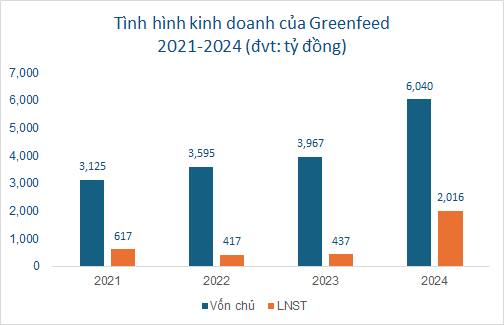

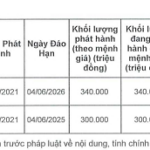

Specifically, Greenfeed reported audited consolidated after-tax profits of over 2.1 trillion VND in 2024, a 4.8-fold increase from the previous year, marking the highest profit in the past four years. On average, the company earned nearly 5.8 billion VND in after-tax profits each day last year.

Owners’ equity increased by over 50% to more than 6.04 trillion VND. This includes 1.5 trillion VND of capital investment from owners, with the remaining comprising undistributed post-tax profits of 4.9 trillion VND and a foreign exchange difference of 48 billion VND.

Source: HNX, Consolidated

|

Total liabilities decreased by 7%, standing at nearly 5.07 trillion VND. Notably, bank loan debt decreased by 46% to over 1.25 trillion VND, while bond debt decreased by 30% to 700 billion VND. All liquidity ratios (current, quick) exceeded 1, while the interest coverage ratio reached 22 times, indicating no risk in the company’s debt repayment obligations.

ROE (return on equity) significantly improved from 11% to nearly 35%, and the after-tax profit margin on total assets also increased from 4.63% to almost 19%.

|

Greenfeed’s owners’ equity surged in 2024 due to substantial profits

Source: HNX

|

Currently, Greenfeed has one outstanding bond issue with the code GFVCH2128001, totaling 1 trillion VND in value. This bond has a tenor of 84 months, issued on November 3, 2021, and will mature on June 15, 2028. Vietcombank Securities Company (VCBS) acts as the advisor, registrar, issuer, and transfer agent for this bond issue.

The interest rate applicable to this bond is 6.53% per annum, with interest payments made semi-annually. The company continues to fulfill its interest payment obligations for this bond.

These are non-convertible bonds, without warrants, secured, and guaranteed. The bondholder is the International Finance Corporation – IFC (IFC). The collateral includes 100% of the capital contribution in GreenFarm Limited Company and LinkFarm Limited Company (both owned by Greenfeed) along with all related or generated rights and benefits.

On June 17, 2024, Greenfeed repurchased 300 billion VND of the bonds and completed its interest payment obligations for 2024.

Established in 2003, Greenfeed Vietnam operates in the animal feed production industry and has since expanded into the slaughtering and food processing sector. The company owns the G Kitchen pork brand in the market.

Notably, the G Kitchen store chain has been downsizing. In March 2022, the company owned 95 stores in the southern region, specifically in Ho Chi Minh City, Dong Nai, and Binh Duong. However, as of May 13, 2025, the official website of G Kitchen lists only 18 stores, all located in Ho Chi Minh City.

A G Kitchen store

|

Despite the contraction in its retail presence, Greenfeed maintains a significant scale in livestock farming. In 2024, the company ranked 37th out of 49 in the World Mega Producer list for large-scale livestock producers, with a total sow herd of 116,000.

– 14:25 05/13/2025

“BIDV’s Strategic Move: Investing VND 12,271 Billion in an Early Bond Repurchase”

The Board of Directors of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has approved a plan to repurchase its capital-raising bonds ahead of schedule. The bank now has the option to repurchase these bonds from the 2nd quarter of 2025 until the end of the 1st quarter of 2026.

The Profit Update for Q4 2024: A Market Surge with Real Estate Leading the Charge

In Q4 2024, the market’s after-tax profit rose by 20.9% year-over-year, marking the fourth consecutive quarter of steady growth. Several industries witnessed remarkable growth spurts during this period, notably Real Estate and Retail, which significantly contributed to the overall positive performance.

The Novaland-Linked Enterprise Surprises with a VND640 Billion Bond Repayment

After defaulting on interest payments for two bond series, CLHCH2126001 and CLHCH2125003, in June, Cat Lien Hoa Real Estate Development JSC unexpectedly announced that it had repurchased the entire principal amount of these two bond lots on September 30.

The Food Empire’s Distribution Dilemma: G Kitchen Slashes Stores, HAGL Exits Bapi Food, KIDO’s MiniBao Ambition

As of March 2022, with the backing of GreenFeed, G Kitchen successfully launched 95 stores in the South, but now only 19 remain. Hoang Anh Gia Lai once boasted 200 Bapi Food stores, but they have since divested entirely. With KIDO’s extensive experience, MiniBao is expected to crack the challenging code of food production for these businesses.