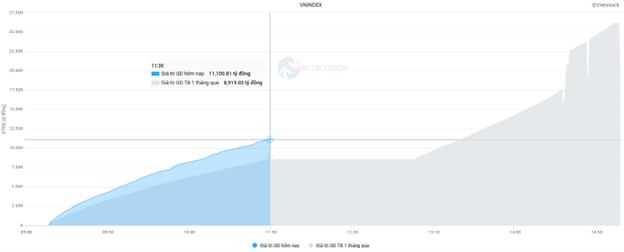

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 829 million shares, equivalent to a value of more than 19.6 trillion VND; HNX-Index reached over 60.8 million shares, equivalent to a value of more than 930 billion VND.

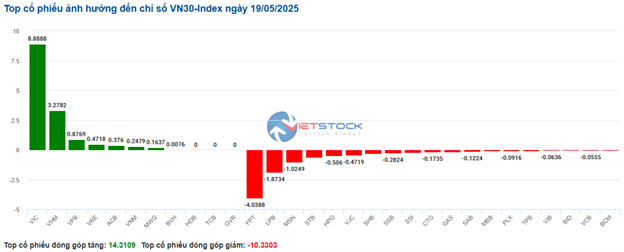

VN-Index opened the afternoon session continuing the tug-of-war with sellers slightly dominating, causing the index to fail to recover and close in the red. In terms of impact, VPL, VCB, FPT, and LPB were the most negative influences on the VN-Index with a 3.9-point drop. On the other hand, VIC, VHM, GEE, and VPB remained in the green and contributed more than 6.9 points to the overall index.

| Top 10 stocks with the highest impact on the VN-Index on May 19, 2025 |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by KSV (-6.47%), IDC (-2.38%), DNP (-8.61%), and NVB (-1.8%)…

|

Source: VietstockFinance

|

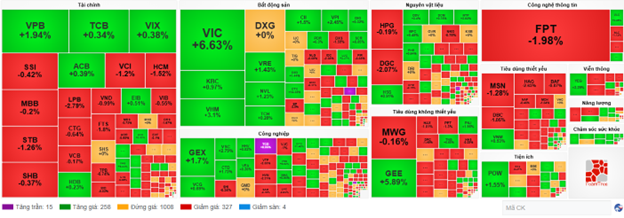

The information technology industry was the group with the largest decrease in the market, falling by 2.29%, mainly due to the 2 stocks FPT (-2.31%) and CMG (-2.43%). This was followed by the telecommunications and energy sectors, which fell by 2.25% and 1.55%, respectively. On the other hand, the real estate industry was the group that maintained its green status with a 2.37% increase, mainly contributed by VIC (+7%), VHM (+1.38%), VRE (+1.02%), and SSH (+0.45%).

In terms of foreign trading, they returned to net buy more than 331 billion VND on the HOSE exchange, focusing on VIC (173.94 billion), MBB (148.43 billion), CTG (83.77 billion), and KBC (70.39 billion). On the HNX exchange, foreign investors net bought more than 20 billion VND, focusing on MBS (13.81 billion), IDC (5.6 billion), VFS (3.73 billion), and TNG (910 million).

| Foreign Trading Net Buying and Selling Activity |

Morning Session: VIC was heavily bought by foreign investors, VN-Index regained green

The market regained its green status with positive leadership from a few pillar stocks. At the end of the morning session, the VN-Index slightly increased by 0.12%, standing at 1,302.97 points. Meanwhile, the HNX-Index decreased by 0.38%, falling to 217.85 points. In terms of market breadth, sellers still dominated with 369 decreasing stocks and 276 increasing stocks.

The trading volume of the VN-Index reached over 437 million units in the morning session, equivalent to a value of more than 11 trillion VND, 24% higher than the 1-month average. The HNX-Index recorded a volume of nearly 29 million units, with a value of over 464 billion VND.

Source: VietstockFinance

|

The duo VIC and VHM are currently the two main pillars contributing the most positively, helping the VN-Index increase by more than 7 points (of which VIC alone contributed more than 5 points). On the other hand, VPL, FPT, and LPB had a significant negative impact, taking away about 2 points from the overall index.

Most sectors are currently dominated by red. The real estate group, although recording an outstanding increase of 2.65%, was mainly contributed by the ceiling price of VIC, along with VHM (+3.28%), VRE (+0.61%), VPI (+2.45%), and KDH (+0.87%). Most of the remaining stocks just traded around the reference threshold or even fell sharply like BCM (-1.8%), SIP (-2.8%), IDC (-2.14%), SJS (-3.17%), SZC (-1.04%), and DXS (-2.17%).

The financial group is also currently polarized. Banking and insurance stocks rose and fell alternately, with a slight advantage for the buying side, while securities were dominated by red, with many stocks falling more than 1% such as VCI, HCM, FTS, MBS, BSI, CTS, VDS, ORS, BVS,…

Information technology and telecommunications are the two temporary “bottom” groups of the market with pressure from FPT (-1.65%); VGI (-1.66%), CTR (-2.45%), FOX (-1.51%), SGT (-1.12%), and ELC (-1.12%).

Foreign investors continued to net sell slightly more than 87 billion VND on the 3 exchanges this morning. MSN, VHM, and GEX were the stocks that were sold the most heavily by foreign investors, with a net value of about 65-80 billion VND. On the other hand, VIC was the most prominent bright spot when attracting more than 161 billion VND in net purchases from foreign investors, far surpassing the rest.

| Top 10 stocks net bought and sold by foreign investors in the morning session of May 19, 2025 (as of 11:30 am) |

10:35 am: Vingroup stocks support the index, narrowing the decline

Unexpected buying demand reappeared, helping the main indices recover near the reference level. As of 10:30 am, the VN-Index slightly increased by 0.21 points, trading around 1,301 points. The HNX-Index decreased by 0.77 points, trading around 217 points.

The VN30 basket is currently in a state of red domination. Notably, FPT took away 4.04 points, LPB took away 1.87 points, MSN took away 1.02 points, and STB took away 0.63 points. On the other hand, only a few stocks such as VIC, VHM, VPB, and VRE remained in the green and contributed more than 13.5 points to the overall index.

Source: VietstockFinance

|

The strongest recovery belonged to the real estate industry with an increase of 2.95% despite the current polarization. Specifically, the pillar stocks in this industry such as VIC hitting the ceiling price, VHM increasing by 4.32%, VRE increasing by 2.24%, SSH increasing by 0.57%… contributed to the general recovery of the index. On the selling side, stocks such as BCM decreasing by 1.48%, NLG decreasing by 0.59%, SJS decreasing by 3.17%, KSF decreasing by 0.62%, SIP decreasing by 1.91%… are hindering the general uptrend.

Next is the healthcare group, which also supports the overall market recovery with the green color mainly in large-cap pharmaceutical manufacturing enterprises such as DHG increasing by 0.47%, IMP increasing by 1.65%, DVN increasing by 0.84%, TRA increasing by 2.61%…

In another development, the information technology group was not very positive when strong selling pressure focused on the two giants in this industry, FPT decreasing by 1.9% and CMG decreasing by 1.28%. However, the green color was still recorded in stocks such as ITD increasing by 1.81%, CMT increasing by 0.71%, POT increasing by 4.61%, and PIA increasing by 1.72%, but the impact was not too significant.

Compared to the beginning of the session, the sellers still dominated. There were 327 decreasing stocks and 258 increasing stocks.

Source: VietstockFinance

|

Opening: Decreasing on a large scale, VN-Index drowned in red

The market in the early morning session took place in a negative atmosphere and was dominated by red in most sectors. In particular, the VN30 index had the most negative impact when most of the stocks in this group decreased.

Red temporarily dominated the VN30 basket with 25 decreasing stocks, 4 increasing stocks, and 1 unchanged stock. In particular, LPB, FPT, GAS, and VJC were the most negatively impacted stocks. On the other hand, VIC, VHM, GVR, and ACB were the stocks with the strongest increases.

The telecommunications service industry was most negatively affected at the beginning of the session with a decrease of 1.82%. Specifically, stocks such as VGI decreased by 1.93%, FOX decreased by 1.51%, CTR decreased by 1.63%, ELC decreased by 0.67%,…

Following was the information technology and communications group when the large-cap stocks in this group were also pessimistic, with FPT decreasing by 1.74% and CMG decreasing by 1%.

Market Beat: Foreign Investors Scoop Up VIC Shares, VN-Index Recaptures Green

The market regained its positive momentum, led by a few key stocks. By the end of the morning session, the VN-Index rose slightly by 0.12%, reaching 1,302.97. In contrast, the HNX-Index fell by 0.38% to 217.85. Despite the overall gain, the market breadth remained tilted towards decliners, with 369 stocks falling against 276 advancing ones.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)