Illustrative image

According to Mr. Nguyen Duc Lenh, Deputy Director of the State Bank’s Branch in Area 2, as of the end of April 2025, total credit outstanding in Ho Chi Minh City reached VND 4,046 thousand billion, up 2.62% compared to the end of 2024 and a strong increase of 12.78% over the same period last year.

This is the first time the credit scale in Ho Chi Minh City has crossed the VND 4 quadrillion threshold – an important milestone, reflecting positive signals from the internal strength of the economy as well as the effectiveness of the State Bank of Vietnam’s monetary and credit policy management.

Compared to the same period in recent years, credit in Ho Chi Minh City in the first four months of 2025 grew much stronger, doubling the growth rate of 1.31% in the first four months of 2024 and significantly higher than the same period in 2023 at 1.72%.

Assessing the reasons for the credit growth momentum, Mr. Lenh said that a favorable socio-economic environment, along with appropriate and flexible monetary and credit mechanisms and policies, are the main factors driving credit growth. Especially, the low-interest rate policy has been effective in supporting businesses to recover and expand production and business activities after a difficult period.

“The effectiveness of the management policies not only helps unblock the credit capital flow but also promotes banking activities, contributing to the economic growth of the city in particular and the country in general,” said Mr. Lenh.

It is noteworthy that the credit capital flow continues to be directed to the production and business sector, especially the key service sectors – which are the driving forces for Ho Chi Minh City’s economic growth.

Specifically, credit for the nine main service sectors (contributing more than 60% of the total output in Ho Chi Minh City), including commerce, tourism, communications, science and technology, health, education, finance, arts, and entertainment… has reached over VND 1,400 trillion, accounting for 35.4% of the total credit outstanding in the city. This debt balance increased by over 3.6% compared to the end of 2024.

Previously, data released by the State Bank showed that the total credit outstanding of the whole system reached more than VND 16,230 trillion by mid-April 2024, up 3.95% compared to the end of 2024. Thus, credit outstanding in Ho Chi Minh City currently accounts for about 1/4 of the country.

Unlocking Vietnam’s Economic Potential: Resolution 68 and the Rise of the Private Sector

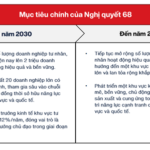

The Politburo has issued Resolution 68 – a significant directive that is expected to bring about a major shift in the orientation of private sector development in Vietnam. Marked as a historic turning point, this Resolution elevates the private sector’s status, clearly recognizing it as the “most important driving force of the national economy.”

“Consumer Credit in Ho Chi Minh City Sees Positive Growth”

Consumer credit outstanding in Ho Chi Minh City reached VND 1,137 trillion as of the end of March 2025, marking a 2.3% increase from the previous year’s end. This surge in consumer credit activity signifies a robust and expanding consumption demand, positively influencing production, business, trade, tourism, and service activities across the region.

Danang – From a Tourist Hotspot to the Promised Land for Settling Down

“With a new focus on becoming a high-tech economic and financial hub, Danang is poised to attract new residents and fuel the growth of the real estate market. Tourism has long been the driving force of the city, but this new direction will create a fresh dynamic, drawing in a new demographic and shaping the future of this vibrant city.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)