In the context of declining stock prices in the Vietnamese stock market, including that of Hoa Sen Group Joint Stock Company (HOSE: HSG), which fell below their intrinsic and book values, the company provides an update on its business operations.

Regarding export activities, since September 2024, the US Department of Commerce has initiated anti-dumping and countervailing duty investigations on zinc-coated, cold-rolled, and color-coated steel products exported from Vietnam. This has temporarily disrupted Hoa Sen Group’s exports to the US due to customer caution. However, the group has leveraged its core competitive advantages to explore and expand into new high-potential export markets, diversifying its export products to over 90 countries and territories. Additionally, with its network of over 400 Hoa Sen Home construction material and furniture supermarkets across 63 provinces, the group has boosted domestic consumption of its products.

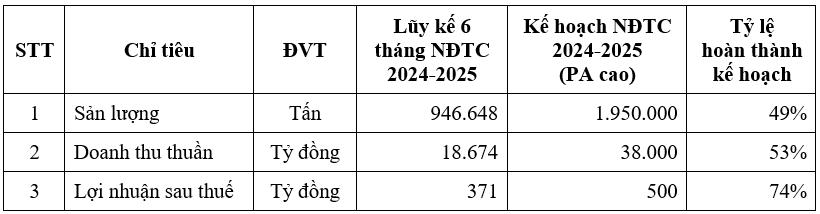

Demonstrating its agility and adaptability to market fluctuations, Hoa Sen Group’s cumulative business results for the first six months of FY 2024-2025 are very positive:

In terms of market share, according to the Vietnam Steel Association, Hoa Sen Group maintained its leading position in Vietnam’s coated steel market (29% market share) and ranked second in the steel pipe market (15% market share).

In terms of business performance, the consolidated output reached 946,648 tons, completing 49% of the plan; consolidated revenue reached VND 18,674 billion, completing 53% of the plan; and consolidated after-tax profit reached VND 371 billion, completing 74% of the high-case plan as follows:

Furthermore, in the first six months of FY 2024-2025, Hoa Sen Group recorded a positive cash flow from operating activities of nearly VND 2,030 billion, ensuring financial stability and enabling the company to proactively repay loans, improve financial safety ratios, enhance its reputation with banks and partners, and strategically develop the Hoa Sen Home system in the medium and long term, laying the foundation for sustainable long-term growth.

Despite the temporary disruption in exports to the US over the past six months since September 2024, the positive business results for the first six months of FY 2024-2025 demonstrate Hoa Sen Group’s exceptional ability to adapt to market changes, indicating that US trade policies have not significantly impacted the group’s business operations.

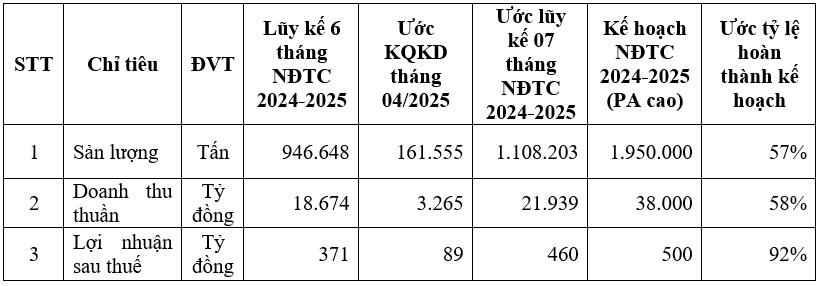

In April 2025, Hoa Sen Group continued its positive business performance. The estimated business results for April 2025 are as follows:

Thus, for the first seven months of FY 2024-2025, HSG has achieved 57% of the output plan, 58% of the revenue plan, and 92% of the after-tax profit plan according to the high-case scenario. The fact that the after-tax profit is close to completing the plan earlier than output and net revenue indicates that the Hoa Sen Group is operating with a higher profit margin than planned, reflecting the company’s improved operational efficiency.

With these positive business results, Hoa Sen Group is confident about surpassing the business targets for FY 2024-2025 according to the high-case scenario approved by the Annual General Meeting of Shareholders.

Why Are ATO and ATC Prices No Longer Displayed During the Periodic Auction Matching Session?

With the new system, the ATO/ATC orders are displayed at a specified price, much like a limit order, rather than the previous ‘ATO’ and ‘ATC’ indicators.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)