|

Source: FPTS, Agriseco

|

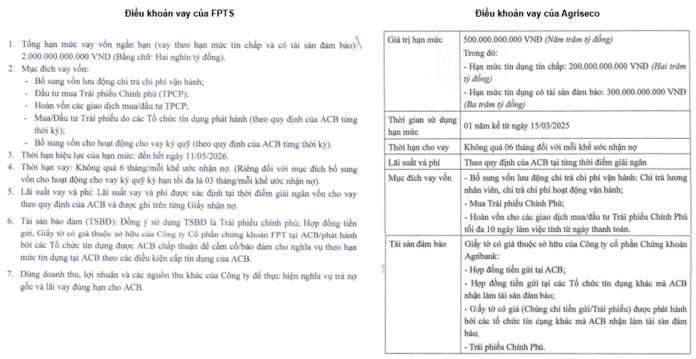

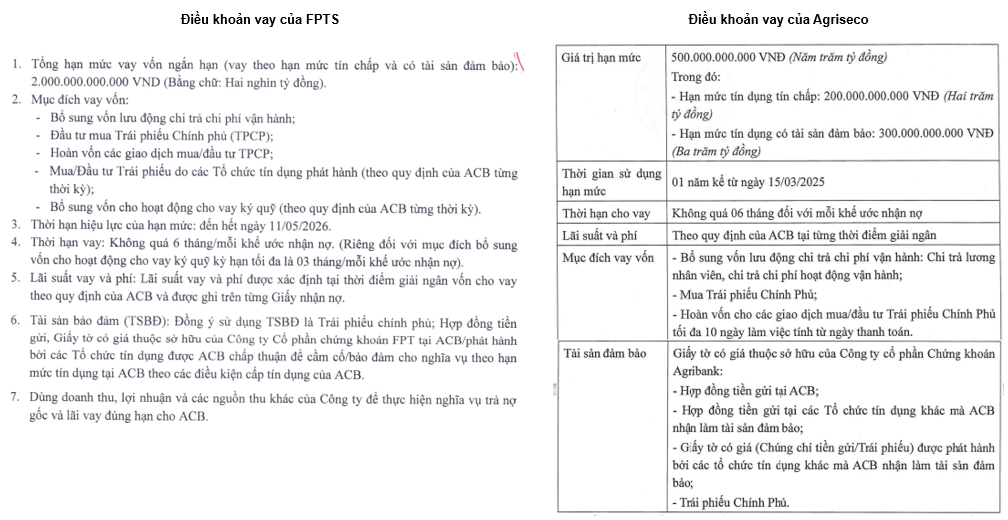

FPTS has taken out a loan to supplement its working capital and fund investments in government bonds. The loan will also be used to repay existing debts incurred from purchasing or investing in government bonds, bonds issued by credit institutions, and to provide additional capital for margin lending. The loan is effective until May 11, 2026.

ACB has agreed to collateralize the loan with government bonds, deposit contracts, and other financial instruments owned by FPTS at ACB or issued by credit institutions approved by ACB. This collateral will secure the loan obligation within the credit limit at ACB.

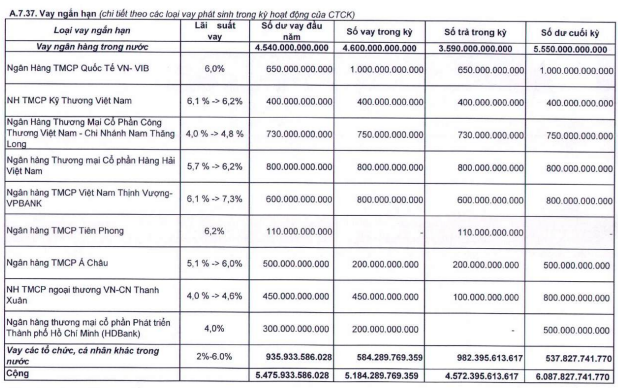

As of March 31, 2025, FPTS’s loan balance stood at nearly VND 6,088 billion, an 11% increase from the beginning of the year, and accounted for 57% of its total capital sources. The company’s major lenders include VIB, MSB, VPBank, Vietcombank, and VietinBank. The loan from VIB has recently been renewed with a new limit of VND 1,750 billion, while the loan from ACB amounts to VND 500 billion with an interest rate of 5.1-6%.

|

Source: FPTS Q1/2025 Financial Statements

|

On May 15, another securities company, Agriseco, also secured a VND 500 billion credit limit from ACB, comprising a VND 200 billion unsecured credit limit and a VND 300 billion credit limit with collateral. This loan has a one-year term starting from March 15, 2025. Similar to FPTS, Agriseco intends to use the loan to purchase government bonds, repay debts incurred from purchasing/investing in government bonds, and supplement working capital for operational expenses. The collateral terms are also comparable.

As of March 31, 2025, Agriseco’s loan balance was VND 322 billion, all short-term, accounting for 11% of its total capital. This balance has decreased by 64% since the beginning of the year. The company stated that these short-term loans from credit institutions carry interest rates ranging from 4.5% to 5.3% and are used for business operations.

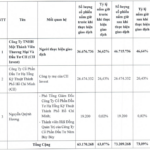

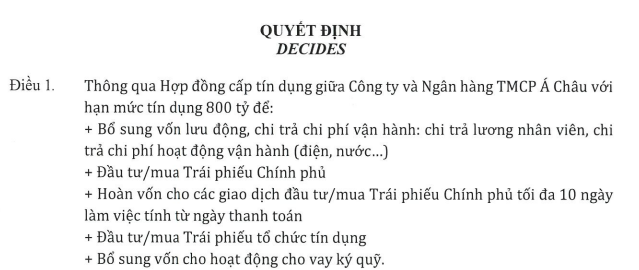

ACB has been actively providing credit limits to securities companies for investments in bonds and working capital supplementation. On May 6, for instance, the Board of Directors of Shinhan Securities Vietnam (SSV) approved a VND 800 billion credit contract with ACB.

|

Source: SSV

|

Other banks have also been active in this regard. In May 2025, BIDV provided a VND 1,000 billion limit to Rong Viet Securities (VDS), and the Board of Directors of Vietinbank Securities (CTS) approved a one-year extension of a VND 1,000 billion credit limit with Vietcombank.

Huy Khai

– 19:56 16/05/2025

A Strategic Stake: CII Invest Acquires Over 10 Million Shares in NBB, Now Holding a Commanding 47% Stake

“In two sessions held between May 9 and May 12, 2025, CII Invest, a renowned private trading and investment company, successfully acquired over 10 million shares of NBB, a leading investment company listed on the HOSE, from My Steel Trading and Services Co., Ltd. This strategic move was executed without the need for a public offering, as per the resolution of the 2025 Annual General Meeting of Shareholders.”

The Young Man’s Debt: A Tale of a 3.7 Billion Dong Debt and a Missing Debtor

Introducing the master of deception, Dat, who weaves lies to secure loans, leaving a trail of broken promises and unpaid debts in his wake. With his silver tongue, he spins tales of financial need, ensnaring unsuspecting lenders in his web of deceit. This crafty individual manipulates the system, using loans to settle scores with banks, only to default on his obligations.