Eximbank’s Extraordinary General Assembly

A clear testament to this was the voting ratio on critical personnel matters for the VIII term from 2025–2030, along with significant Eximbank decisions.

Specifically, Proposal No. 01 on the number of members of the Board of Directors (BOD) for the term 2025–2030, with five members, including two independent members, was passed with an impressive 99.97% approval rating. Proposal No. 02 on determining the number of members of the Supervisory Board, also at five members, was approved with a nearly identical 99.98% majority.

Regarding the BOD structure, the elected members garnered an overwhelming number of votes. Mr. Nguyen Canh Anh secured a vote ratio of over 101.17%, followed by Mr. Pham Tuan Anh at 99.69%, Ms. Do Ha Phuong at 99.68%, Mr. Hoang The Hung at 99.71%, and Ms. Pham Thi Huyen Trang, who attained a ratio of 99.66%.

The Supervisory Board’s five members were similarly elected with near-unanimous support. Mr. Nguyen Tri Trung led with a vote ratio of 101.1%, followed by Ms. Doan Ho Lan at 99.74%, Mr. Lam Nguyen Thien Nhon at 99.71%, Mr. Hoang Tam Chau at 99.69%, and Ms. Tran Thi Minh Ly, who secured a ratio of 99.67%.

Beyond personnel matters, other significant Eximbank agenda items were passed with flying colors, boasting approval ratings ranging from over 92% to a near-perfect 99.98%.

Eximbank shareholders demonstrate strong unity in supporting the bank’s key decisions

These figures showcase the remarkable unity among Eximbank shareholders and their alignment with the bank’s leadership. After a decade of division that hindered the bank’s progress, Eximbank now stands at the precipice of a new, optimistic era.

“We aspire for the VIII term to be a breakthrough period, marked by transparency and a stable governance structure, with the accompaniment of major shareholders who possess financial prowess and a progressive management mindset,” shared Eximbank’s Acting CEO, Mr. Nguyen Hoang Hai. “When we unite in vision, I firmly believe that Eximbank will evolve, our image will improve, and we will solidify our market position.”

Swift, Controlled, and Substantial Action

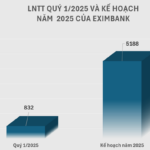

For 2025, Eximbank aims high, targeting a 10.7% increase in total assets to VND 265,500 billion. The bank plans to mobilize VND 206,000 billion in capital, reflecting a substantial 15.5% surge compared to the previous year. Expectedly, credit outstanding will witness a 16.2% boost to VND 195,500 billion. Notably, the bank is committed to reducing its bad debt ratio, targeting a decrease of 0.54% to 1.99%. Profit before tax is projected to surpass VND 5,188 billion, representing an impressive 23.8% year-on-year growth.

Mr. Nguyen Hoang Hai elaborated, “From 2025 onwards, our increased charter capital will facilitate expanded credit limits, and we will diligently maintain our capital adequacy ratio (CAR) at a stable 12%, as mandated by the State Bank of Vietnam. Eximbank always prioritizes capital safety, opting for a steady yet gradual growth approach. We strategically focus on selective credit growth in sectors with high potential and those that play to Eximbank’s strengths.”

“The bank leverages its expertise in import-export financing and trade finance optimization, prioritizing transaction fees and service income over mere interest rate competition,” continued the Acting CEO. “Eximbank takes pride in its long-standing clients, some of whom have been with us for 15 to 20 years, placing us among the market leaders in terms of customer loyalty. This solid foundation enables us to foster sustainable growth in trade finance. Notably, we have secured substantial trade finance limits, ranging from USD 200 to 400 million, from multiple foreign partners over the last year.”

Currently, Eximbank is undergoing a significant digital transformation, embracing a comprehensive digital mindset. This encompasses digital onboarding, the deployment of digital financial services, and an enhanced digital customer experience. These initiatives will substantially reduce operating costs, streamline personnel, and accelerate system efficiency.

“Our valued shareholders can rest assured about the quality of the bank’s assets,” assured Mr. Hai. “Moving forward, we will implement optimization strategies to enhance operational efficiency and benefit our customers, shareholders, and employees alike. United in purpose, our team is committed to swift, controlled, and substantial action to keep pace with market trends, ensuring a customer-centric approach and a strong focus on internal auditing, risk management, and safeguarding the interests of our customers, employees, and shareholders. As we commemorate Eximbank’s 35th anniversary, we are dedicated to fortifying the brand’s reputation and values.”

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.

Launching the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW

On May 7, 2025, the Forum on Developing New Impetus for the Nation and the Launch Ceremony of the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW was held in Hanoi. This significant event, organized by FPT Corporation in collaboration with various ministries, departments, and organizations, aimed at contributing to the development of human resources to ensure the successful implementation of Resolution 57-NQ/TW.

“Eximbank Empowers FDI Enterprises with Comprehensive Financial Solutions”

In a volatile global economic landscape, Vietnam remains a shining beacon for FDI attraction. Eximbank stands as a trusted financial partner for FDI enterprises, offering tailored financial solutions that optimize costs and enhance competitive advantage. With our support, businesses can unlock sustainable growth opportunities, bolstered by our agile approach to financing.

“Capital Solutions for Small and Medium-Sized Enterprises”

“At the “Elevating Vietnamese Enterprises” event held on the morning of May 8, experts from banking and payment solution companies offered insights into supporting Vietnam’s small and medium-sized enterprises (SMEs) to enhance their governance, optimize operations, and foster sustainable growth in the current economic landscape.”

A New Era for Nhat Viet Securities: Unveiling the Appointment of a Visionary Leader

“Nhất Việt Securities appoints Ms. Nguyen Thi Thu Hang as its new CEO and legal representative, succeeding Mr. Tran Anh Thang. “