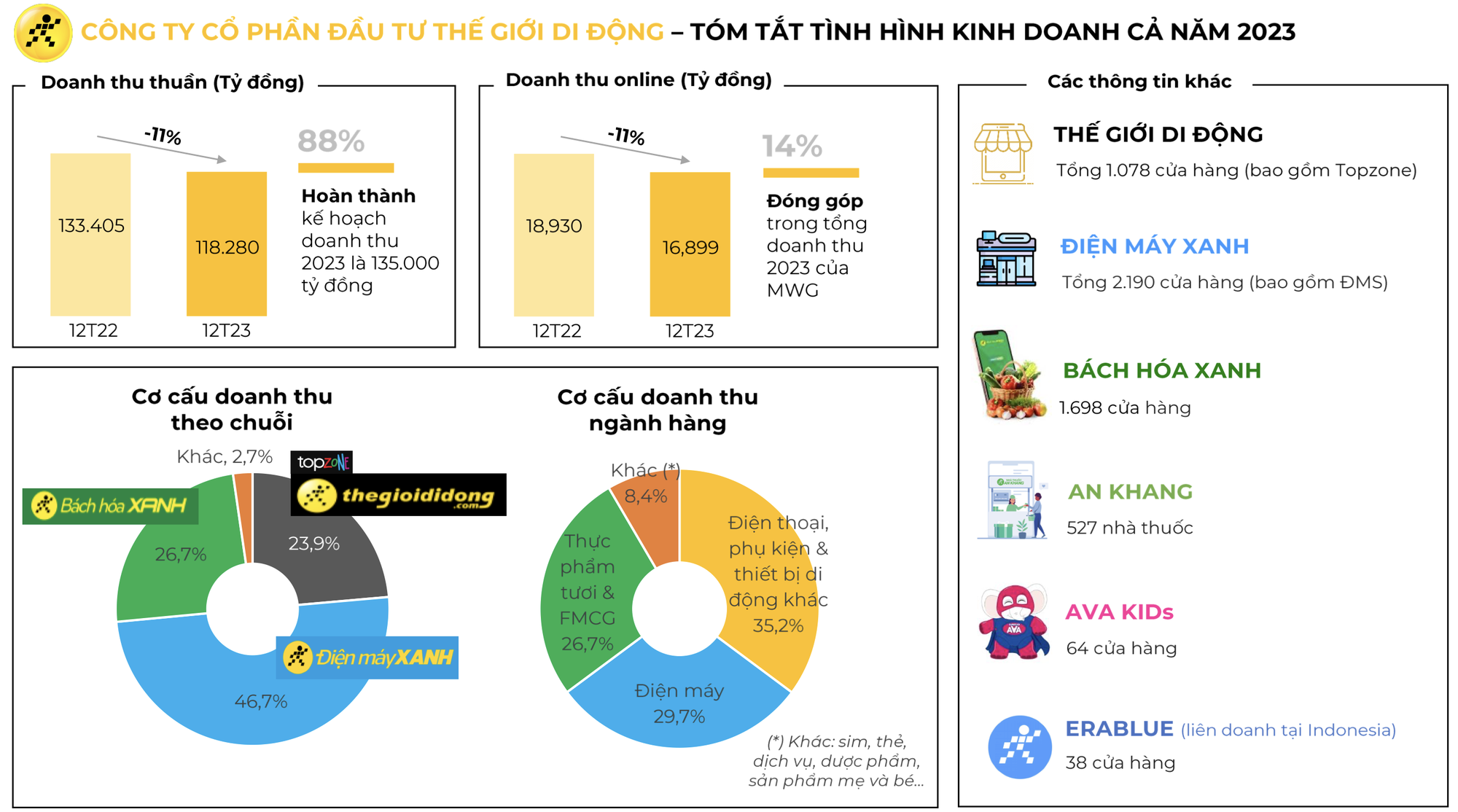

In terms of chains, Dien May Xanh (DMX) still contributes the most to revenue with a share of 46.7%. Notably, revenue from Bach Hoa Xanh (BHX) accounted for 26.7%, surpassing the revenue from 2 chains, Thế Giới Di Động (TGDĐ) and topzone (with a share of 23.9%).

In 2023, most categories belonging to 2 chains DMX/TGDĐ saw negative growth (except for air conditioners). Specifically, revenue from mobile phones, laptops, refrigerators, washing machines, and appliances decreased by 10-20%. Meanwhile, BHX’s revenue in 2023 reached 31.6 trillion VND, a growth of 17% compared to 2022. Particularly in Q4, revenue increased by 31% compared to the same period.

Even without opening new stores, BHX continues to steadily increase revenue through each month since March 2023 thanks to the growth of revenue from existing stores. Compared to the same period, the growth in the number of purchases reached 20% and the value of invoices was maintained at a level similar to 2022. The online channel served more than 2.6 million successful transactions and contributed more than VND 900 billion, accounting for 3% of BHX’s total revenue.

Both fresh food and FMCG categories saw revenue growth. Thanks to focusing on increasing output and stabilizing product quality, fresh food products increased by 35%-40% compared to the same period, playing a role in attracting customers and as a competitive advantage helping BHX increase market share. The increase in sold quantity also helped BHX (i) establish strategic cooperation with many reputable and large meat and seafood suppliers such as CP, Minh Phu, Navico, HDC Corp., (ii) secure products and better quality control for cooperatives and local fruit and vegetable suppliers, and (iii) diversify the portfolio of imported goods.

FMCGs categories witnessed a growth of 5-10% compared to the same period. BHX actively cooperated closely with suppliers to implement many attractive promotional programs that bring practical benefits to customers, help brands advertise products, and increase sales.

In December 2023, with an average revenue of VND 1.8 billion per store, BHX has achieved the break-even point after all costs corresponding to the current operational reality, and based on core business operations (excluding (i) one-off expenses already accounted for in Q4 and (ii) a part of depreciation expenses related to the reduction of store area due to restructuring will gradually decrease over time, BHX is confident to make up for this part and have net profit for the whole year 2024).