025 shows an increase of about 13.6% compared to the revenue realized in 2024.

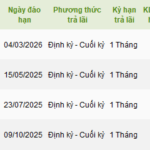

The VDS Issuance of Corporate Bonds: An Exclusive Offering of 800 Billion VND

The Board of Directors of Rong Viet Securities Corporation (VDSC, HOSE: VDS) approved a plan to issue the second tranche of bonds worth VND 800 billion to professional investors on May 7th, 2025. This move aims to restructure the company’s debt and strengthen its financial position. With this new issuance, VDSC demonstrates its commitment to optimizing its capital structure and ensuring long-term financial stability.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

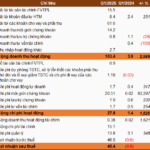

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

The Power of Persuasive Writing: Crafting a Compelling Headline

Unveiling the Secrets of a Profitable Quarter: VGC’s Impressive 56% Growth

Thanks to its robust land leasing segment and strong infrastructure development, Viglacera reported impressive earnings for the first quarter of 2025, with a profit of nearly VND 321 billion, a 56% increase compared to the same period last year. The company has successfully achieved 24% of its annual profit target.