Illustrative image

The Joint Stock Company Tasco (HUT on the stock exchange) has just sent a document to the State Securities Commission and the Hanoi Stock Exchange (HNX) announcing the resolution of its Board of Directors on approving the details of the plan to use the expected proceeds from the public offering and updating the registration dossier for the public offering of shares.

Accordingly, the entire amount expected to be raised from the public offering of shares, amounting to VND 1,785,023,930,000, will be used to supplement investment capital for investment, capital contribution, and production and business activities.

Specifically, the capital will be used to invest in and increase the charter capital of its subsidiaries, including Tasco Auto Joint Stock Company (VND 485 billion), Tasco Insurance Limited Company (VND 800 billion), and VETC Joint Stock Company (VND 500 billion).

The disbursement is expected to take place in the first half of 2025.

In the event that the offering period ends and the company is unable to sell all the registered shares or the proceeds are insufficient, the Board of Directors plans to request an extension of the offering period to continue selling the remaining shares in compliance with legal regulations.

The company will also consider other legal and internal capital supplement options to ensure the implementation of its plans. If necessary, the company will adjust its capital contribution plans for the three subsidiaries to match the actual situation and amend the capital usage plan accordingly.

In the event that the proceeds from the offering are still insufficient to cover all the aforementioned purposes after the Board of Directors has handled fractional and excess shares, the company will prioritize using the proceeds to contribute capital to Tasco Auto Joint Stock Company, followed by Tasco Insurance Limited Company, and then VETC Joint Stock Company.

In another development, on May 9, 2025, Tasco received resignation requests from Mr. Dinh Duc Tung and Mr. Tran Duc Huy, who wished to step down from their positions as members of the Board of Directors and independent members of the Board of Directors, respectively.

In their resignation letters, both individuals cited personal reasons and a lack of time and conditions to focus on fulfilling the tasks assigned by the company’s General Meeting of Shareholders.

The resignations of Mr. Dinh Duc Tung and Mr. Tran Duc Huy will take effect from the time they are considered and approved by the General Meeting of Shareholders.

The Master Plan for a Massive $2.7 Billion Seaport: A Visionary Project Unveiled

On May 14, Tran Van Lau, Chairman of the People’s Committee of Soc Trang province, announced that the Ministry of Construction has approved the Detailed Planning for the Development of Soc Trang Seaport Land and Water Area for the period of 2021-2030, with a vision towards 2050. It is expected that this port cluster will require an investment of over VND 61,500 billion in the next five years.

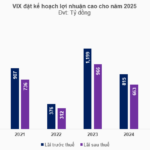

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

“Chairman Dao Manh Khang: NPL Management is ABBank’s Bright Spot, 1st Quarter Profit Reaches VND 400 Billion”

On April 18, 2024, An Binh Joint Stock Commercial Bank (ABBank) held its Annual General Meeting for 2025 to present its business plan, profit distribution, and elect new members to its Board of Directors.