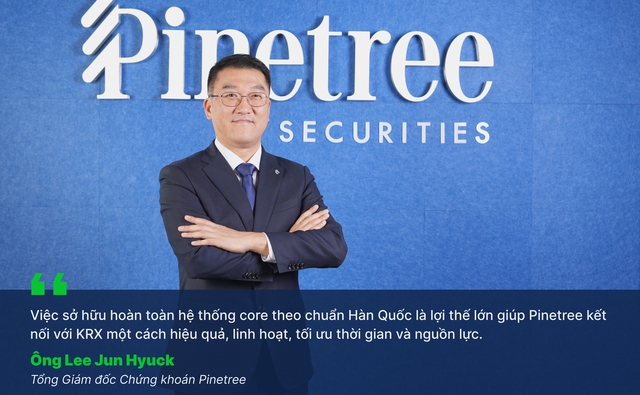

Let’s hear from Mr. Lee Jun Hyuck, CEO of Pinetree Securities (a comprehensive digital securities company and a member of Hanwha Investment and Securities Co., Ltd. in South Korea), as he shares his insights and outlook on the market after a week of trading with the new technology infrastructure.

The new IT system has been officially operational since the beginning of this week. How has the transition and operation been at Pinetree after a full week of trading?

On May 5, the KRX system officially went live, marking a significant turning point for the Vietnamese stock market. At Pinetree, the integration with the new technology infrastructure of Ho Chi Minh City Stock Exchange, banking systems, and Vietnam Securities Depository (VSDC) went smoothly according to the established plan.

During the first week of trading, orders at Pinetree were seamless and stable, with no technical issues recorded. We will continue to listen to our clients and optimize our systems to deliver an even better experience for investors.

What preparations did Pinetree make to ensure a smooth connection with KRX?

Since the beginning of the year, Pinetree has proactively developed plans and backup options for the implementation of the KRX system – one of the industry’s key technology projects. As soon as we received the official announcement from the Exchange and VSDC, we immediately allocated resources for collaboration on testing and developed a transition plan to ensure a seamless integration process.

With our vision as a comprehensive digital securities company, Pinetree has focused on investing in technology since our establishment. We are proud to be one of the few companies in Vietnam that independently develops and fully owns our securities core system. This ownership gives us the advantage of autonomy and flexibility in connecting with the new technology infrastructure, free from reliance on third parties.

Notably, our system has been designed according to Korean standards since 2019 – highly compatible with the architecture of KRX developed by the Korea Exchange. This not only shortens the time and saves resources but also enhances testing efficiency and operational stability.

Apart from technological readiness, what support activities has Pinetree implemented or is planning to implement for clients during this system transition phase?

We always put our clients at the center of our decisions. During this transition, our top priority is to ensure that our clients can adapt well to the new system. Specifically, Pinetree implemented a transition plan from late April to early May, enabling clients to maintain their trading capabilities and 24/7 fund deposit/withdrawal capabilities. Conditional orders from the old system were also preserved and processed when transferred to the new platform.

Additionally, Pinetree simultaneously deployed multiple solutions, including timely communication through our website, fanpage, trading platforms, and hotline; provision of a multi-platform support team; guidance on using new features; and continuous technical monitoring to promptly address any issues that may arise.

During this period, for the first time, we offered a special promotion of up to 30 days of interest-free margin loans to new margin clients and investors who had opened an account at Pinetree but had no margin debt in the last six months. Pinetree also introduced additional margin packages, allowing investors to choose and proactively register, such as P-5.9% (5.9% margin interest per year for 90 days, with a limit of VND 100 million per day) and P-6.8% (6.8% margin interest per year for 30 days, with a limit of up to VND 5 billion per day).

As an investor with experience in both the Korean and Vietnamese stock markets, how do you assess the challenges during this transition phase? Will Vietnamese investors face difficulties in adapting to the new system?

In the initial phase, KRX has not yet implemented all the new business functions, while information about the changes has been clearly communicated by the authorities and securities companies. This helps reduce confusion for investors.

The new functions will be introduced gradually, giving investors time to learn and adapt. With thorough preparations from the regulatory body and securities companies, I believe investors will quickly familiarize themselves with the new system and effectively utilize the advantages it offers.

What is your assessment of the prospects for the Vietnamese stock market now that the KRX system is officially operational?

KRX is a system that has been long-awaited. However, at this point, investors may not see many changes, as expectations such as T+0 or short selling are still in the future. Nonetheless, the new system brings significant improvements in order display, especially during the ATO and ATC sessions. Investors can now monitor the predicted matching price and volume of buy/sell orders at the nearest price to place reasonable orders, avoiding the previous issue of “hidden orders.”

In the long term, KRX opens up opportunities for developing various new products, such as index option contracts, derivatives, and other innovative financial instruments. Simultaneously, the new system enhances processing capacity, minimizing the risk of overload, as experienced in 2021. KRX is also a critical factor in the market upgrade goal for October, attracting stronger foreign capital inflows.

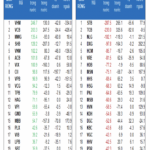

Market Pulse May 5: Real Estate Sector Leads, VN-Index Surges Over 12 Points

The market closed with positive gains, seeing the VN-Index rise by 12.32 points (+1%), finishing at 1,238.62. Likewise, the HNX-Index climbed 0.87 points (+0.41%), ending the day at 212.81. It was a predominantly green market with 476 gainers compared to 247 losers. Within the VN30 basket, bulls held sway with 19 gainers, 7 losers, and 4 stocks closing flat.

HoSE: Official Launch of the KRX System on May 5th

The Ho Chi Minh Stock Exchange (HoSE) is proud to announce the official launch of its new information technology system, effective May 5, 2025. This state-of-the-art technology infrastructure marks a significant milestone in the exchange’s journey towards becoming a leading stock exchange in the region.