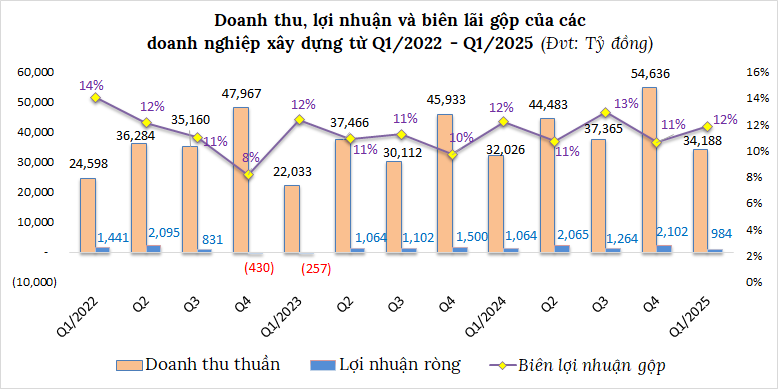

According to statistics from VietstockFinance, 108 construction companies listed on the stock exchange (HOSE, HNX, UPCoM) have published their first-quarter financial statements for 2025, reporting a combined revenue of over VND 34,188 billion, a 7% increase year-on-year. However, their net profit decreased by 7% to VND 984 billion, the lowest since the second quarter of 2023. When compared to the previous quarter (Q4 2024), both revenue and profit decreased by 37% and 53%, respectively. The industry’s gross profit margin for this quarter stood at 12%.

Source: VietstockFinance

|

A Tale of Two Extremes

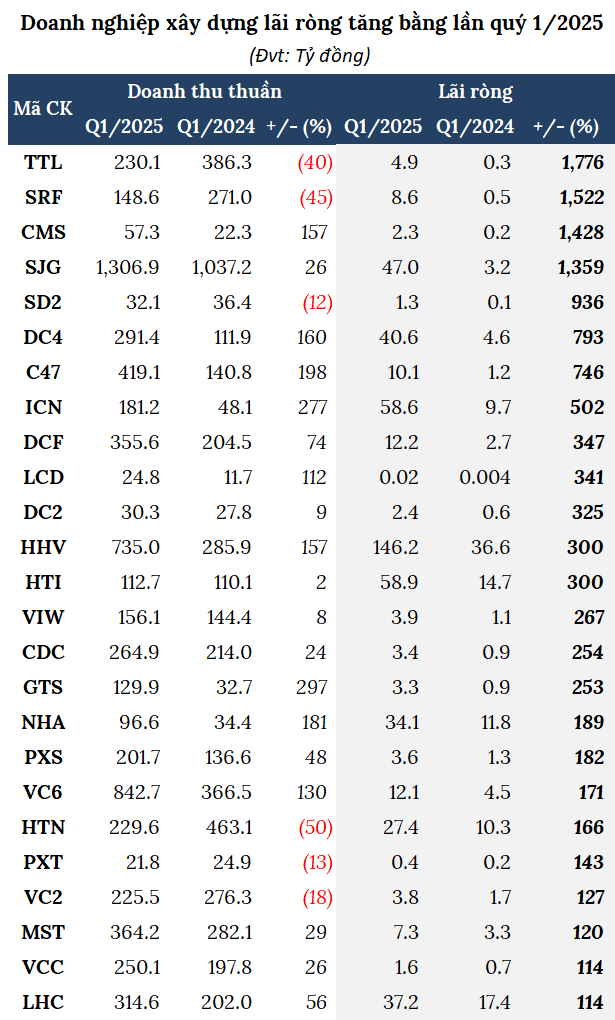

Out of the companies that have published their financial statements, 44 reported an increase in profits, accounting for 41% of the total. Among them, 25 companies achieved exponential growth, some thanks to unexpected income sources.

Topping the list is Tong Cong Ty Thang Long (HNX: TTL), with a profit of nearly VND 5 billion, 19 times higher than the previous year. This impressive performance is attributed to their effective cost-cutting measures. Searefico (HOSE: SRF) also experienced a windfall with a profit of nearly VND 9 billion, 16 times higher, thanks to the proceeds from the transfer of shares in its subsidiary.

Tong Cong Ty Song Da (UPCoM: SJG) recorded a profit of VND 47 billion, almost 15 times higher than the previous year, due to their increased focus on construction activities and higher dividend income.

On the other hand, Deo Ca (HOSE: HHV) reported a net profit of over VND 146 billion, quadrupling the figure from the same period last year—a record high since its listing. This surge in profit is attributed to revenue from bridge and road maintenance, financial activities, and the consolidation of business results from the Cam Lam-Vinh Hao expressway project.

Source: VietstockFinance

|

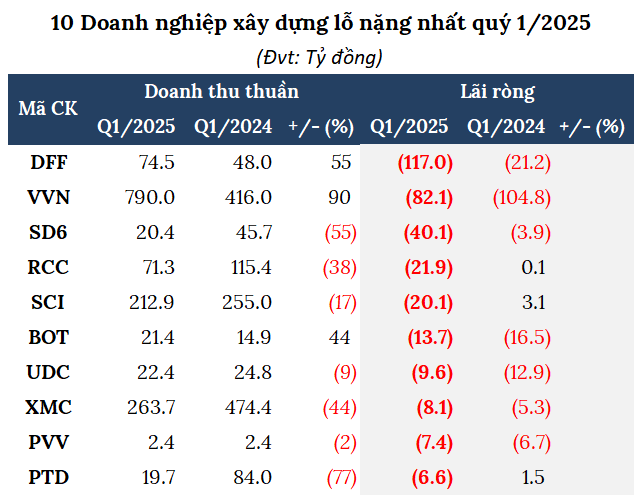

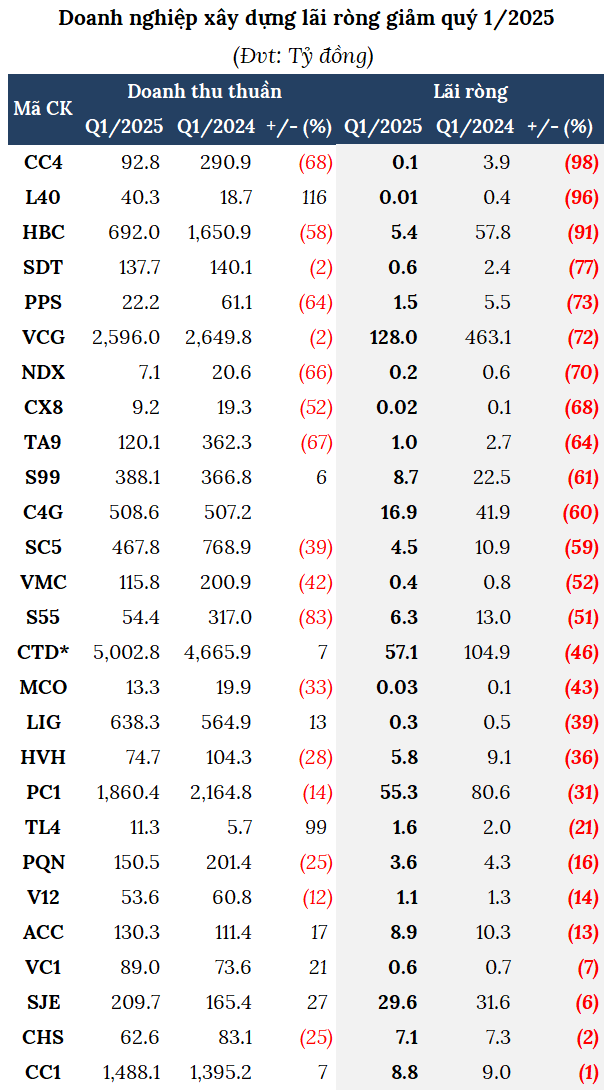

Contrarily, numerous businesses continue to struggle with prolonged losses or plummeting profits. Tap doan Dua Fat (UPCoM: DFF) suffered its seventh consecutive quarterly loss, amounting to over VND 117 billion, with cumulative losses surpassing VND 680 billion—a concerning figure considering their charter capital of VND 800 billion. DFF attributes these losses mainly to high borrowing costs and prolonged construction periods, resulting in increased production costs.

Tong Cong Ty Co Phan Xay dung Cong nghiep Viet Nam (UPCoM: VVN) incurred a loss of over VND 82 billion, marking its tenth consecutive quarterly loss, with cumulative losses exceeding VND 3 trillion. Meanwhile, Song Da 6 (UPCoM: SD6) faced a loss of over VND 40 billion due to a lack of projects, yet they had to maintain their operational structure.

Source: VietstockFinance

|

Notably, Hoa Binh (UPCoM: HBC) witnessed a significant drop in net profit, which stood at just over VND 5 billion for the first quarter, a 91% decrease year-on-year. Despite a reversal of nearly VND 40 billion in management expenses, the company’s profit failed to improve due to market challenges and declining revenue. Tap doan CIENCO4 (UPCoM: C4G) and Tap doan PC1 (HOSE: PC1) also reported declining profits, with C4G earning VND 17 billion and PC1 earning VND 55 billion, representing decreases of 60% and 31%, respectively.

Source: VietstockFinance

|

Leading Companies Maintain Billion-Dollar Revenues

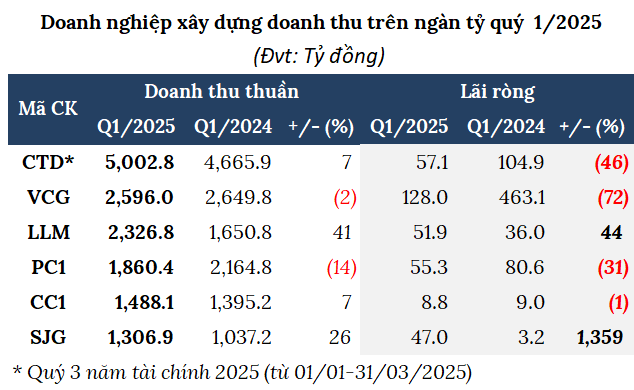

During the first quarter, six companies achieved revenues exceeding VND 1,000 billion.

For the third quarter of the 2025 financial year (January 1 to March 31, 2025), Xay dung Coteccons (HOSE: CTD) recorded a consolidated net revenue of nearly VND 5,003 billion, a 7% increase year-on-year. This growth is mainly attributed to construction contracts totaling VND 4,909 billion, a 6% increase. However, their net profit decreased by 46% to VND 57 billion due to rising input costs and the global economic landscape.

Tong Cong Ty Co phan Xuat nhap khau va Xay dung Viet Nam (Vinaconex, HOSE: VCG) generated a net revenue of VND 2,596 billion, with a net profit of VND 128 billion, representing decreases of 2% and 72%, respectively.

The total revenue of Tong Cong Ty Xay dung So 1 (UPCoM: CC1) exceeded VND 1,488 billion, a 7% increase, while their net profit reached nearly VND 9 billion, a slight decrease of 1%.

Source: VietstockFinance

|

Most Major Construction Companies Aim for Growth

The real backbone of the construction industry at present is public investment. The year 2025 marks the final year of the medium-term public investment plan for 2021-2025, with a total allocated capital of up to VND 791,000 billion approved by the National Assembly. This record-breaking figure holds significant importance for construction companies.

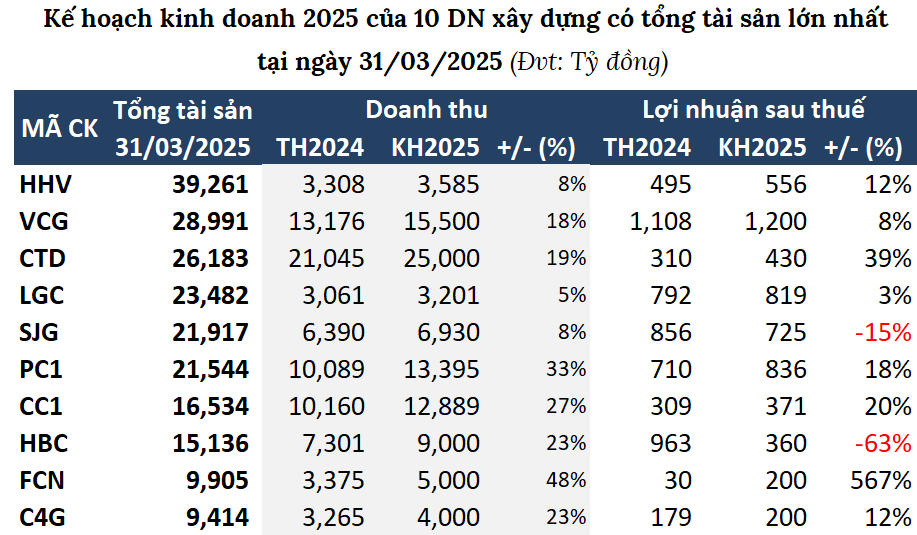

Consequently, most major players in this sector have set growth targets for 2025 compared to the previous year.

For instance, HHV aims for a revenue of VND 3,585 billion and a post-tax profit of VND 556 billion, representing increases of 8% and 12%, respectively. At an investor conference on April 25, Vice Chairman of the Board of Directors, Nguyen Huu Hung, stated that the company is preparing its human resources and technology to seize opportunities arising from the upcoming wave of public investment.

FECON (HOSE: FCN) has set an ambitious target of achieving a consolidated revenue of VND 5,000 billion, a 48% increase, and a post-tax profit of VND 200 billion, a sixfold increase compared to 2024. This would be the highest profit since 2020. At the 2025 Annual General Meeting of Shareholders, Board member Nguyen Van Thanh mentioned that the value of their ongoing contracts carried over from 2024 amounts to approximately VND 2,500 billion. As of the first quarter of 2025, the company has secured new contracts worth about VND 1,300 billion, providing a solid foundation for their 2025 business plan.

Cong Ty Co Phan Dau tu Cau duong CII (HOSE: LGC) has set a target of nearly VND 3,201 billion in total revenue and nearly VND 819 billion in post-tax profit, representing increases of 4.6% and 3.4%, respectively, compared to 2024.

Meanwhile, SJG and HBC have set more cautious profit targets despite aiming for revenue growth, with planned profit decreases of 15% and 63%, respectively.

Source: VietstockFinance

|

The period from 2025 to 2030 is crucial for the completion of major infrastructure projects such as the North-South high-speed railway, Long Thanh International Airport, and Can Gio International Port. According to Chung khoan Ngan hang TMCP Ngoai thuong Viet Nam (VCBS), the North-South high-speed railway project is expected to comprise 60% bridges, 30% embankments, and 10% tunnels, offering significant opportunities for construction companies during the 2027-2035 period.

In the field of civil construction, VCBS assesses that the real estate market is entering a recovery phase. However, the recovery is uneven due to pressures from new land prices, high land use costs, and stringent credit requirements. The market will focus on financially robust developers with clean land funds, leading to intense competition among contractors.

Social housing, despite its slower-than-expected progress, remains a potential “piece of cake” for small and medium-sized enterprises due to the large unmet demand and limited supply.

In conclusion, the construction industry is undergoing a transformation, with a clear polarization among enterprises. Those with strong foundations, strategies aligned with public investment, and proactive restructuring are expected to seize the opportunity to break through during this critical phase of infrastructure development.

– 12:00 19/05/2025

“SDA Stock Plunges Following Trading Restriction News”

“Shares of Simco Song Da Joint Stock Company (HNX: SDA) plummeted on May 19th, following an announcement by the Hanoi Stock Exchange. The exchange has decided to impose trading restrictions on the stock starting May 21st due to a delay in submitting its audited financial statements for the year 2024. With this development, traders are left wondering about the future performance of SDA and its ability to rebound from this setback.”

“Kido Aims for $80 Million Profit, Targets 12% Cash Dividend”

In 2024, KIDO had initially planned to distribute a 12% cash dividend to its shareholders, however, this plan did not come to fruition. Despite this setback, the company remains committed to providing value to its investors and has proposed a similar dividend payout for this year.

“SHB Announces Record Date for 2024 Cash Dividend Payout”

“Vietnam-based Saigon-Hanoi Commercial Joint Stock Bank (SHB) has announced a dividend payout for its shareholders. As per the latest update, SHB will be offering a 5% cash dividend for the fiscal year 2024. This announcement is in line with the resolutions passed during the Annual General Meeting of Shareholders in 2025, where the bank committed to distributing an impressive 18% total dividend, comprising a 5% cash dividend and a 13% stock dividend.”

Billionaire Nguyen Thi Phuong Thao’s Airline to Deploy 50 Boeing 737 Aircraft to Vietjet Thailand

Let me know if you would like me to tweak it further or provide additional content suggestions.

“Vietjet Thailand is thrilled to announce the delivery of its first aircraft in October 2025. This marks a significant milestone in the airline’s expansion plans, enabling us to strengthen our domestic and international flight network. With these new aircraft, we aim to offer our passengers enhanced connectivity and an unparalleled travel experience.”