‘Bitumen King’ Struggles with Profitability

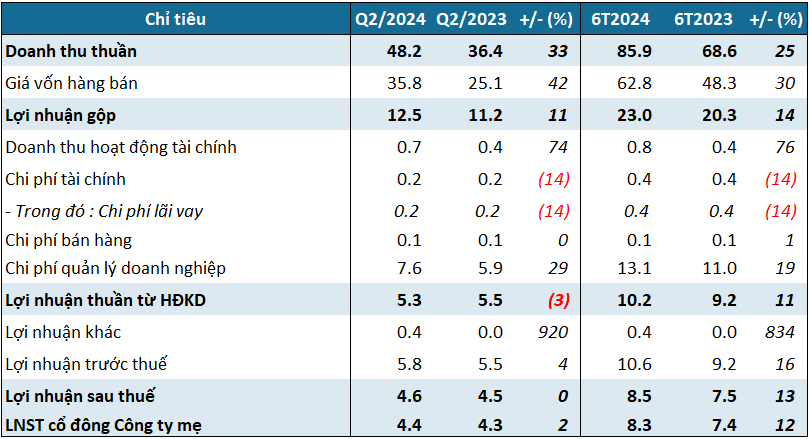

Vietnam’s leading bitumen company, Petrolimex Joint Stock Company (code: PLC), has announced its Q1 2025 financial results, with revenue reaching over VND 1,900 billion, a 20% increase compared to the same period last year. As a result, net profit after minority interest reached VND 32 billion, a significant surge of 106%.

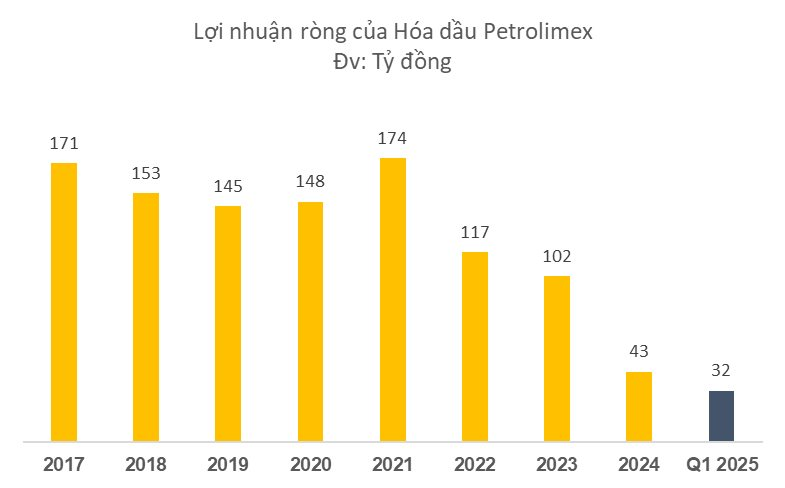

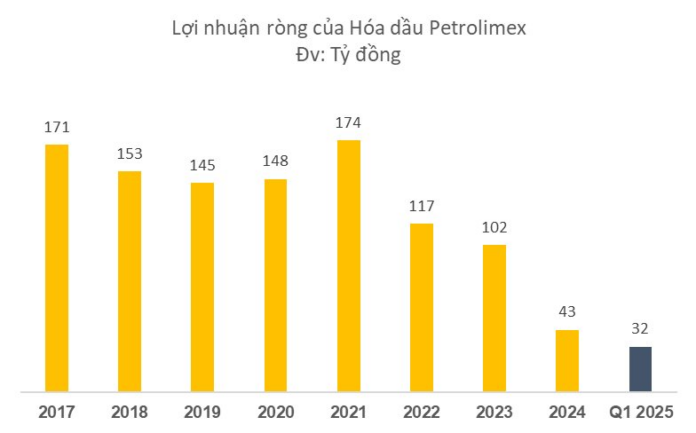

However, with this growth, PLC’s profit has only returned to the level of two years ago, i.e., Q1/2023, as the company witnessed a drastic 60% decline in 2024.

PLC’s profit has been on a downward trend for the past three years.

The growth in net profit after minority interest in Q1/2025 was mainly due to gross profit and financial income (up 109%), reflecting favorable exchange rate gains during this quarter.

The gross profit from the bitumen segment increased by 23% year-over-year, mainly due to a 31% rise in revenue, with market share recovering to 29.5% and faster disbursement of public investment projects.

Battling Cheap Bitumen Imports from Middle Eastern Rivals

PLC is a leading player in the petrochemical industry, offering a range of products, including lubricants, bitumen, and chemicals.

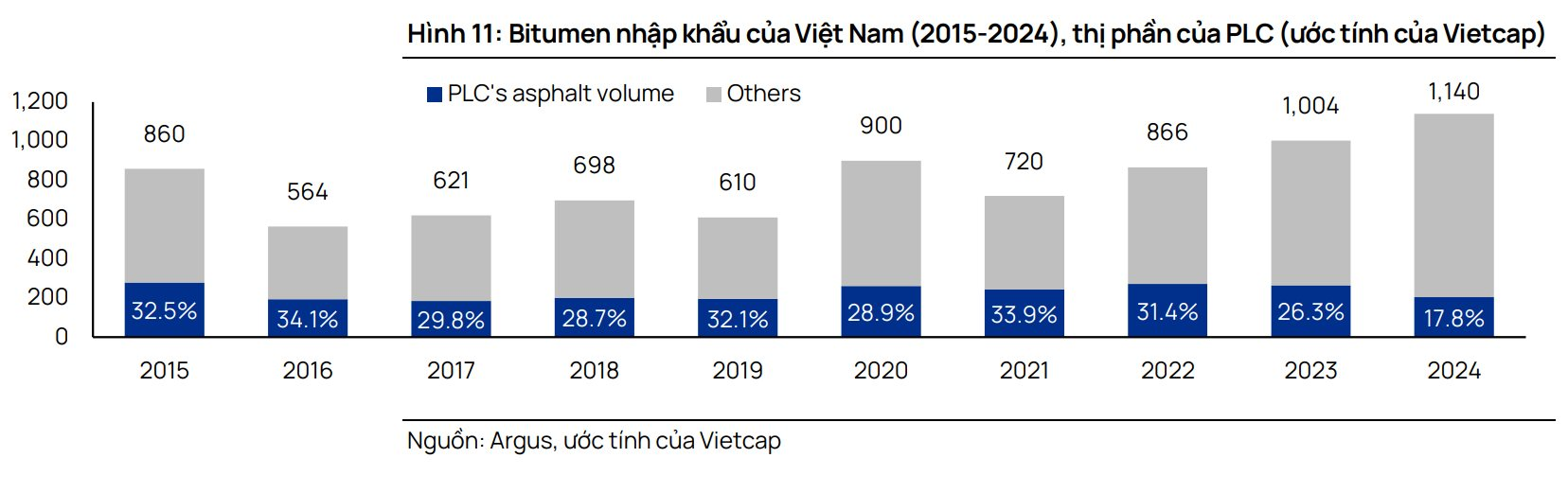

In the bitumen market, PLC has maintained an average market share of 28-30% over the years, solidifying its position as the largest player in this sector. In Q1/2025, their market share stood at 29.5%.

The company has a designed capacity of 400,000 tons/year, and their annual output typically reaches around 230,000 tons. PLC’s management has stated that they can increase production to 350,000-400,000 tons/year when market demand peaks.

However, according to Vietcap, PLC faced challenges during 2023-2024 due to an influx of cheap bitumen imports from Middle Eastern competitors.

In 2024, low-cost bitumen from private companies, particularly those based in the Middle East, accounted for 34% of the domestic supply, a significant jump from the 25% recorded in 2023.

These imported products put pressure on PLC’s profit margins. The intense price competition caused PLC’s market share to drop to 17.8% in 2024, the lowest in a decade.

At the 2024 Annual General Meeting, the company’s management attributed the decline to reduced market demand, fierce competition, and the surge in bitumen imports from the Middle East (with altered origins) into Vietnam, which led to a 10% decrease in average selling prices compared to 2023. The gross profit margin for 2024 stood at 8.54%, translating to a 170 billion VND loss in profit compared to the previous year.

These challenges persisted into Q1/2025, resulting in bitumen output reaching only 25% of the plan and a profit of approximately VND 11 billion. In Q2, bitumen output is expected to reach 25,000 tons, corresponding to a revenue of VND 300 billion.

Many industry players have voiced their concerns to regulatory authorities about the quality of unofficial imports from the Middle East, fearing that these products might not meet Vietnam’s stringent technical standards for infrastructure projects.

Can ‘Public Investment’ Wave Turn the Tide?

After plunging to VND 18,900/share on April 8 due to a market-wide downturn triggered by countervailing duty news, PLC’s stock price has rebounded to VND 26,300, marking a remarkable 39% gain in just over a month.

As the ‘Bitumen King’ of Vietnam, PLC is now pinned with high hopes on the ‘public investment’ keyword.

Vietcap forecasts that PLC’s net profit will more than double to VND 113 billion in 2025, mainly driven by the bitumen segment, with expected revenue growth of 22% and an improved gross profit margin of 10.5%.

Vietcap believes that PLC is well-positioned to defend and regain market share, benefiting from the rising demand for higher-quality bitumen, particularly polymer-modified asphalt (PMA).

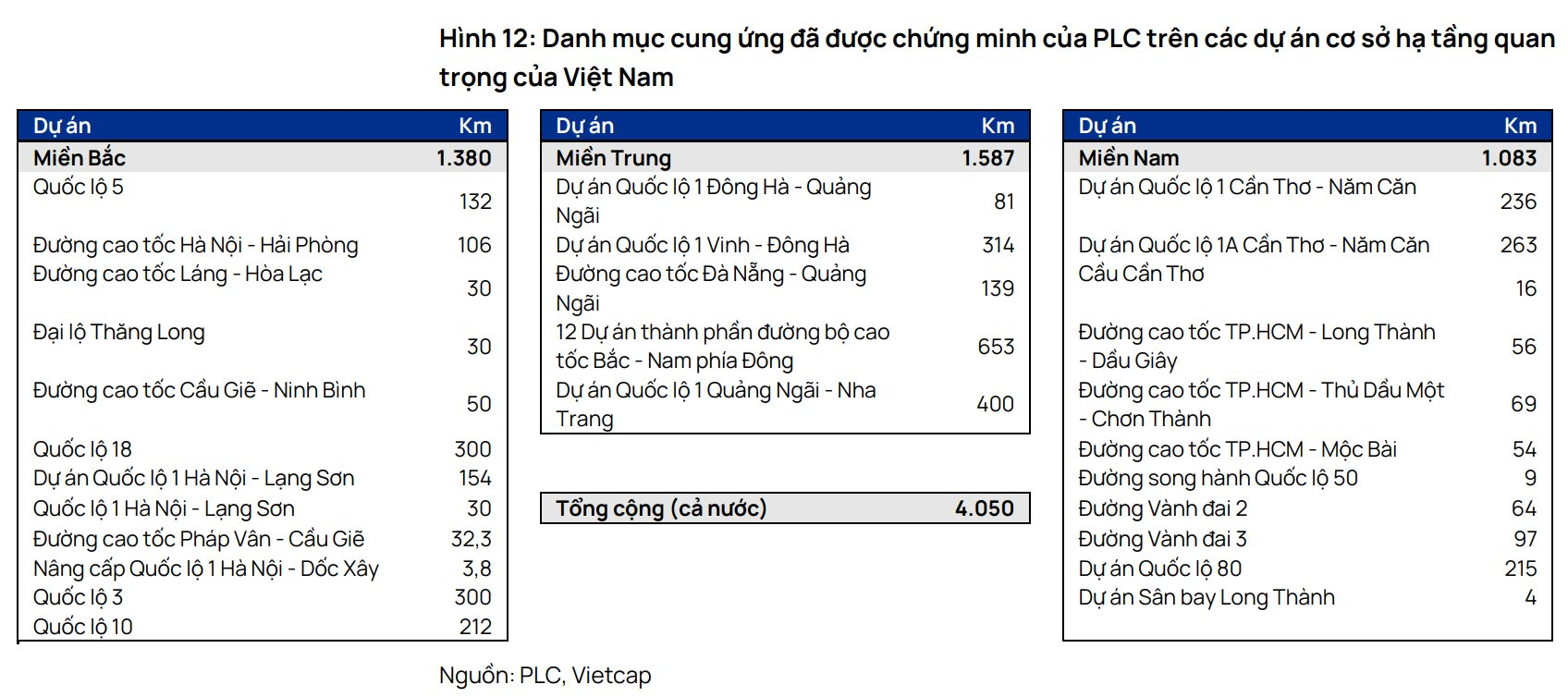

PLC has a strong track record of supplying bitumen for large-scale domestic infrastructure projects.

The company’s bitumen products have been used in most of the country’s key projects, including major expressways: Ho Chi Minh City-Long Thanh-Dau Giay, Hanoi-Haiphong, Danang-Quang Ngai, and Phap Van-Cau Gie; National Highways: National Highway 1 (various sections), National Highway 5, National Highway 10, and National Highway 18; Airport and other infrastructure projects: Tan Son Nhat Airport expansion project, Nhat Tan Bridge, and key belt roads in Ho Chi Minh City and Hanoi.

Vietcap predicts that PLC will sell a total of 1.7 million tons of bitumen during 2025-2029, a 39% increase compared to the 2020-2024 period. This growth aligns with Vietnam’s infrastructure development, with the Ministry of Transport expected to disburse a total of VND 477 trillion in the 2025-2029 period (94% of the VND 510 trillion budget, a 65% increase compared to 2020-2024).

Similar to previous cycles, Vietcap anticipates a strong correlation between the Ministry of Transport’s disbursement and bitumen demand.

However, the company’s management emphasizes that the issue of cheap bitumen imports with altered origins is not easily resolved. If left unaddressed, PLC will continue to face intense competitive pressure, eroding its profit margins.

The Pharma Chairman’s Dark Secrets: How a Daughter-in-Law’s Bribe Exposed a Web of Corruption.

“In order to secure lucrative contracts to supply medicines to hospitals and medical centers in Hung Yen, the former chairman of Duoc Son Lam Company had to grease palms, paying bribes of between 10% and 15% on every invoice. This practice was seemingly commonplace, and the chairman was all too willing to play the game, ensuring his company’s success in the region.”

The New Game in the $1.05 Billion Tech Vehicle Market: Xanh SM Overtakes Grab, Be Remains Loyal to Super App, and the Entry of a Special Player

“2024 witnessed a significant restructuring phase following the exit of Gojek from the Vietnamese market in September, leaving a substantial 17% market share up for grabs (as indicated in the Q3 2024 report, ‘The Connected Customer’). This presented a unique opportunity for existing and new players to strategize and capture this newly available market share.”

“Big Benefits for Small Businesses: Transforming into an Enterprise”

To achieve Vietnam’s ambitious target of having 2 million enterprises by 2030, the government is set to introduce attractive incentives to encourage households engaged in business activities to transform into formal enterprises.

![[Photo Essay]: National Conference on the Propagation and Implementation of the 11th Plenum Resolutions](https://xe.today/wp-content/uploads/2025/05/img2050-17447720177111743218177-150x150.jpg)