Commercial banks (CBs) are continuously launching mortgage loan programs with unprecedented low interest rates, but borrowers are still hesitant for fear of a sharp increase in interest rates after the incentive period expires. Meanwhile, the real estate market has yet to fully recover, supply is scarce, and prices remain high, making homeownership inaccessible to many.

Competing for mortgage incentives

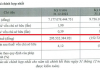

Speaking to reporters from the Nguoi Lao Dong newspaper, both bank and real estate professionals stated that never before have banks offered so many home loan programs with ultra-low interest rates as they are now. For example, major banks such as Vietcombank and BIDV are offering home loan packages with interest rates as low as 5%-5.5%/year for the first 12 months and 6%-7%/year for the following 2-3 years.

Private commercial banks such as ACB, Eximbank, and VIB offer slightly higher preferential interest rates, but most are still below 8%/year in the initial years. To attract customers, each bank also offers additional incentives such as grace periods (principal payment exemption) of up to 5 years and no penalty fees for early loan repayment.

Although interest rates for loans in general and mortgages in particular are said to have bottomed out, actual credit growth has yet to meet expectations. The latest statistics from the State Bank of Vietnam show that in the first four months of 2024, credit growth in the banking system reached only about 1.5%, an improvement compared to the first two months of the year but still below the same period last year. Many prospective homebuyers say that mortgage rates are “very attractive” but are still not ready to take out loans for housing, rental, or investment due to various reasons.

Mr. Tran Minh Tam (residing in Go Vap district, Ho Chi Minh City) said that his primary concern is what interest rates will be charged by banks after the incentive period. “Banks say that after the end of the preferential period, they will apply the base interest rate plus a margin of 2.5% – 3.5% or a floating interest rate, but it’s not clear. I don’t know what the base rate or floating rate is to calculate my repayment capacity. Not to mention, if I repay the loan early, I will be charged a penalty fee of 1% – 4%, which makes me very hesitant,” said Mr. Tam.

Meanwhile, according to our research, the floating interest rate currently being applied by many banks is 9% – 10%/year, significantly higher than the preferential interest rates in the initial period. With this interest rate, potential homebuyers will have to carefully consider.

Mortgage rates are low, but many people are still hesitant to buy for housing, investment, or rental… Photo: LAM GIANG

Market remains challenging, investors fear “debt burden”

Ms. Hoai Thu (residing in Binh Thanh district, Ho Chi Minh City) said that she has about 4-5 billion VND and wants to buy an apartment or townhouse for investment but has not dared to “put down the money.” “Many credit officers have advised me to borrow an additional 1.5-2 billion VND to buy high-end real estate that sellers are “cutting losses on,” waiting for the market to recover to sell for a profit.

But I realize that in the current market conditions in Ho Chi Minh City, it is very difficult to buy for a quick profit. If I can’t sell the property by the end of the preferential interest rate period, I will have to bear a large amount of debt and interest,” Ms. Thu analyzed.

In fact, according to our findings, there are still many investors who are “holding” real estate and struggling to pay bank interest of tens of percent for the past two years since the market froze.

Some have even borrowed money to buy 2-3 plots of land or condominium units, or pooled money with friends to buy real estate in the provinces for up to tens of billions of VND. Now that prices have fallen sharply, they can’t cut their losses and have to hold on to their debt, paying interest of hundreds of millions of VND each year.

Regarding floating interest rates, a senior executive of the Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) said that for a long time, many banks have based their base interest rate announcements on the average 12-month term deposit interest rate of the four major banks (Vietcombank, Agribank, VietinBank, and BIDV).

Homebuyers can monitor the savings interest rate trend at major banks to determine the base interest rate and calculate the loan interest rate. This will help them estimate their monthly loan payments after the fixed interest rate period.

To avoid “financial distress” when taking out a mortgage, a branch manager of Vietcombank recommends that in addition to interest rates and other loan-related costs, borrowers carefully consider other factors such as whether they have a stable income, how much of their family’s living expenses (children’s tuition, continuing education, healthcare, and emergency funds) will take up their income. “Based on this, borrowers can choose the loan interest rate and fixed interest rate period that suit their financial capacity,” said a branch manager of Vietcombank.

Difficulties in early loan repayment

Recently, the Nguoi Lao Dong newspaper received several complaints from homebuyers about unexpectedly receiving notifications of interest rate adjustments on their loans without a clear explanation of the interest calculation basis.