BAF forecasts that in 2023, the livestock industry will face many challenges related to disease outbreaks and disruptions in the supply chain of raw materials. The price of live pigs continues to decline due to the influx of pigs from small-scale farmers and the risk of smuggled pigs.

However, 2023 is also the year that BAF will significantly expand its operations, becoming one of the leading livestock companies in the country. Disbursements from the International Finance Corporation (IFC) and a group of three institutions from South Korea have provided the company with the capital to expand its farms. At the same time, the advantage of its closed livestock model has helped the company maintain its livestock population – a factor that BAF Chairman Truong Sy Ba has repeatedly emphasized is critical during the pandemic.

As of March 2024, the company’s livestock population reached nearly 430,000, an increase of almost 87% compared to the same period last year, corresponding to an output of approximately 1 million commercial pigs per year.

Aiming for the second highest after-tax profit in history

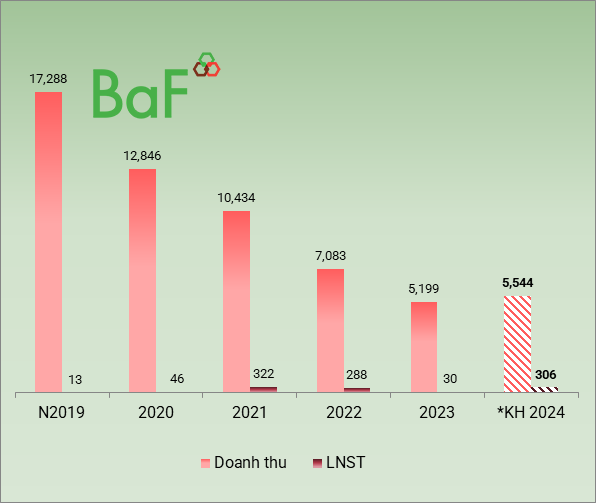

With the advantages gained, the 2024 General Meeting of Shareholders approved a business plan with a significant increase compared to the previous year. Specifically, target revenue is over VND 5.5 trillion, an increase of 6%; after-tax profit is nearly VND 306 billion, 10 times higher than the previous year, and also the second highest level since the company’s establishment in 2017. Notably, BAF‘s most successful business year was 2021 with a net profit of VND 322 billion.

|

Results of past years and BAF‘s 2024 plan

Source: VietstockFinance

|

In terms of output, BAF expects its livestock segment to produce nearly 610,000 pigs in 2024 (96% pork, 4% breeding pigs), 2.1 times more than last year. The gross profit margin for the livestock segment is expected to be 23%. According to the Chairman of BAF,

Regarding the animal feed production segment, revenue is expected to reach VND 144 billion, with after-tax profit estimated at over VND 3 billion, accounting for 1% of consolidated profit. The agricultural business segment is expected to generate VND 2,000 billion in revenue and VND 32 billion in after-tax profit, accounting for nearly 11% of the company’s total profit.

To implement the plan, the company aims to continue developing in the direction of large-scale, increasing the livestock population, and putting modern and high-tech livestock farms into operation. In particular, it will focus on developing sustainable agriculture. In addition, it will actively seek support from investment funds and commercial banks to invest in breeds, infrastructure, and technology innovation.

BAF‘s target is proven to be well-founded by the results of the first quarter. According to the consolidated financial statements for the first quarter of 2024, which were released just before the general meeting, BAF had a profitable quarter. The company ended the first quarter with revenue increasing by nearly 60% compared to the same period last year, to VND 1.3 trillion; net profit was nearly VND 119 billion (compared to only VND 4 billion in the same period last year).

Part of this profit was generated from the proceeds of land transfer. Chairman of the Board of Directors Truong Sy Ba said that BAF has a plot of land in Mai Chi Tho, with an area of nearly 1,600 m2, intended for the construction of an office building for both self-use and lease.

“But after completing the design proposal, including bank interest, we realized that the cost was very high and inefficient. In contrast, leasing would result in better financial costs. On the other hand, the company needs to mobilize many resources for investment, so we decided to sell this land. I can disclose that this lot has brought significant profit to the company, amounting to about VND 80 billion.” – quoted from Mr. Sy Ba.

The company also identified the Food segment (part of the 3F chain Feed – Farm – Food) as a competitive factor in the future with the highest profit margin in the chain. After slaughter, this segment still has 60% of the pig’s secondary components that are not easy to sell or have a very low price. BAF is researching to create processed products, in order to optimize the output.

Continuing to start construction of 6 new livestock farms

Recognizing the competitive and volatile market, BAF has set out a specific strategy for 2024, including: expanding distribution channels, linking with farmers to develop the pig population, investing heavily in farm development, strengthening personnel and upgrading systems, and opening up international cooperation opportunities.

2024 General Meeting of Shareholders of BAF. Photo: Chau An

|

The most notable aspect of BAF‘s plan is the farm development segment. According to the general meeting documents, in 2024, the company plans to put 7 farm projects into operation, including 4 farms in Tay Ninh (Tan Chau, Tam Hung, Hai Dang, Tay An Khanh), 1 farm in Phu Yen (Phu Yen 2), 1 farm in Binh Phuoc (Thien Phu Son), and 1 farm in Gia Lai (Hung Phat Farm 1).

Specifically, the Hai Dang farm cluster (with 5,000 sows and 60,000 commercial pigs), Tan Chau farm (30,000 commercial pigs), and Tam Hung farm (5,000 breeding sows) were put into operation in March 2024.

At the same time, the company expects to start construction on an additional 7 projects in 2024, including 6 livestock farm projects and 1 animal feed production plant project in Binh Dinh. By the end of 2024, the total livestock population is expected to double, increasing to 75,000 breeding sows and 800,000 commercial pigs (at the end of 2023, the corresponding figures were 37,000 and 330,000).

In addition to business indicators, the Board of Directors of BAF plans to continue implementing the dividend payment plan at a rate of 17% in the form of shares, issuing ESOP shares at a rate of 5%, and offering shares to the public for existing shareholders at a ratio of 100:47 (47.677%, equivalent to a shareholder owning 100 shares being able to purchase 47 new shares), with an offering price of VND 10,000 per share.

The above plans have been approved by the 2023 General Meeting of Shareholders. Accordingly, the charter capital is expected to increase to VND 2,435 billion.

At the general meeting, Mr. Truong Sy Ba also shared the story of the concentration of farms mainly in the South and Central Highlands (70%), with the rest in the North.

“The simple reason is the conditions for livestock farming and land. The Southern and Central Highlands regions have enough land to build large farms. In the North, the area is smaller and narrower, so only smaller farms can be built. In addition, although the South is hot, it is stable year-round. BAF‘s barns are enclosed, and the temperature is regulated at 23-26 degrees C. In contrast, the North has the disadvantage of being very cold in winter, with monsoon winds sometimes dropping temperatures to below 10 degrees C, and the fans in the barns cannot regulate such low temperatures.”.

Regarding the scale of the