**VPBank to Pay Out Cash Dividends: A Testament to its Financial Strength and Commitment to Shareholders**

Illustrative image

Vietnam Prosperity Joint-Stock Commercial Bank (VPBank – Code: VPB) has announced that May 16, 2025, is the record date for cash dividend eligibility. Dividends will be paid out on May 23.

With a payout ratio of 5% of par value (VND 500/share), the expected cash dividend expenditure amounts to VND 3,967 billion.

This marks the third consecutive year of cash dividend distributions by VPBank. In 2024, the bank allocated VND 7,934 billion for cash dividends, representing a 10% payout ratio. Over the past three years, nearly VND 20,000 billion has been earmarked for cash dividends.

Previously, VPBank’s management committed to sustaining cash dividend policies for five consecutive years, starting in 2023.

At the 2025 Annual General Meeting, Chairman of VPBank, Ngo Chi Dung, shared that the dividend distribution strategy aims to balance the interests of shareholders while ensuring sufficient capital to sustain relatively high growth, as outlined in the bank’s strategic plan.

Mr. Dung emphasized the critical importance of capital in the banking sector and the need to strike a balance between long-term growth objectives and shareholders’ expectations for cash dividends. From 2010 to 2022, VPBank prioritized growth, achieving exceptional expansion compared to the industry average. In 2022, considering both long-term growth and shareholder interests, VPBank initiated cash dividend payments. Over the past three years, the bank has allocated nearly VND 20,000 billion for dividends, meeting shareholder expectations while maintaining adequate capital for continued high growth in the upcoming years.

According to Mr. Dung, VPBank will maintain its cash dividend policy for the next two years. However, the specific payout ratio will depend on the bank’s annual business performance, capital mobilization, and growth.

“I can assure you that VPBank will definitely continue cash dividend distributions for the fourth and fifth years,” Mr. Dung asserted.

So far this year, VPBank is the third bank to announce the record date for shareholders eligible to receive cash dividends. Previously, Tien Phong Commercial Joint-Stock Bank (TPBank) announced May 14 as the record date for a 10% cash dividend, with a payout date of May 23, 2025. Vietnam International Commercial Joint-Stock Bank (VIB) also finalized its shareholder list on April 23 to distribute 2024 cash dividends at a rate of 7%. As a result, VIB plans to distribute VND 2,085 billion in cash dividends, equivalent to VND 700 per share, on May 23.

In addition to VPBank, TPBank, and VIB, six other banks have approved cash dividend plans for 2025: ACB, Techcombank, LPBank, SHB, OCB, and MB.

According to the first-quarter 2025 financial reports, VPBank is the largest private bank in terms of asset size, second only to state-owned banks such as BIDV, Agribank, VietinBank, Vietcombank, and MB.

As of March 21, 2025, VPBank’s total assets exceeded VND 994,000 billion, an increase of 8% compared to the end of 2024. The bank is expected to reach the milestone of VND 1,000,000 billion in total assets in the second quarter of 2025.

Following VPBank in asset size are Techcombank, ACB, SHB, Sacombank, and HDBank.

The three banks with the smallest total assets in the system are Kienlongbank (VND 97,164 billion), PGBank (VND 73,552 billion), and Saigonbank (VND 33,506 billion).

A Real Estate Company Prepares to Dish Out an 84% Cash Dividend in May

In the first quarter of 2025, the company witnessed a remarkable surge in profit, with a 707% increase in PAT reaching $10.5 billion, compared to the same period last year.

The Business Highlights of SCIC’s 2025 Annual General Meeting

The government’s ambitious 8% GDP growth target sets a challenging yet achievable goal for businesses in a year of anticipated economic hurdles. The determination to strive towards this target was evident in the recent round of shareholder meetings, with enterprises partially or wholly owned by the State Capital Investment Corporation (SCIC) leading the charge.

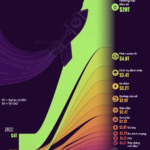

The 18 Industries That Will Shape the Global Economy Over the Next 15 Years

The infographic below depicts 18 sectors that are predicted by the global consulting firm McKinsey Global Institute to experience significant growth and make the largest contributions to the world economy by 2040.

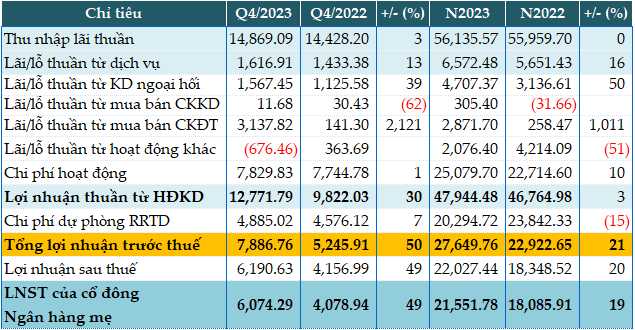

“The Battle of the Banks: VPBank and Techcombank’s Race to the Top”

“Techcombank and VPBank, two of Vietnam’s leading private banks, are not just rivals in size and scale but also in their ambitious plans to transform into comprehensive financial groups. Both institutions have set their sights on diversifying their offerings by venturing into the insurance sector and significantly expanding their securities and asset management arms. This strategic shift underscores their commitment to becoming one-stop shops for all their customers’ financial needs, solidifying their positions as industry leaders.”