The most recent dividend payout by NHA was in 2018. For the next five years, from 2019 to 2023, the company refrained from distributing dividends.

The company has approved a 10:1 stock split, meaning that for every 10 shares owned, shareholders will receive one additional share. With over 44.1 million shares currently in circulation, NHA is expected to issue more than 4.4 million new shares. The additional shares will be funded by undistributed post-tax profits as of December 31, 2024, as per the audited financial statements.

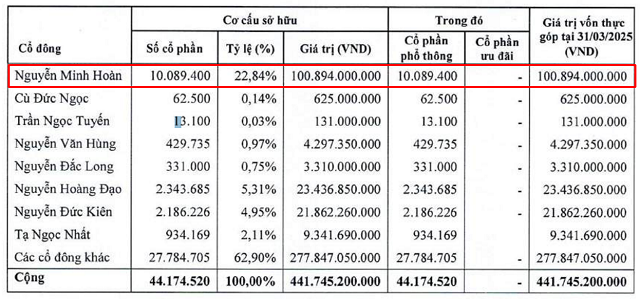

As of March 2025, NHA’s largest shareholder is its Chairman, Nguyen Minh Hoan, who holds a 22.84% stake in the company. He is estimated to receive over 1 million shares from this dividend distribution.

Source: NHA

|

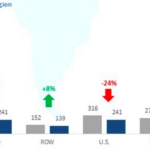

This dividend announcement comes on the back of a strong financial performance in Q1/2025. NHA reported quarterly revenue of nearly VND 97 billion, almost triple that of the same period last year. Net profit also tripled to over VND 34 billion, marking the highest profit in 20 consecutive quarters since Q1/2020.

| NHA’s net profit from Q1/2020 to Q1/2025 |

Construction company reports Q1 profit nearly triple that of last year

The impressive growth was mainly attributed to the completion and handover of several construction projects for the Industrial Park Infrastructure Development Investment Joint Stock Company of Dong Van III Industrial Park in Ha Nam province. Additionally, the continued transfer of land use rights in the Moc Bac residential area, Duy Tien district, also contributed significantly to the company’s profits.

At the 2025 Annual General Meeting of Shareholders, NHA approved a revenue target of VND 260 billion for the year, representing a 62% increase from 2024. However, the net profit target was set at VND 50 billion, a 21% decrease. After the first quarter, the company has achieved 37% and 68% of these targets, respectively.

Addressing shareholders’ concerns about the conservative profit target, Chairman Hoan explained that this year’s revenue structure is weighted towards the construction segment, which typically has lower profit margins than real estate. Given the economic uncertainties, the company has adopted a cautious approach. Nonetheless, Mr. Hoan expressed confidence in NHA’s ability to achieve the set goals.

Regarding land resources and project prospects, the Chairman shared that land clearance has been completed for two housing projects in Cho Luong and Van Xa, Duy Tien town, Ha Nam province. The company is awaiting the allocation of the remaining land area. To address issues related to commercial land in these two projects, NHA has proposed to the Ha Nam Provincial People’s Committee to return a portion of the land and auction the remaining portion as per regulations.

Commenting on the impact of the provincial merger plan, Mr. Hoan acknowledged certain challenges but emphasized the long-term advantage of Duy Tien town’s proximity to major urban areas.

– 14:58 14/05/2025

The Race to Profit: Veteran Taxi Firm Struggles with Tech Rivals

The rise of tech-based ride-hailing companies like Grab, XanhSM, and Be has left traditional taxi businesses struggling to regain their market share. With rising operational costs and declining profits, Vinasun’s earnings for the first quarter of 2025 have taken a hit, falling to a new low.

The Long Thanh Airport Investor Considers Record Dividend Payout

The Vietnam Airports Corporation (UPCoM: ACV) is seeking shareholder approval for a generous dividend plan. The company has proposed a dividend payout ratio of 64.58% – the highest in its history – in the form of stock dividends. This bold move underscores ACV’s commitment to rewarding its shareholders and fostering long-term growth. Stay tuned as we bring you more updates on this exciting development.

“Real Estate Firm with Shark Hung as Vice President Reports 60% Drop in Profits in Q1”

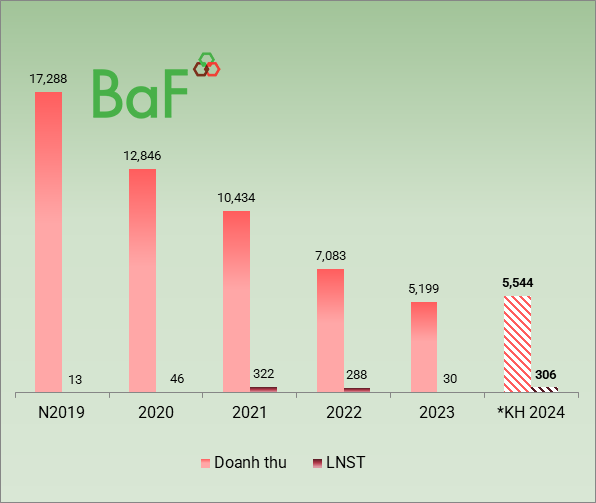

In 2025, the company aims for a net revenue target of VND 4,150 billion and a pre-tax profit of VND 300 billion, representing an impressive growth of 170% and 424%, respectively, compared to the previous year.