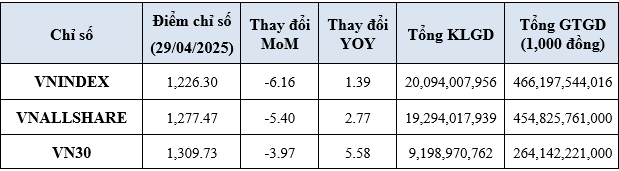

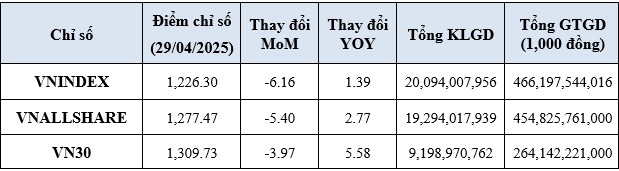

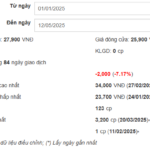

In detail, the VN-Index reached 1,226.3 points, VNAllshare 1,277.47 points, and VN30 1,309.73 points. During the month, all three indices witnessed a decline, with losses of 6%, 5%, and 4%, respectively.

|

Monthly Trading Statistics by Index

Source: HOSE

|

Regarding sector indices, except for the real estate sector index (VNREAL) which rose by 1.2%, all other sector indices experienced declines. Notably, the energy sector (VNENE), information technology (VNIT), and materials sector (VNMAT) indices dropped by 17%, 10%, and 8%, respectively.

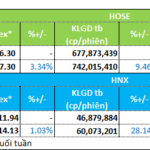

In terms of liquidity, the average trading volume exceeded 1 billion shares per day, marking a 14% increase. Meanwhile, the average trading value surpassed VND 23,309 billion per day, representing a 12% rise compared to March 2025.

For covered warrants (CW), the average daily trading volume stood at nearly 58.7 million CW, while the average trading value was VND 41.6 billion, indicating an increase of 7% in volume but a decrease of 16% in value.

Turning to ETF certificates, the average daily trading volume exceeded 4.5 million ETFs, reflecting a notable surge of 76%. Concurrently, the average trading value surpassed VND 107.5 billion per day, equivalent to a substantial increase of 64%.

Foreign investors’ total trading value for April 2025 exceeded VND 118,162 billion, accounting for 13% of the entire market. They net sold during the month, with a net selling value of over VND 13,228 billion.

As of April 29, 2025, HOSE had 613 listed and traded securities, encompassing 391 stocks, 4 closed-end fund certificates, 17 ETF certificates, and 201 CWs. The total number of listed securities exceeded 178.4 billion.

The market capitalization of stocks on HOSE surpassed VND 5.1 quadrillion, representing a 6% decrease from the previous month. This amount is equivalent to 44.5% of the 2024 GDP and accounts for nearly 94% of the total market capitalization of listed stocks across all exchanges.

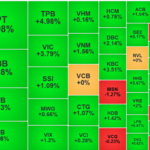

As of April 29, 2025, HOSE featured 40 companies with a market capitalization of over USD 1 billion. Notably, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB) was the sole company with a market cap above USD 10 billion.

– 15:39, May 12, 2025

“Capital Flows into Blue-Chip Stocks, VN30-Index Heals from Withholding Tax Wounds”

The significant de-escalation in tariff tensions between the economic superpowers has spurred a robust stock market rally at the start of the week. This development prompted a substantial influx of funds into the blue-chip stock category, with the VN30 basket’s liquidity surging to an 11-session high. Consequently, the representative index for this group has rebounded to pre-April 2nd levels, when the countervailing duty shock occurred.

Market Pulse, May 12: US-China Tariff Cuts Spur VN-Index Rally

The market closed with positive gains; the VN-Index rose by 15.96 points (+1.26%), reaching 1,283.26, while the HNX-Index climbed 1.91 points (+0.89%) to 216.04. The market breadth favored the bulls with 502 gainers versus 260 decliners. A sea of green was seen in the VN30 basket, as 27 stocks advanced, 2 declined, and 1 remained unchanged.

The Strategic Capital Retreat: Biwase Members Plan Massive Divestment from Vwaco

Biwase Installation – Electricity Joint Stock Company (Biwelco) has registered to sell 7.1 million VLW shares of Vinh Long Water Supply Joint Stock Company (Vwaco, UPCoM: VLW) from May 13 to June 6, expecting to reduce its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%).