FPT Retail, a leading digital technology company in Vietnam, and Vietcombank, one of the country’s foremost foreign trade joint-stock banks, have entered into a strategic partnership to integrate financial services into FPT’s retail ecosystem. This collaboration marks a significant step forward in offering optimized convenience to their customers.

As of May 16, 2025, FPT Shop will integrate Vietcombank’s payment services into its nationwide network of stores. This move will provide customers with comprehensive financial solutions in a more accessible and expedited manner. Specifically, with this model, customers can directly perform Vietcombank’s financial services such as cash deposits and withdrawals at FPT Shop locations, offering an unparalleled level of convenience and simplicity to their banking experience.

One of the standout advantages of this partnership is the flexibility it offers in terms of timing. Customers can now conduct their financial transactions during FPT Shop’s operating hours, which include after-work and weekend hours, providing them with greater control over their schedules and an enhanced overall experience.

“The collaboration between FPT Retail and Vietcombank to implement this payment agency model is a breakthrough in expanding financial utilities for customers nationwide,” said Mr. Hoang Trung Kien, CEO of FPT Retail. “We aim to provide swift, seamless, and secure services that offer convenience and peace of mind to our valued customers. We strongly believe that the relationship between FPT Retail, including FPT Shop, and Vietcombank will continue to strengthen, contributing to a prosperous Vietnam and aligning with the goals of Resolution 57 to promote technology application and foster innovation and creativity.”

Echoing this sentiment, Ms. Doan Hong Nhung, Director of Vietcombank’s Retail Banking Division, shared, “The payment agency model is a testament to the continuous innovation within Vietnam’s financial sector. In this digital age, where technology is evolving daily, Vietcombank is committed to exploring creative solutions to meet our customers’ diverse needs. Our collaboration with FPT Retail allows us to leverage our combined technological strengths and extensive retail networks to bring banking services closer to the people.”

This collaboration between FPT Retail and Vietcombank extends beyond payment agency services, aiming to expand into other areas such as digital technology integration, consumer finance, and financial after-sales services at the point of sale. The ultimate goal is to create a seamless and accessible ecosystem that meets customers’ technological and financial needs, enhancing their overall experience.

By combining Vietcombank’s financial solutions with FPT Shop’s technological platform and extensive network, this partnership promises to deliver tangible benefits, fostering the development of Vietnam’s digital economy.

What Did the Investment Fund Buy and Sell This Week?

Last week (May 5-9, 2025), the investment fund primarily announced transactions made towards the end of April.

“Vietcombank Reports Flat Profit in Q1 2025 Despite Significant Cut in Provisions”

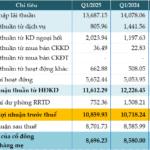

In the first quarter of 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank (HOSE: VCB), reported a slight increase in pre-tax profits, reaching nearly VND 10,860 billion, a 1% rise compared to the same period last year. This positive result is attributed to a significant reduction in provision for risks.

Unveiling NCB’s Exclusive New Offering: Revolutionizing Operations for Businesses in Industrial Parks

In the midst of the thriving industrial park model, NCB has introduced a timely and superior financial solution to aid businesses operating within these industrial zones. This innovative offering from NCB aims to alleviate challenges, foster expansion, and enable sustainable growth for enterprises in this sector.

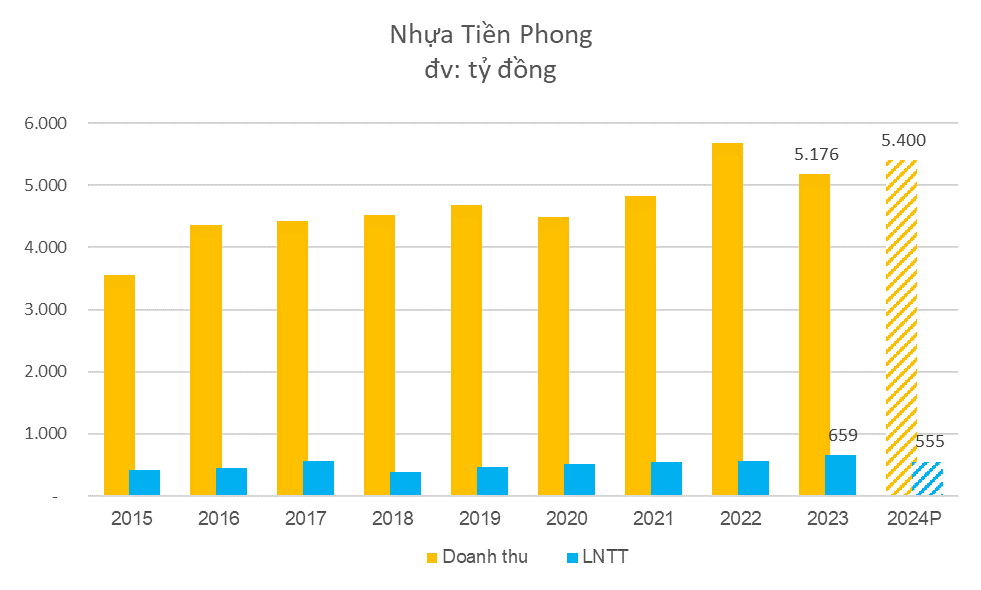

“Post-2024 Recovery: FRT Aims for 900 Billion VND in Pre-Tax Profit”

The upcoming 2025 Annual General Meeting of FPT Digital Retail Joint Stock Company (HOSE: FRT) is scheduled for April 25 and will consider several important matters, notably the consolidated 2025 business plan with a revenue target of VND 48,100 billion and pre-tax profit of VND 900 billion. If achieved, these targets would represent the company’s best performance since 2015.