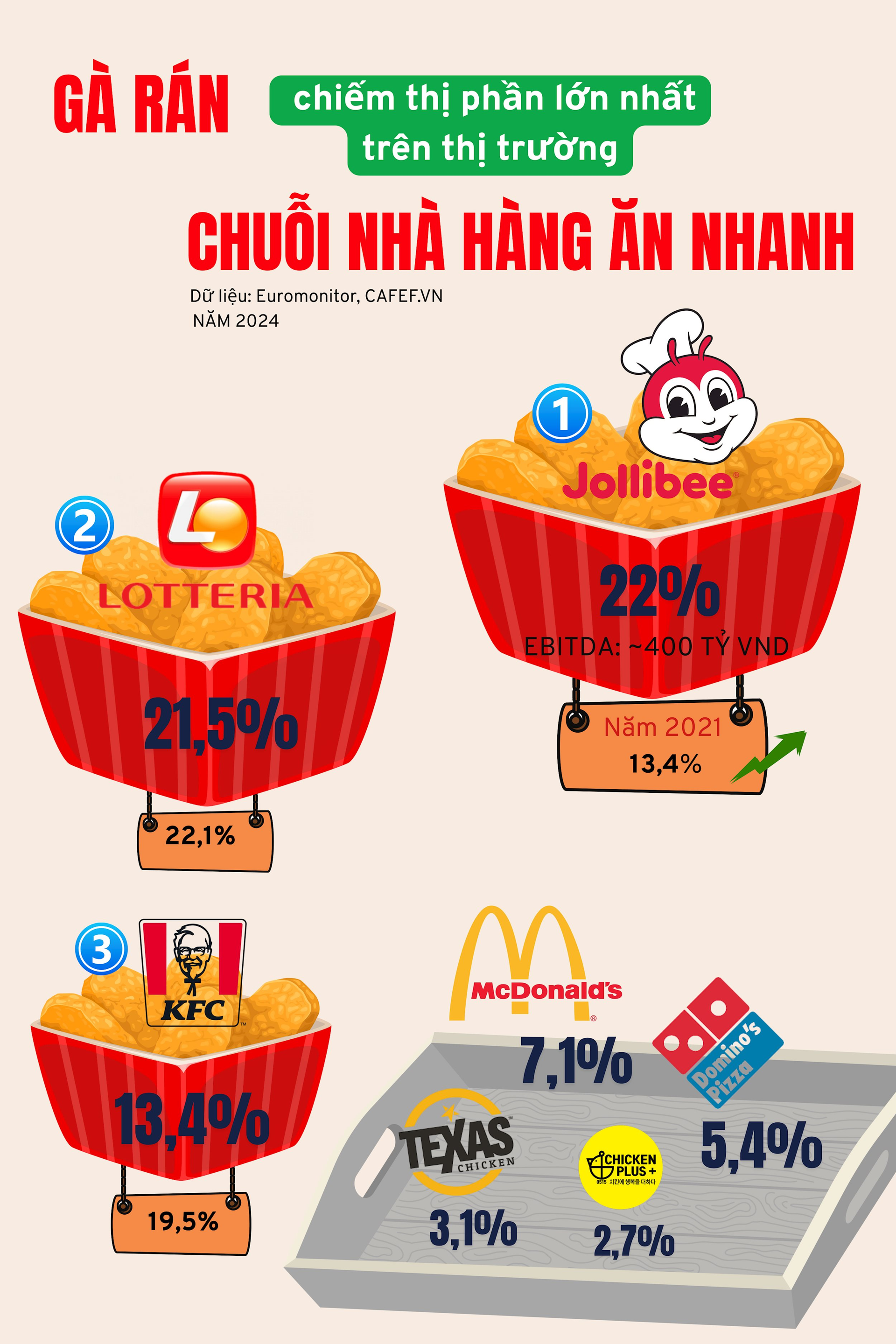

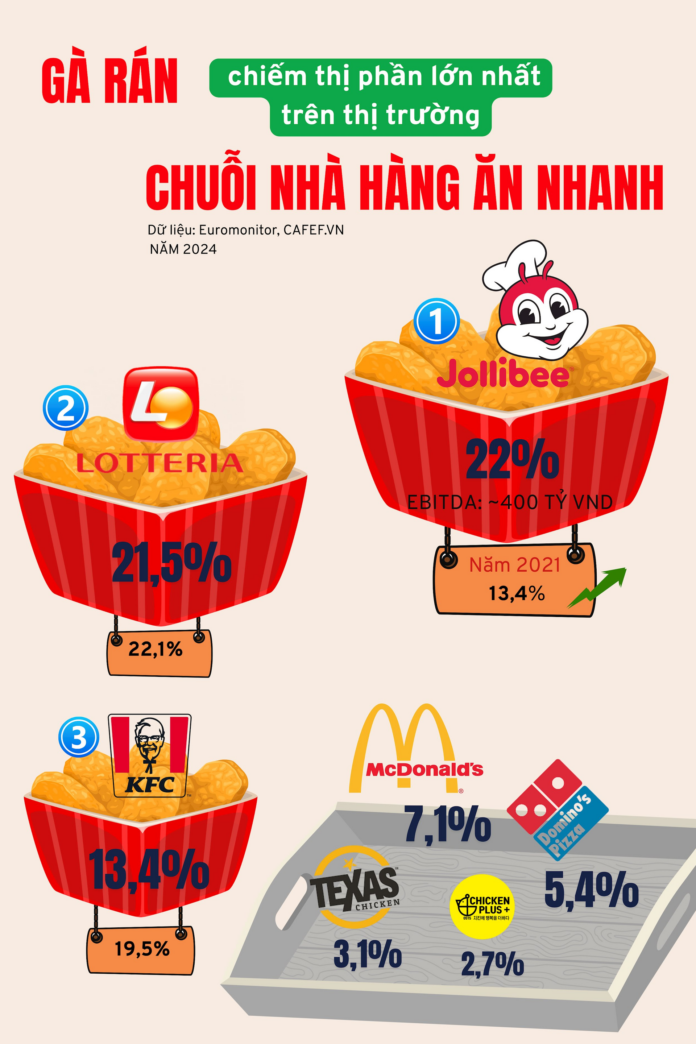

A 2024 Euromonitor report on Vietnam’s fast food market revealed that Jollibee Chicken holds the leading position in the country’s fast food chain market in 2024, with a 22% market share, surpassing its two biggest rivals, Lotteria and KFC.

Moreover, in the overall restaurant chain market, Jollibee claimed a 5.2% market share, second only to its sister brand, Highlands Coffee (8.9%), under the Jollibee Foods Corp. group.

Jollibee’s Rise Since 2022

According to the report, the total fast food market revenue (Limited-Service Restaurants, including chains and individual stores) in 2024 reached VND 22,392 billion, a 6.8% increase from 2023. Specifically, in the chicken fast food segment (Chicken Limited-Service Restaurants), revenue reached VND 5,780 billion, with chain chicken brands contributing VND 5,577 billion, a 6.5% increase.

In the fast food chain market, while Jollibee trailed Lotteria and KFC in 2021, its rise began in 2022, when its market share surged to 21%, claiming the top spot since then.

As Lotteria maintained a slight lead, KFC struggled to keep up. The US chicken brand’s market share continuously declined to 13.4% in 2024, while Jollibee dominated with 22%, followed by Lotteria at 21.5%.

The report also noted that as of the end of 2024, Jollibee, Lotteria, and KFC operated 191, 246, and 185 stores, respectively.

However, Jollibee Food Corporation’s annual report stated that they have 213 stores in Vietnam. This is the second-highest number of Jollibee stores globally, after the Philippines, with 1,279 outlets.

Considering only foreign markets, with 480 stores in total, the number in Vietnam stands out compared to 75 in the US, 60 in the Middle East, 28 in Canada, 22 in Singapore, and 21 in Brunei, among other locations.

KFC, on the other hand, has announced on its website that it operates over 200 stores.

Jollibee Food Corporation’s annual report also disclosed, for the first time, the EBITDA (earnings before interest, taxes, depreciation, and amortization) in Vietnam, amounting to PHP 904 million (approximately VND 424 billion) in 2024, a 20.2% increase from the previous year.

Excluding the home markets of the Philippines and China, Jollibee’s EBITDA in Vietnam is the highest among its markets in Europe, the Middle East, and Asia (EMEA).

Euromonitor attributed Jollibee’s success to its ability to incorporate local flavors into its menu. Signature dishes such as the crispy Chickenjoy and special spaghetti have gained popularity among Vietnamese consumers.

Additionally, the spicy chicken (Chilli Chicken) with its pungent and rich flavor has been adjusted to suit Vietnamese tastes.

Jollibee Vietnam also launched creative marketing campaigns to capture the interest and excitement of domestic customers. For instance, in December 2024, Jollibee initiated the Bee Dance Challenge on TikTok, collaborating with influential Vietnamese figures, including singer Kay Trần.

Meanwhile, facing a significant decline in market share, KFC Vietnam is pioneering sales on the TikTok social media platform.

In June 2024, KFC Vietnam leveraged TikTok to boost sales through captivating livestreams with exclusive offers and interactive content. This strategy proved successful by offering time-limited promotions, such as discounted combos and free delivery, exclusively for viewers.

The livestreams typically featured well-known Vietnamese influencers who presented the food and interacted directly with the audience, creating a sense of excitement and urgency.

This approach enabled KFC to target young customers, build brand loyalty, and drive immediate sales through TikTok’s interactive shopping features.

Young Consumers Increasingly Drawn to Fast Food

Euromonitor projected that the younger generation would drive the growth of quick-service restaurants. This aligns with the fact that young consumers are increasingly attracted to fast food as part of the Westernization of their lifestyles.

Furthermore, quick-service restaurant chains often collaborate with celebrities or popular TikTokers to enhance their appeal to young customers. The diverse menu of this model—including hamburgers, french fries, pizza, and especially fried chicken—is not only appealing but also affordable for young people.

Young consumers are increasingly attracted to fast food as part of the Westernization of their lifestyles.

In the future, online ordering and delivery services are expected to continue their strong growth, driven by the relentless advancement of technology. Major brands will focus on enhancing their online food delivery systems.

Industry leaders like Jollibee, KFC, and McDonald’s are anticipated to upgrade their dedicated apps and websites to facilitate smoother ordering experiences for customers, reducing technical glitches. Conversely, smaller brands may opt to collaborate with third-party applications like GrabFood or ShopeeFood to establish their online presence and reach a broader customer base.

The Capital’s 20,000-Billion-Dong Cable-Stayed Bridge Project Takes Flight: A Soaring Dragon Symbolizing Hanoi’s Ambition

“Introducing Hanoi’s newest landmark – the city’s second cable-stayed bridge. This stunning structure, with its sleek design and modern engineering, is a testament to the progress and development of Vietnam’s capital. Like a graceful dancer, it spans the waters, connecting the shores with elegance and strength. A true marvel to behold, it captivates all who witness its majestic presence.”

The Future of Long An: An 8-Billion-Dollar, 10-Lane Highway to Boost the Province’s Economy and Connect Its Districts

There are three investment proposals for the Tan An – Binh Hiep road project currently under consideration. The lowest proposal estimates a total investment of nearly VND 8,500 billion, while the highest proposal exceeds VND 11,100 billion.

The Rising Tide: In 2024, Vietnam’s Average Income Surges to 5.4 Million Dong

According to the General Statistics Office, the average monthly income per capita in 2024 reached VND 5.4 million at current prices, a 9.1% increase from 2023.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)