Despite a sharp fall of 11.81 points in the last session, the VN-Index closed the week with a strong gain for the second consecutive week, reaching 1,301.39 points, up a total of 34.09 points (+2.69%) from the previous week’s close.

Since the April low of 1,070 points – when the US announced a tariff of up to 46% on goods from Vietnam – the market’s main index has surged over 230 points, or 21%, forming a surprising V-shaped recovery.

However, most individual investors have not yet recovered from the shock. On stock forums, many admitted that they were still heavily in the red, having sold in a panic and then stayed on the sidelines as the market rebounded strongly.

In an interview with Báo Người Lao Động, Mr. Tran Quoc Toan, Branch Director 2 – Head Office, Mirae Asset Securities Company (MAS), analyzed that although the VN-Index has rebounded strongly in a short period of time, most individual investors have not been able to recover from the tariff shock. This is due to the lack of breadth in the recovery, along with limited portfolio management strategies by investors amid uncertain information.

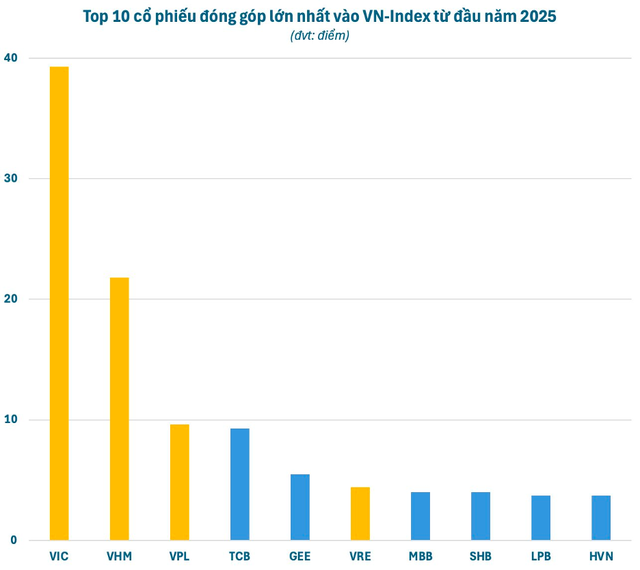

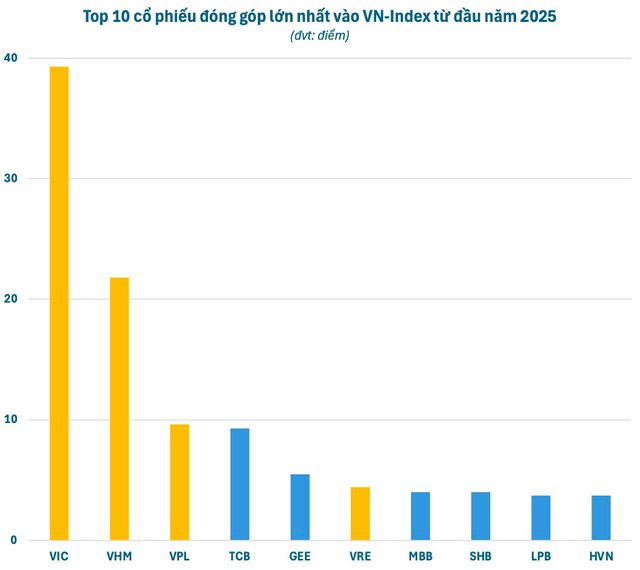

The recovery of the VN-Index was largely driven by a group of large-cap stocks. Just four stocks of the VinGroup contributed more than 75 points to the index, while the index has gained less than 43 points since the beginning of the year (as of mid-May). This indicates that many other stocks – especially mid-cap and penny stocks – are still in a weak recovery or sideways trend.

“The market recovered quickly but lacked breadth, relying mostly on some large-cap stocks like VinGroup, which does not represent the entire market,” said Mr. Tran Quoc Toan, Branch Director of Mirae Asset Securities Company.

VinGroup stocks, most recently VPL of Vinpearl, contributed significantly to the rise of the VN-Index. Source: MAS

In addition to VinGroup stocks, bank stocks also made notable contributions to the rise due to expectations from Resolution 68-NQ/TW related to private economic support policies. However, the heavy reliance on a few large-cap stocks makes the VN-Index an incomplete reflection of the market’s overall health.

Mr. Toan also stated that herd mentality, lack of a clear investment strategy, and limited portfolio management skills are factors that lead investors to incur losses. When the market falls sharply due to adverse news, many investors rush to sell, and then fail to get back in when the market rebounds. Fear and indecision cause them to miss out on opportunities in both downward and upward trends.

Sharing his investment strategy for the current phase, Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Company, opined that many stocks that fell deeply by 30-40% in April have only partially recovered and are still down about 15-20%. According to him, from now until June, the market will continue its recovery phase, but investors need to be patient. For stocks with large weights in the portfolio, if they fail to advance further after recovering, consider closing positions for restructuring.

Mr. Son advised investors to focus on industries they understand well, build appropriate risk appetites, and have specific investment strategies, instead of vague expectations or holding onto weak stocks for too long.

Stock portfolios are still in the red despite the strong rise of the VN-Index

“Upcoming Dividend Dates: Don’t Miss Out on the 100% Cash Payout!”

There are 46 businesses offering cash dividends, with the highest being an impressive 100% and the lowest a modest 1%.

The Value Investing Strategy is “Making a Comeback”

Warren Buffett, the greatest investor of all time, has just announced his retirement, shocking the value investing community. But they have bigger problems to worry about. Their favored investment style has been out of favor for years, and their clients are growing impatient. In a world where the US stock market consistently outperforms, low-cost passive funds seem like the sensible option.

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.