On the morning of April 27, Thien Phong Plastics Joint Stock Company (stock code NTP) held its 2024 Annual General Meeting of Shareholders, approving the BOD’s presentation.

PAY 2023 DIVIDEND IN CASH AT A RATIO OF 25%, ANTICIPATED RATIO OF 20% FOR 2024

In its report at the meeting, Thien Phong Plastics’ leaders assessed that the Vietnamese economy in 2023 faced many challenges, not only due to objective factors from the world economic situation but also due to internal economic instability. The real estate market faced difficulties from mid-2022 to the end of 2023, and credit for the real estate sector remained tight. Although bank interest rates have decreased, businesses still find it difficult to access credit, and several provinces and cities in the northern region and Hanoi have been severely affected by rolling power outages. Multiple industries have limited employment opportunities, especially those related to export processing.

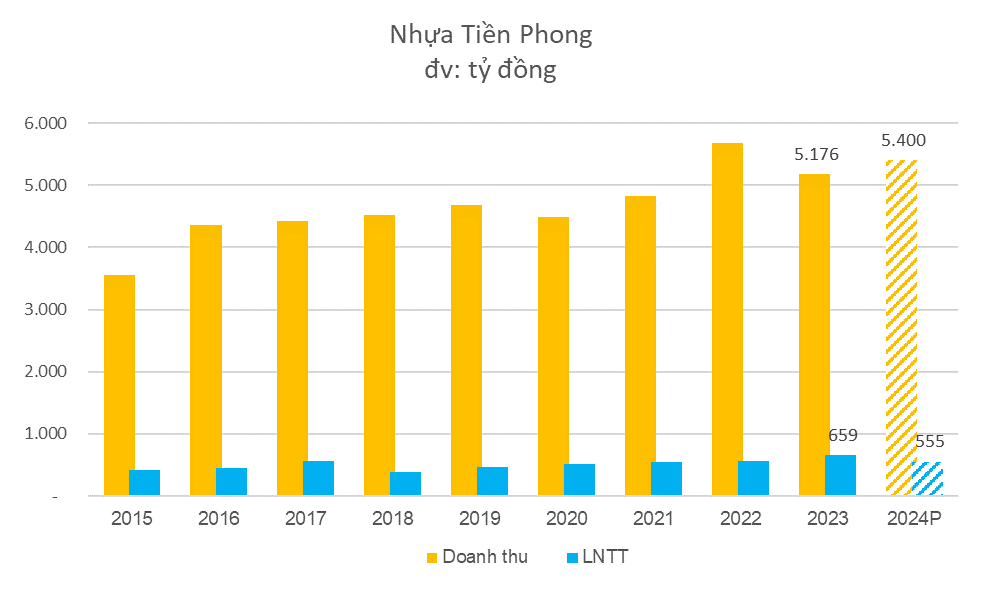

For Thien Phong Plastics, due to the impact of the real estate market, the declining consumer demand resulted in total revenue for 2023 reaching 5,084 billion VND, a decrease of 9% compared to the same period in 2022 (equivalent to a decrease of 531 billion VND), completing 87% of the 2023 plan. Sales volume in 2023 reached 98,582 tons, a decrease of 2% compared to the same period in 2022 (equivalent to a decrease of 2,476 tons), completing 93% of the 2023 plan.

However, pre-tax profit in 2023 reached 641 billion VND, an increase of 20% compared to 2022 (equivalent to an increase of 109 billion VND). This is also the company’s highest profit margin in history.

Explaining the reason for the revenue decrease, Thien Phong Plastics’ leaders said that, first of all, due to the decrease in prices for the primary material (plastic beads), the company has reduced the selling prices of products according to the competitive market situation.

Accordingly, Thien Phong Plastics reduced the selling price twice on August 1, 2022, and September 21, 2022, each time by 5% for the UPVC product lines. This had an impact on reducing revenue by 413 billion VND, equivalent to a decrease of more than 7%.

The second reason was that the real estate market was stagnant, so the demand for construction materials (iron, steel, cement, bricks, stones, etc.), in general, and plastic pipes for the construction industry, in particular, all decreased, resulting in a revenue decrease of 118 billion VND, equivalent to a decrease of 2%.

In addition, Thien Phong Plastics assessed that the inflation rate was still high, and several industries had limited employment opportunities, so people restricted their consumption, limiting new construction, and home repairs, thereby decreasing the demand for plastic pipes.

As for Thien Phong Plastics’ highest profit to date, the main reason was that the prices of primary raw materials have decreased compared to the same period last year. When anticipating the time when raw material prices would be low, the company purchased a large volume; when raw material prices were high, it purchased a small volume or made no purchases at all.

Other reasons include lower bank interest rates compared to the same period last year, and the company’s cost-cutting in production and business (using cheaper alternative materials, saving on external warehouse rental costs, rearranging the delivery area for easier convenience, thereby reducing freight costs, etc.).

The 2024 plan sets the revenue target at 5,400 billion VND, an increase of 6% compared to 2023, and pre-tax profit of 555 billion VND, a decrease of 13%.

The GMS approved a plan to distribute cash dividends for 2023 at the rate of 25% of charter capital with a total cost of approximately 324 billion VND, of which the first dividend payment was 15% in December 2023 and the second payment will continue to be 129.5 billion VND. The dividend payment ratio for 2023 is 10%.

The cash dividend rate for 2024 is expected to be maintained at a high level of 20% of charter capital.

With the above results, the GMS approved a proposal to reward the BOD with 1 billion VND because the profit in 2023 exceeded the plan by 20%.

PLAN TO INVEST IN AN EDUCATIONAL COMPLEX

A noteworthy plan approved at the meeting was the addition of an educational and training business line. Thien Phong Plastics plans to invest in an educational complex called “Tien Phong Multi-Level School” at No. 2 An Da – the company’s head office.

Answering a shareholder’s question about the reason for the investment, Dang Quoc Dung – Chairman of the BOD, said that this land has a 64-year history with Thien Phong Plastics since its establishment. Previously, the company had a 1/500 scale plan to build a commercial complex but encountered many obstacles and decided to cancel it. If there is no plan for its use, the city authorities will reclaim this land to build a multi-story parking lot. Therefore, Thien Phong Plastics proposed a plan to build an educational complex.

Dang Quoc Dung shared: “Many people wonder about Thien Phong Plastics’ lack of experience in education. However, success or failure depends on people; no one can do anything naturally. They must all learn and gain experience.

The Chairman of Thien Phong Plastics also believes that referring to this complex as an investment outside the main business is just a matter of language.

“Thien Phong Plastics is a national enterprise born from the people, and part of its foundation was built with the contributions of young children. We build a school because we think of social responsibility, and investing in education is also investing in the future”, said Mr. Dung.

According to the CFO, after the plan is approved by the GMS, the company will carry out the following procedures with the city authorities regarding the project. The preliminary investment capital is estimated at 600 billion VND, with 50% being financed from equity, an expected revenue of 180-200 billion VND/year, and a capital recovery period of approximately 8-10 years.

“SELLING PRICE LOWER THAN COMPETITORS BY 15-20%”

A long-time shareholder of Thien Phong Plastics expressed concern about the company’s profit: In 2023, it reached the highest level in history with 641 billion VND, but it is still far behind its “sibling” in the same industry. Although no names were mentioned, it is understood that the shareholder was referring to Binh Minh Plastics Joint Stock Company (BMP) with a pre-tax profit of over 1,300 billion VND.

According to Dang Quoc Dung, the reason why the company’s revenue is lower than its “sibling” despite higher sales is because Thien Phong Plastics’ selling price is always 15-17% lower than that of its competitors. Thien Phong Plastics keeps its prices low to fulfill its social responsibility as a state-owned enterprise, sharing difficulties with partners, distributors, and consumers amid economic pressures.

Mr. Dang Quoc Dung – Chairman of the BOD of Thien Phong Plastics

Mr. Dung cited an example: when input material