The Race for Retail Dominance

The recently published report on Modern Trade in Vietnam for 2025 by Q&Me reflects the intense competition among coffee chains in the country.

One of the fastest-growing players in this race is Phúc Long. The company opened 79 new stores in just one year, increasing its total number of outlets from 158 in 2024 to an impressive 237 in 2025, representing a remarkable 50% growth rate.

Phúc Long’s financial reports for Q1 2025 show a 9.7% increase in revenue compared to the same period last year, amounting to 424 billion VND. This growth is attributed to their expansion strategy. Notably, their food segment, including pastries, sweets, ice cream, and yogurt, experienced a significant 52.1% surge in revenue compared to the previous year. This segment is identified as a potential driver of higher average transaction values for Phúc Long.

In the first quarter of 2025, Phúc Long had a total of 184 flagship stores nationwide. Currently, the company is in a transition phase, focusing on restructuring its business model rather than rapid expansion.

Closely following Phúc Long’s lead is Katinat. They have increased their store count from 69 to 93, a substantial 35% increase.

Katinat’s strategy revolves around securing prime locations—most of their cafes are strategically positioned at prominent intersections and crossroads in the heart of major cities. Additionally, Katinat invests heavily in interior design, offering a luxurious and modern aesthetic with an average price range of just 40,000 to 60,000 VND per cup. This pricing strategy is far more accessible than that of its upscale competitors, creating the perception of “affordable luxury.” As a result, the brand has successfully attracted a younger demographic, particularly Gen Z, who view cafes as both a workspace and an aesthetically pleasing backdrop for their social media content.

Starbucks, a well-known international coffee chain, has also expanded its presence in Vietnam. They increased their number of stores from 104 to 127, representing a 22% growth rate.

Starbucks’ strategy in Vietnam can be described as “selective growth.” Rather than focusing on rapid expansion, they prioritize maintaining their premium brand positioning and delivering a personalized experience—an aspect that few other large-scale chains can replicate.

Starbucks cafes in Vietnam consistently deliver a uniform standard of space, service, and quality. Coupled with their loyalty programs and convenient payment options, Starbucks targets a loyal customer base willing to pay a premium for an international experience and reliable service.

Highlands Coffee, Vietnam’s largest coffee chain in terms of store count, with 770 outlets in 2024, continues its expansion journey. They have added 85 new stores, bringing their total count to 855, a modest 11% increase.

Highlands Coffee’s strategy is to “blanket the nation,” targeting a diverse range of customers, from office workers to students and locals. They focus on affordable, popular drinks served quickly, catering to the needs of those on the go. With their large-scale chain advantage, Highlands Coffee has greater negotiating power for premises, cost control, and logistics optimization.

However, The Coffee House has taken a different approach. In contrast to its competitors, the chain has reduced its number of stores from 141 to 93, a significant 34% decrease.

What’s Happening to The Coffee House?

While its competitors are reporting profits, The Coffee House is facing a different reality.

According to Vietdata, The Coffee House’s revenue in 2023 was approximately 700 billion VND, an 11% decrease from the previous year. Moreover, the company continued to incur losses, with a net loss of over 100 billion VND. As a result, The Coffee House is one of the two major coffee chains reporting losses this year, alongside Ông Bầu.

It’s worth noting that The Coffee House has reported consecutive losses for the past five years, with accumulated losses reaching 1,170 billion VND by the end of 2022.

Industry experts attribute these challenges to a loss of brand identity and market position following the departure of its founder, Nguyễn Hải Ninh, from the CEO role. The intense competition from chains like Highlands Coffee, Phúc Long, and Starbucks, as well as newer brands like Katinat and Phê La, has left The Coffee House struggling to maintain its foothold. A vague brand positioning and monotonous menu have caused the chain to lose its appeal among consumers.

Their expansion into the tea market with the Ten Ren brand also fell short of expectations, and all 23 Ten Ren stores were closed within two years of operation.

In response to these challenges, The Coffee House has undergone a restructuring process, closing multiple branches in cities like Can Tho, Da Nang, Hanoi, and Ho Chi Minh City. Simultaneously, they have shifted their focus to developing online sales channels and a dedicated delivery app, with online transactions now accounting for 50% of their daily transactions.

In late 2024, Golden Gate, a prominent F&B group known for brands like Gogi House, Manwah, and Kichi-Kichi, acquired 99.98% of The Coffee House’s shares for approximately 270 billion VND. This acquisition brings hope for a brand revival, leveraging Golden Gate’s extensive F&B ecosystem.

Phan Trang

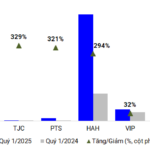

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.

Unlocking Rewards: A Token of Appreciation for Our Loyal Customers

On May 13, the Board of Directors of Mobile World Investment Joint Stock Company (HOSE: MWG) convened a meeting to discuss and approve several key matters. Notably, the Board endorsed a proposal to implement a conditional share warrant issuance program at Bach Hoa Xanh Grocery Investment – a majority-owned subsidiary in which MWG directly holds a 94.99% stake.

The Tasty Triumph of Masan’s Meat Brand

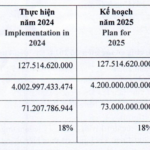

The first quarter of 2025 marked a pivotal moment for Masan MEATLife (MML) as the company turned a profit for the third consecutive quarter. Evolving from a traditional livestock farming business, MML has successfully transformed into a branded meat processor, setting its sights on a $2 billion revenue target.

“Vietbank’s Q1 2025 Profit Soars: A Triple-Digit Surge in Core Income”

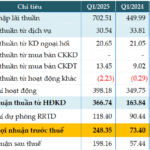

The consolidated financial statements for Q1 2025 reveal that Vietbank (VBB on UPCoM) recorded a remarkable performance with a pre-tax profit of over VND 248 billion, tripling its earnings from the previous year’s first quarter. This impressive growth is primarily attributed to the bank’s core income streams.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)