Vietravel is offering nearly 28.7 million shares to existing shareholders through a preferential rights issue at a ratio of 1:1, meaning that for every 1 share owned, shareholders will receive 1 right, and for every 1 right, they can purchase 1 new share. The ex-rights date is set for May 20, and the subscription and payment period will run from May 26 to July 7.

The company has stated that these shares will not be subject to transfer restrictions. However, any unallocated shares that are subsequently offered to other investors will be restricted from transfer for one year.

In terms of partners, this offering is being advised by Rong Viet Securities Company and audited by AFC Vietnam Audit Company Limited.

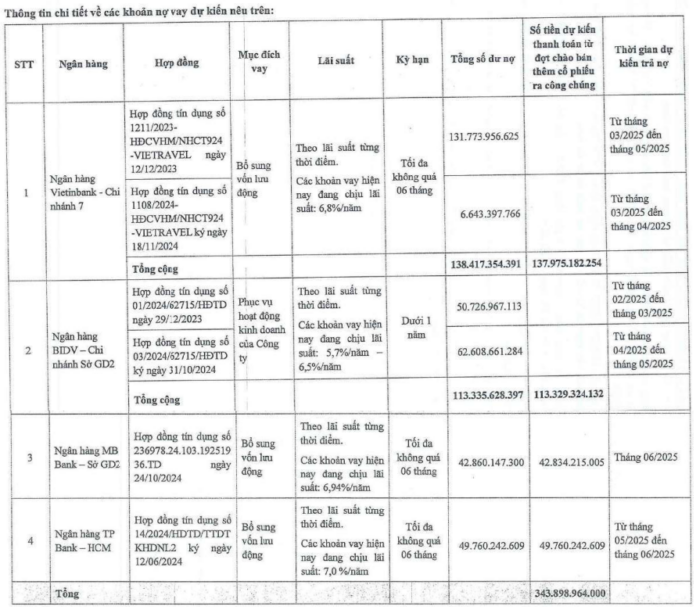

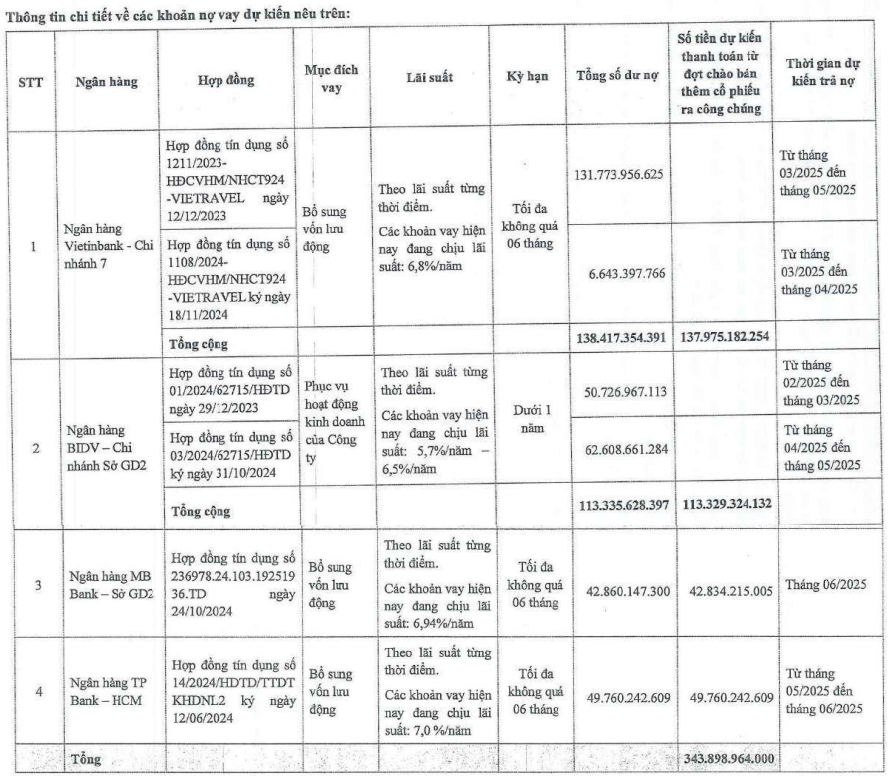

With a share price of 12,000 VND, Vietravel expects to raise nearly VND 344 billion. These funds will be used to repay the company’s short-term debts in the first half of 2025, including VND 138 billion to VietinBank Branch 7, over VND 113 billion to BIDV Transaction Office 2, nearly VND 43 billion to MB Transaction Office 2, and nearly VND 50 billion to TPBank HCM.

These loans, with annual interest rates ranging from 5.7-7%, were taken out by Vietravel to supplement their working capital and support their business operations.

Source: Vietravel’s Prospectus

|

In reality, this issuance is one of the options that the Board of Directors will present to the Annual General Meeting of Shareholders for approval to continue implementation, following a period of delay due to various reasons.

Specifically, one year ago, at the 2024 Annual General Meeting of Shareholders, Vietravel had approved the offering of nearly 28.7 million shares to existing shareholders (phase 1), the issuance of nearly 8.6 million shares to increase charter capital from owner’s equity, and the offering of nearly 2.9 million shares under an employee stock ownership plan (phase 2), totaling over 40.1 million shares, which would increase the charter capital to nearly VND 694 billion.

However, for the offering to existing shareholders, the company received a written request from the State Securities Commission of Vietnam on April 14, 2025, asking to update the first-quarter financial statements for 2025 to complete the file for the issuance certificate. The updated documents were submitted on April 22.

The delay in completing phase 1 also postponed phase 2. Therefore, after the completion of the first phase, the company will implement the remaining phases, expected to be in the third quarter of 2025.

Vietravel plans to hold its 2025 Annual General Meeting of Shareholders on the morning of May 17 at the Fleur de Lys Quy Nhon Hotel in Quy Nhon city, Binh Dinh province. In addition to considering the share offerings, shareholders will also vote on the proposal to shorten the company’s name from “Vietnam Transport and Marketing Travel Joint Stock Company – Vietravel” to “Vietravel Tourism Joint Stock Company”. They will also vote on adding three business lines to expand investment and immigration consulting.

Additionally, the dividend plan for 2024 will be presented for approval, with a proposed rate of 10% in cash (VND 1,000 per share), to be paid out in the second or third quarter of 2025. For 2025, the company plans to distribute dividends at a rate of 5%.

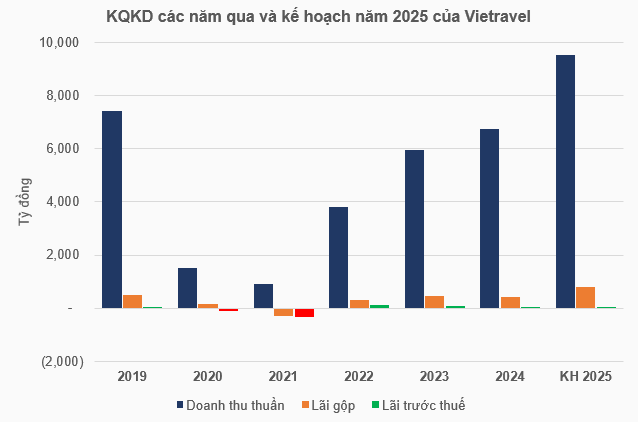

In terms of business plans, the company forecasts a revenue of VND 9,549 billion, a 42% increase, and a pre-tax profit of VND 50 billion, an 11% decrease.

In the first quarter of 2025, Vietravel achieved a revenue of over VND 1,294 billion, an 8% increase year-on-year, but its pre-tax profit was only over VND 8.4 billion, a 47% decrease. Thus, with the results of the first quarter, the company has achieved only 14% of its revenue plan and 17% of its profit plan.

Source: VietstockFinance

|

Huy Khai

– 09:39, May 12, 2025

The First Bank Targeting Over 30% Profit Growth by 2025

This bank has set an ambitious target for its 2025 performance, aiming for a pre-tax profit of 5,338 billion VND, representing a remarkable 33% increase from 2024.