For many families, the dream of owning a home is a legitimate aspiration. However, financial constraints, especially the initial repayment pressure, often become obstacles that postpone this dream. Meanwhile, by the end of 2024, apartment prices in Hanoi increased by 72.4% compared to Q2/2019, while Ho Chi Minh City saw a 34.3% rise. It is predicted that in 2025, prices could continue to increase by 5-10% annually, depending on the segment and region. Empathizing with the concerns and challenges faced by homebuyers, from the first quarter of this year, the International Bank (VIB) has launched a VND 45 trillion package for apartment and townhouse purchases, offering breakthrough solutions never seen before in the market.

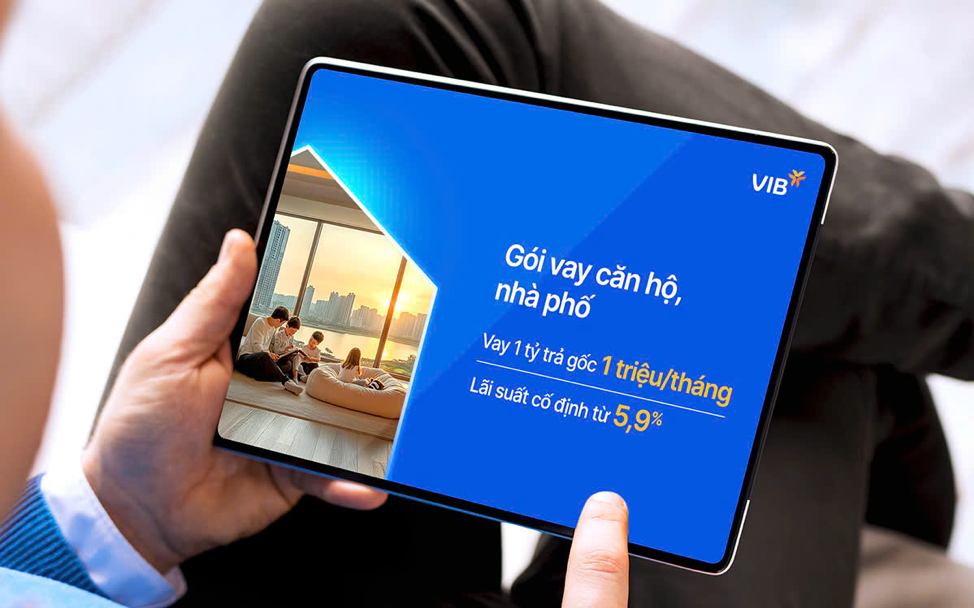

In addition to offering an attractive fixed interest rate for an extended period, VIB’s VND 45 trillion package also focuses on the repayment ability and long-term financial stability of homebuyers, especially young people, with a unique approach: Borrow VND 1 billion, repay VND 1 million.

Borrow VND 1 billion, repay VND 1 million – The key to unlocking homeownership

The standout feature of this package is its flexible repayment method. VIB is a pioneer in applying this feature. Accordingly, in the first five years, customers only need to pay VND 1 million per month for VND 1 billion of outstanding debt, i.e., 0.1%/month, which is much lower than the market average of 0.3% to 0.8%.

According to VIB’s representative, this solution is tailored for young people. Young people often have limited initial savings but hold great potential for future income growth. This approach alleviates their financial burden during the initial stages, making it easier to access larger loans and own a home earlier.

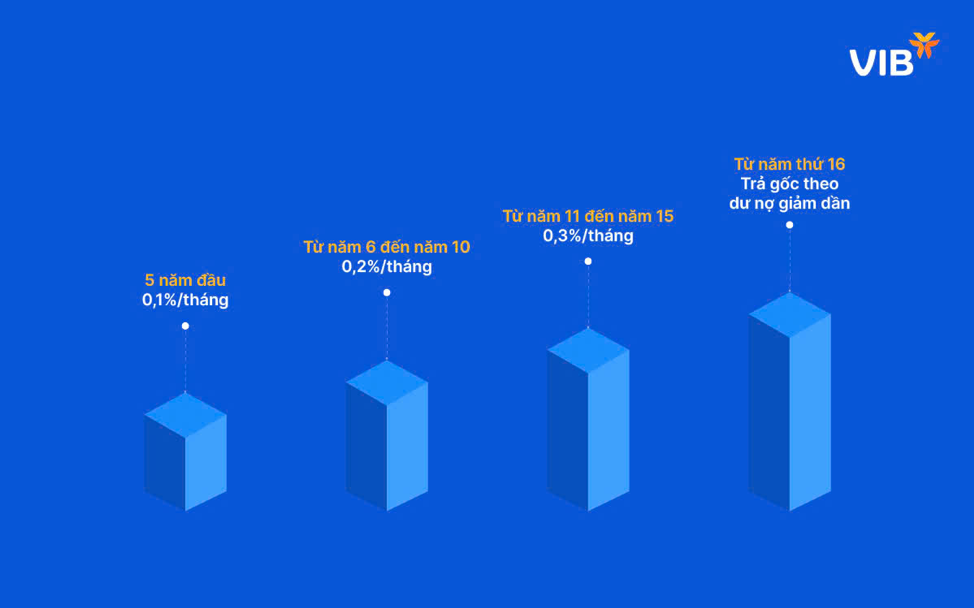

Illustrative table of stepwise repayment

In addition to this solution, customers can also customize their principal repayment plans to match their needs and financial capabilities at different life stages. Those with stable incomes can opt for equal monthly principal payments. Meanwhile, young people who have just started working or are embarking on entrepreneurship can choose to waive principal payments for the first five years or select the stepwise repayment option, starting at just 0.1% for the first 15 years. Notably, customers can also proactively make prepayments of up to VND 25 million per month (equivalent to VND 300 million per year) without incurring any prepayment fees.

Fixed Interest Rate – The Foundation for Long-Term Financial Planning

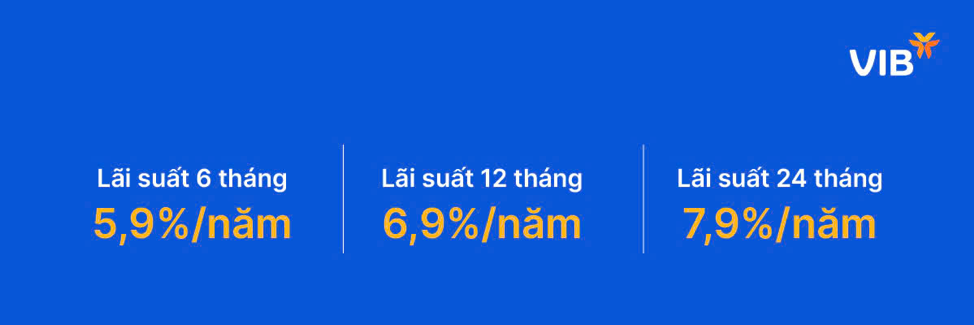

Apart from its flexible repayment method, VIB’s package also offers homebuyers three fixed-rate options: 5.9%/year for the first 6 months; 6.9%/year for the first 12 months; and 7.9%/year for the first 24 months.

Notably, this is the only interest expense that customers have to bear, without any conditional requirements regarding the area, cross-selling products, or loan ratio. This transparency enables borrowers to easily calculate their cash flow and take control of their financial planning.

After the fixed-rate period, the interest rate will be calculated based on the base rate plus a reasonable margin (currently at 2.9%), all of which are clearly disclosed on the website and loan contract.

Superfast Approval Thanks to Technology and Big Data

One of the significant barriers in home loan processes is the lengthy waiting time for approval and disbursement. However, with a database of over 500,000 apartments in major provinces and cities such as Hanoi, Ho Chi Minh City, Danang, and Binh Duong, VIB can value real estate properties within just 1 minute. As a result, loan approval time has been shortened to just 4-8 hours, a remarkable improvement compared to the multiple working days typically required by other banks.

This innovative breakthrough, coupled with the tangible and transparent benefits of the loan package, has earned VIB the “Best Bank for Home Loans in Vietnam” award from Global Brands Magazine in April 2025.

The Dream of Homeownership Needs a Boost

As housing prices continue to outpace incomes, the dream of homeownership for many needs a boost. Experts suggest that loan packages should span 20-30 years, covering the entire work cycle of the borrower, to help reduce their monthly repayment burden. Moreover, stable interest rates are crucial for maintaining borrowers’ peace of mind. Any fluctuations in interest rates can cause anxiety and affect the quality of life and the “live and work” mentality, a core factor driving their long-term commitment to a city and their dedication to their work.

The VND 45 trillion package, with its array of breakthrough benefits, demonstrates VIB’s profound understanding of its diverse customer base, including young people. They aspire not only to own a home but also to pursue other goals such as education, travel, and entrepreneurship. Therefore, a loan package with initially low and flexible payments is an optimal solution.

Fixing the interest rate for 6, 12, or 24 months instead of letting it float early on is also a testament to VIB’s customer understanding. The options for longer fixed rates, along with the post-fixed rate calculated based on the base rate plus a reasonable margin (currently at 2.9%), are all clearly disclosed on the website and loan contract. This transparency enables borrowers to easily manage their cash flow and take control of their personal finances.

Through this package, VIB not only provides a financial product but also accompanies customers on their journey to realizing their dream of homeownership. With competitive interest rates, flexible repayment methods, and a swift process, more people can confidently take the first step towards owning their first home, laying the foundation for a stable and long-term living environment.

For more information about the loan package, please visit here.

“Don’t Let Your Money Sleep”: Shark Truong Ly Hoang Phi’s Practical Financial Strategies

In today’s ever-changing economic landscape, optimizing cash flow is no longer a choice but a survival skill for individuals and businesses alike. In Episode 6 of the “Unlocking Passive Income” podcast series, Shark Truong Ly Hoang Phi delivers candid and practical insights on how to manage personal finances with flexibility, even with the smallest amounts of money.

Simple Insurance, Maximum Benefits for the Young

In today’s volatile economic climate, taking charge of one’s personal finances is essential for individuals to navigate life’s uncertainties with confidence. Young adults, in particular, are increasingly seeking financial solutions that offer not just efficiency and accessibility but also comprehensive protection.

Does Low Interest Rates Affect Banks’ Business Plans?

The impact of low-interest rates on the banking sector is undeniable, and the first half of 2025 will be a critical period. The varying strategies, business models, and adaptive capabilities of banks will determine the extent of the impact, with some feeling the pinch more than others. It’s a time of strategic adaptation and a test of resilience for the industry.

Gen Z and the Homeownership Conundrum: A Wise Investment or a Financial Burden?

Owning a home is a significant milestone and a substantial investment. With skyrocketing property prices, many young people are left wondering if they’ll ever be able to save enough for a down payment. It’s a daunting prospect, but with careful planning and a strategic approach, the dream of homeownership can become a reality. This article aims to empower aspiring homeowners by offering valuable insights and practical tips to navigate the challenging yet rewarding journey towards buying your first home.