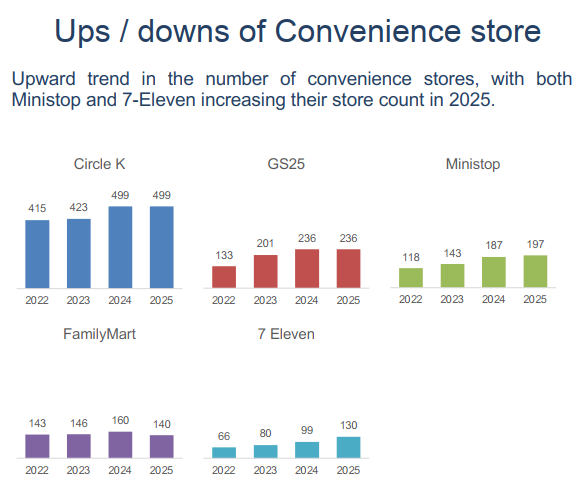

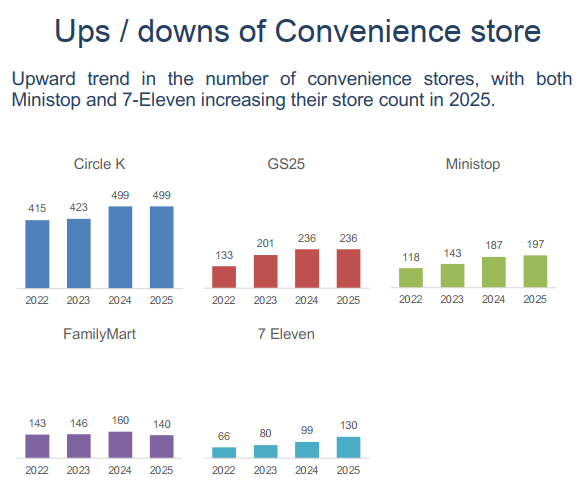

The convenience store market in Vietnam is witnessing dynamic shifts. While brands like 7-Eleven and Ministop are making remarkable strides, once-promising names like GS25 and FamilyMart show signs of stagnation or decline. Meanwhile, Circle K, the chain with the largest presence, maintains stability but has lost its growth momentum.

According to the Modern Trade Retail Trends report by Q&Me, the total number of convenience stores and mini-supermarkets nationwide reached 7,806 outlets in 2025, a slight increase from 7,362 in 2024. However, this growth has not been evenly distributed among the chains, clearly reflecting a strategic and competitive divide.

The Race to Redefine the Landscape Among the Big Players

7-Eleven leads in growth rate, expanding from 99 to 130 stores within a year. While most of their outlets are still concentrated in Ho Chi Minh City, their expansion pace underscores their ambition to dominate the Vietnamese market.

Notably, in early 2025, 7-Eleven attracted attention by starting to recruit staff in Hanoi. However, as of now, no stores have opened in the capital. Nevertheless, their expansion plans into Hanoi affirm their long-term commitment to the race.

Alongside 7-Eleven’s ascent, Ministop also registered positive growth, increasing its stores from 187 to 197. In contrast to 7-Eleven’s aggressive acceleration, Ministop pursues a steady development strategy, focusing on stability and operational quality control, thereby building a solid foundation for sustainable growth.

Meanwhile, GS25, a brand that once expanded rapidly, did not record any new outlets in 2025, remaining at 236 stores. However, the South Korean chain made a notable move by officially venturing north, simultaneously opening six stores in Hanoi. This effort aims to break the monopoly in the 24/7 convenience store segment in the capital, previously dominated by Circle K.

Nonetheless, GS25’s stagnation reflects significant challenges. Industry experts suggest that their model of spacious stores with substantial investments in ambiance and experience results in high operating costs. Simultaneously, their product or service differentiation is not distinct enough to create a competitive advantage. Additionally, consumers are increasingly price-conscious and value quick convenience, factors that GS25 has not optimized compared to rivals embracing leaner models like 7-Eleven and Ministop.

If GS25’s stagnation is a concern, FamilyMart’s decline is more pronounced, dropping from 160 to 140 stores. In a sector characterized by expansion, this retreat is a warning sign. The causes may lie in their slow adaptation to market demands: an unchanged business model, lagging in customer experience and trends, and less competitive technology integration for ordering, payment, and loyalty programs. Their ambiguous brand positioning further hinders their ability to retain consumers in a rapidly evolving retail environment.

While Circle K did not increase its store count, it remains the largest chain in Vietnam, with 499 outlets. Unlike its previous expansion phase, the brand did not add new stores in 2025. This stability suggests that the markets in Ho Chi Minh City and Hanoi, their primary areas of operation, are nearing saturation. Moreover, the presence of GS25 in Hanoi and the potential entry of 7-Eleven will intensify competition in these urban centers.

The Q&Me report also highlights a notable trend of chains moving away from urban centers. While Ho Chi Minh City has 2,483 stores and Hanoi 1,382, the rest of the country accounts for 3,941 outlets, over 50% of the industry. This shift indicates that convenience store chains are exploring less saturated markets, avoiding direct competition in densely populated metropolitan areas.

The Circle K Parent Company Seeks to Acquire the Enterprise Behind 7-Eleven Convenience Stores

This will be the largest M&A deal of a foreign enterprise with a Japanese company to date. The transaction is set to revolutionize the industry, creating a powerhouse with unparalleled global reach and innovation. With this merger, the two companies will combine their unique strengths and expertise, solidifying their position as a dominant force in their respective fields. The impact of this collaboration will be felt across international markets, as it paves the way for new opportunities and unprecedented growth.