“Sell in May and Go Away”: Unraveling the Famous Adage

The well-known financial proverb, “Sell in May and go away,” has its roots in the olden days of London, with a fuller version saying, “Sell in May and go away; come back on St. Leger’s Day.” The simple advice suggests selling stocks in May, exiting the market, and returning in September when the St. Leger horse-racing season begins.

This adage reflects the Victorian and Edwardian eras’ pace, when affluent investors would leave the city for summer vacations in the countryside or abroad. Financial markets would then quiet down, experiencing subdued trading activity. Transcending the Atlantic to America, the saying was condensed, but its essence remained. Wall Street, too, witnessed brokers and fund managers taking summer breaks in the Hamptons, resulting in reduced capital flow and subdued investment performance. Indeed, history has recorded the “summer doldrums” as the period of weakest stock market returns in the Western world.

Changing Times

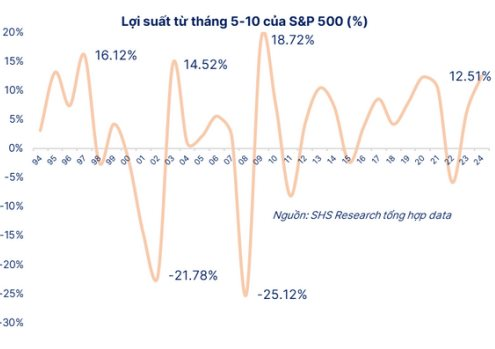

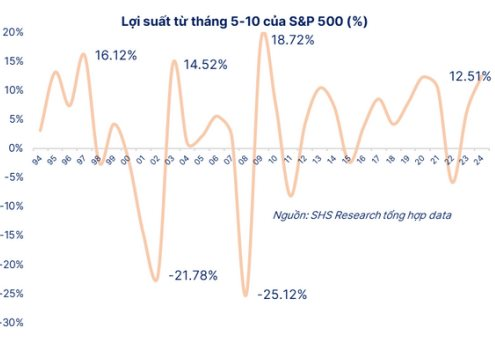

As with all natural laws, times change. The latest report from SHS Securities reveals that reality is not as gloomy as it used to be. The average yield during this period still reaches around 4.2%, with 74% of the years showing positive growth. Globalization, electronic trading, and the rise of cross-border investment funds have transformed the market landscape. Capital now flows ceaselessly, 24/7, maintaining liquidity throughout the year.

Furthermore, if everyone believed in the “Sell in May” phrase, astute investors would act early, starting in April, thus negating the very seasonal pattern within the market’s efficient functioning. Additionally, macroeconomic factors have increasingly overshadowed seasonal effects. Events like the 2008 financial crisis, the COVID-19 pandemic, or shifts in monetary policies can trigger market fluctuations regardless of the timing. For instance, the summer of 2020 was far from dull, marking an impressive recovery thanks to large-scale stimulus packages.

According to SHS experts, investors need to be vigilant against the allure of the “avoid summer” strategy. Statistics show that the strongest rallies often occur right after steep declines. By staying out of the market due to the “Sell in May” belief, investors risk missing out on potential golden opportunities.

In conclusion, in the current context, the saying “Sell in May” may be more nostalgic than a practical investment guide. In this modern era, investing cannot solely rely on calendar cues or FOMO psychology. Instead, it demands a close watch on economic realities, macroeconomic policies, business cycles, and profit prospects. The market waits for no one, so a wise investor stays attuned to the pulse of the times, understanding that no formula is permanent, only constant vigilance and adaptation.

“FE Credit Embarks on a New Growth Cycle: VPBank Targets 20-25% Profit Increase by 2025”

VPBank’s representatives anticipate a 20-25% increase in the Group’s profits in 2025 compared to 2024. This optimistic forecast is attributed to a combination of favorable factors and the new growth cycle of FE Credit.

What Impact Do Macro Factors Have on the Stock Market?

In recent years, macroeconomic factors have emerged as key influencers of stock price trends, not just in Vietnam but globally. However, the impact of these factors is ever-evolving, contingent on the specific macroeconomic conditions prevailing at a given time, as evidenced by the contrasting landscape between 2024 and 2023.