SCID’s Annual General Meeting for 2025 was held on the morning of May 16, 2025. Photo: Thuong Ngoc

|

Resuming dividend payouts after 7 years

SCID’s Annual General Meeting approved the 2025 business plan with a total revenue of nearly VND 168 billion and a pre-tax profit of over VND 73 billion, up 34% and 28%, respectively, compared to 2024. The dividend for 2024 was 3%.

Member of the Board of Directors and General Director Pham Trung Kien stated that revenue and profits for 2025 will come from fundamental sources, including direct leasing of the 253 Dien Bien Phu project (District 3, Ho Chi Minh City), revenue from Saigon Co.op, and mainly financial activity income through profit sharing from SCID’s invested units. Accordingly, this year’s profit is expected to be higher than the previous year due to additional dividends from Sense Ben Tre.

On the other hand, Chairman of the Board of Directors, Vu Anh Khoa, said that 2024 was the first year SCID resumed dividend payouts after 7 years. In previous years, the company had capital needs and did not pay dividends. In the last two years, 2023-2024, the company’s business results have been encouraging due to depreciation, allowing for the resumption of dividend payments.

In 2025, the SCID Board of Directors will promote the development of key commercial real estate projects following new models, including new shopping center models such as Sense Plaza and Sense Festi, and a model for leasing offices.

The company is preparing project and financial resources in parallel for development in the following years. In addition, SCID continues to improve the operational efficiency of Sense City and Sense Market shopping centers, along with managing and operating SC Vivo City shopping center.

According to the Board of Directors’ report, the company plans to commence construction of Sense Plaza Cam Pha and Sense Festi Vinh Long shopping centers this year, in addition to inaugurating the 102 Nam Ky Khoi Nghia office building. SCID will also continue legal procedures for the An Phu project.

Furthermore, SCID expects to complete and hand over the Co.opmart Thong Nhat supermarket project to Saigon Co.op in 2025.

SCID’s projects are expected to reach fruition in about two years

General Director Pham Trung Kien shared that SCID’s overall strategy is to be a subsidiary of Saigon Co.op, specializing in developing commercial infrastructure to serve Saigon Co.op’s retail business.

Global political and economic fluctuations impact commercial real estate through commodity and retail activities, and SCID is no exception. However, SCID will focus on its assigned task of developing shopping centers for retail, while also expanding into hotels and offices to create a supportive ecosystem for retail real estate. When the economy grows, retail real estate will be the main source of revenue, and vice versa for commercial real estate.

The trade war will undoubtedly have complex developments, affecting Vietnam’s economy and businesses. Mr. Kien assessed that this is only a short-term phase for major economies to negotiate and redefine the system, even though the actual outcome cannot be certain. Still, the trade war situation must end. In the short term, SCID will be affected, but the company has prepared projects with a two-year timeline. The management team is confident that after the current challenging period, the economic upturn will favor SCID’s investment activities.

General Director Pham Trung Kien shared at the meeting. Photo: Thuong Ngoc

|

Unable to disclose partner information for the Sense Plaza Vinh project

Regarding the Sense Plaza Cam Pha shopping center project, SCID plans to negotiate with its partner to buy back the charter capital in the joint venture and expects to commence construction in the second half of 2025.

Mr. Kien shared that the joint venture responsible for the project is Dong Bac Trading Development Center Company Limited, with SCID and a local enterprise in Quang Ninh holding capital contributions. When finding a partner, SCID allowed the partner to hold the majority stake but retained management control. However, there have been some inconveniences during the collaboration, leading SCID to consider buying back the capital for smoother operations. Nevertheless, the management has only formulated a plan and will not execute it in the near future. It is understood that Dong Bac Company has a charter capital of VND 32 billion, of which SCID holds 40%.

Apart from Cam Pha, SCID is negotiating with another partner to invest in the Sense Plaza Vinh shopping center project. However, as the project is in its initial phase and the partner has not agreed, SCID cannot disclose the partner’s information.

In Q3 2025, SCID plans to commence construction of the Sense Festi Vinh Long shopping center following the Sense Festi model. The General Director of SCID stated that Sense Festi is the largest of the four shopping center models that SCID has developed since 2023. This model integrates various services, including a shopping center, hotel, and offices, creating a community, cultural, and traditional attraction.

SCID has submitted a request to overturn VIAC’s ruling

Regarding the An Phu project, the General Director of SCID affirmed that there is no risk of project revocation as SCID directly handled the compensation and clearance. Currently, the project is delayed due to objective obstacles common to many projects in Ho Chi Minh City, relating to procedural and state regulatory issues.

Firstly, there is the issue of fulfilling the obligation to contribute to technical infrastructure, but as Thu Thiem Real Estate Joint Stock Company has not completed site clearance, SCID cannot determine the amount to be paid. Secondly, while the project has a 1/500 plan, Ho Chi Minh City’s 1/2000 plan has not been approved, leading to inconsistencies.

Concerning the collaboration with Novaland at the An Phu project, Mr. Kien said that SCID had requested to terminate the cooperation contract between the two parties to renegotiate a new contract according to current regulations. The previous contract, signed in 2020, is no longer applicable. SCID tried to persuade Novaland, but for various reasons, Novaland decided to sue SCID. Consequently, Novaland’s request is to continue with the previously signed contract.

After the ruling of the Vietnam International Arbitration Center (VIAC), SCID submitted a request to the Economic Court of the Ho Chi Minh City People’s Court to overturn VIAC’s ruling. The Economic Court has accepted SCID’s request as of May 14.

The General Director of SCID affirmed that as the investor of the An Phu project, whether cooperating with Novaland or any other unit, SCID will ensure compliance with current regulations. The project involves legal issues and may take time, but SCID will persist.

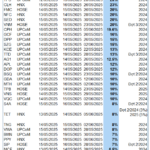

Week 12-16/05: A Shower of Dividends, with the Highest Yielding Over 60%

The season of annual general meetings brings a flurry of activity for listed companies, as they rush to finalize dividend distributions. This week, from May 12th to 16th, a staggering 45 businesses will be finalizing their cash dividend distributions, with rates reaching as high as 60.67%. This means that for every share owned, investors will receive 6.067 units of currency in dividends.

The Unpredictable Real Estate Market: Experts Outline 3 Potential Scenarios for Q2

The real estate market is currently in a state of cautious observation and anticipation, making it challenging to predict its trajectory. Experts forecast three potential scenarios for the industry’s growth in the second quarter of 2025.

“Slow Progress on Key Projects: SCID Disburses Only $29 Million of Raised Funds After Over a Decade”

As of May 5th, Saigon Co.op Investment and Development JSC (UPCoM: SID) reported on the progress of capital utilization from its public securities offering. The company has only invested slightly over VND 29 billion of the planned VND 198+ billion for the An Phu project, despite capital mobilization commencing over a decade ago.

The Tantalizing Dividend Dates for the Week of Oct 28–Nov 1: A Whopping 20% Cash Dividend.

This week, we have nine businesses dishing out cash dividends, with rates ranging from a generous 20% to a modest 4%.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)