For the quarter, Vinh Hoan recorded a net profit of over VND 211 billion, an increase of nearly 12% year-over-year.

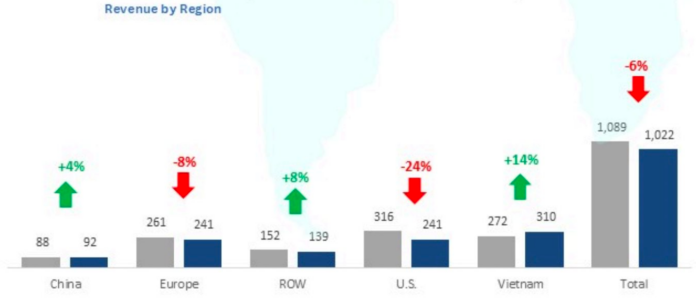

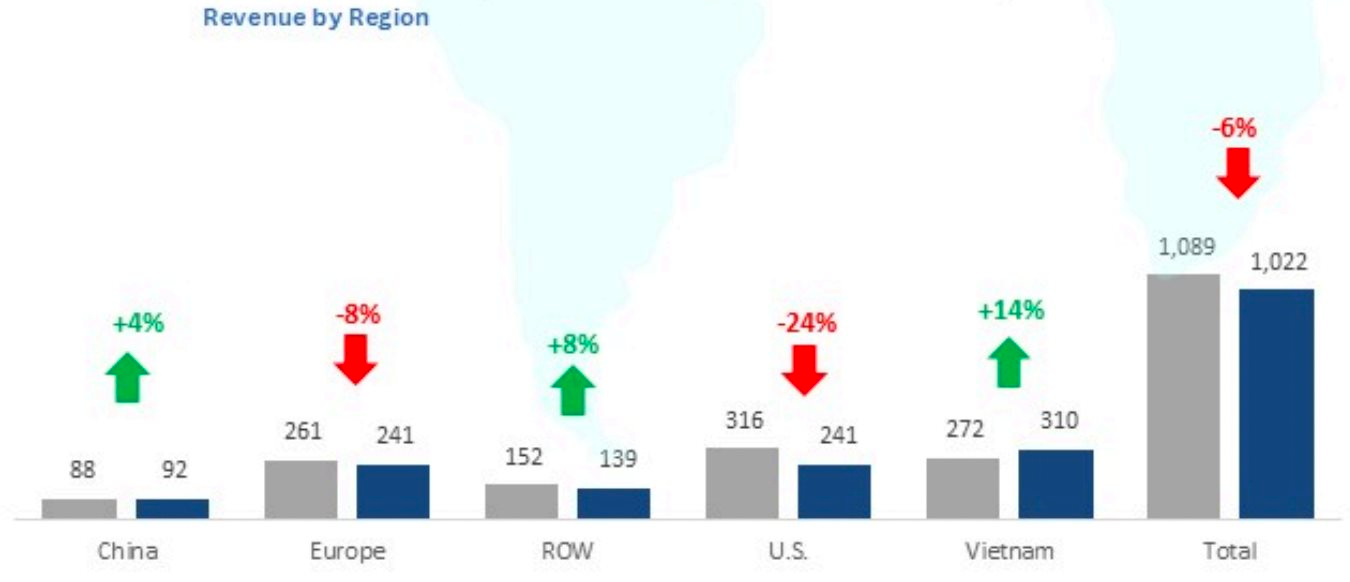

Notably, in March 2025, the company’s revenue reached VND 1,022 billion, with a significant contribution from the domestic market, which accounted for VND 310 billion. In contrast, revenue from the US market decreased to VND 241 billion.

Figure 1: Vinh Hoan’s March 2025 Revenue by Market

The US market has long been one of the most important export markets for Vinh Hoan. While the contribution of this market to the company’s total revenue has varied over the years, it typically accounts for the largest share.

In 2024, the US market generated the highest revenue for Vinh Hoan, bringing in VND 3,937 billion, which accounted for 31.4% of total revenue and represented a 33% increase from the previous year.

As of February 2025, the US remained the largest export market, with revenue reaching VND 233 billion, a 12% increase compared to the same period in 2024.

However, for the first three months of 2025, Vinh Hoan’s domestic revenue surpassed that of the US, contributing VND 817 billion compared to the US market’s VND 686 billion. The domestic market accounted for 31% of the company’s total revenue during this period.

At the 2025 Annual General Meeting of Shareholders, Vinh Hoan approved a business plan with a revenue target of VND 10,900 billion and a net profit goal of VND 1,000 billion, representing a 13% and 18% decrease, respectively, from the previous year. These adjustments were made in light of the challenges faced by the tra fish industry, including countervailing duties imposed by the US.

In a more optimistic scenario, the company forecasts a revenue of VND 12,350 billion, a 1.3% decrease from 2024, and a net profit of VND 1,300 billion, a 6% increase.

With regards to the US market, the company’s leadership remains confident and sees no reason to withdraw. CEO Nguyen Ngo Vi Tam shared that they have carefully considered the impact of countervailing duties on profitability and provided conservative estimates to ease investor concerns.

“We have presented the most cautious forecasts to alleviate investor worries. While future developments depend on market conditions, we remain optimistic about surpassing these plans,” said Tam.

Vinh Hoan is confident in achieving a 9-10% growth in tra fish exports, attributed to the declining production of other whitefish and the increasing market share of Vietnamese tra fish, particularly with the bans on catching cod and pollock.

The company highlights the potential to exceed their plans, depending on US consumers’ acceptance of higher prices and the strength of the economy. American clients have maintained stable demand and encouraged the company to accelerate the cultivation of fast-growing fish to meet export needs.

In early 2025, Vinh Hoan became the only Vietnamese company to have anti-dumping duties lifted by the US after a 21-year legal battle, marking a significant milestone in their trajectory in the US market.

The Cement Industry’s Performance in Q1 of 2025: A Comprehensive Overview.

In the first quarter of 2025, several cement companies witnessed an increase in revenue, yet they reported net losses amounting to billions of Dong.