In BSC Securities’ latest market outlook update, they argue that after the Q1/2025 financial results, the VN-Index valuation remains attractive compared to historical levels, trading above -1 standard deviation (PE trailing = 12.72x). As a result, the P/B ratio is also trading near historical lows of 4 years (PB trailing = 1.64x)

In a context of multiple fluctuations, investors should focus on micro factors within businesses instead of guessing unpredictable macro factors.

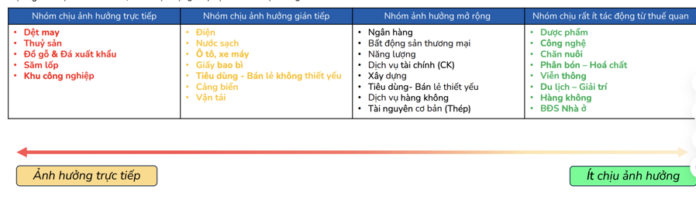

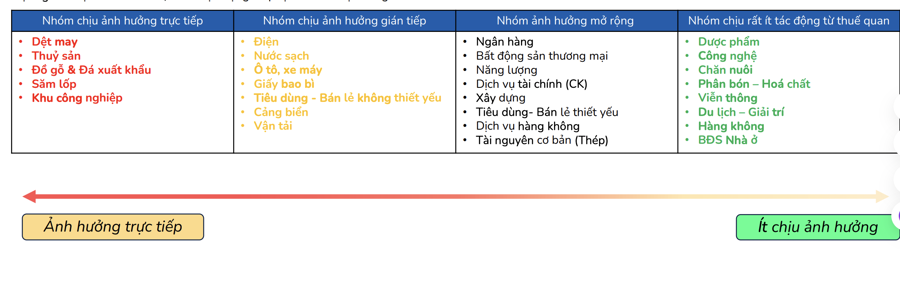

BSC provides evaluation factors and suggested investment themes for stock selection. Investors can prioritize restructuring their portfolios during the recovery phase, focusing on stocks that are less directly impacted and have solid fundamentals and attractive valuations, given the unclear tax negotiation outlook.

These groups include Pharmaceuticals; Technology; Livestock; Fertilizers – Chemicals; Telecommunications; Tourism – Entertainment; Aviation; and Real Estate.

In a positive tax scenario, investors can choose stocks directly or indirectly affected by taxes that have been deeply discounted to take advantage of the market recovery.

In the base tax scenario presented by BSC, most of the tax rates applied by the US to Vietnamese goods range from 15-25%.

This scenario is based on the fact that Vietnam’s key products are 15-20% cheaper than those in other regional countries. Vietnam also enjoys a favorable position on global maritime trade routes and has a stable business and political environment. The Vietnamese government offers numerous incentives for foreign businesses investing in the country, such as corporate income tax breaks, import duty exemptions, and land-related fee reductions.

Vietnam’s export structure is heavily FDI-driven (accounting for about 70%) with key products being computers, electronics, and components; and telephones and parts. Electronics-related exports to the US account for approximately 46% of total export value. President Trump considers the 10% tariff as a floor, and 46% as the ceiling.

Among the directly impacted industries is textiles and garments. In the event that Vietnam is subjected to taxes similar to those of its competitors like India, Bangladesh, and Indonesia, BSC believes that Vietnamese apparel companies can still retain orders due to their skilled labor force capable of producing high-value-added products with higher productivity; meeting ESG criteria; and a stable political environment. However, in the short term, order volumes may decrease due to weak current demand in the US.

Seafood: Even with the imposed taxes, BSC asserts that the competitiveness of Vietnamese catfish remains relatively strong, especially when compared to Chinese tilapia. However, in the short term, export volumes will be impacted by weak demand in the US market, as evidenced by the decline in exports during Q1/2025 and early Q2/2025.

Wood: At this tax rate, Vietnamese wood products will face almost identical taxes as Canada and lower taxes than China. Overall, the industry remains competitive in the long term, especially compared to China, the second-largest exporter of wood products to the US. In the short term, demand and orders will decrease significantly as wood products are non-essential consumer goods, and the US housing market has yet to recover with low sales figures.

Industrial Real Estate: BSC anticipates a slowdown in FDI inflows in 2025 and a continued push for supply chain diversification across multiple countries to mitigate risks. This may impact the land leasing speed of industrial real estate enterprises. However, we believe it’s crucial to monitor the negotiations between Vietnam and the US regarding the rules of origin for goods, components, and accessories, as this could encourage more positive FDI inflows due to the involvement of upstream suppliers.

Chemicals – Fertilizers: The export ratio to the US market for chemical and fertilizer companies is currently low. This group can diversify their export markets and adjust their consumption structure, thus minimizing the impact of potential US import tax increases.

Tires: The US is temporarily imposing an additional 10% tax on tires. If this measure is not extended, tires under HS codes 4011.10.x and 4011.20.x will be subject to an additional 25% tax under Proclamation 10908, applicable to all countries except Mexico. This could significantly affect the profit margins and competitiveness of tire exporters to the US.

The indirectly impacted groups include Port Logistics: With this tax rate, container volumes will only slightly decline at deep-water port clusters as they serve diverse markets and countries. On the other hand, river ports are largely unaffected as they mainly focus on the Inner Asian market.

Steel: Steel is not on the list of products subject to retaliatory tariffs. In addition to the 25% import tax, galvanized steel producers face tariffs ranging from 40% to 88%, making it challenging to compete in the US market. However, HRC manufacturers currently only bear the 25% import tax, maintaining their competitive edge and potential for export growth.

Banking: As intermediaries, banks will only be indirectly impacted by the general slowdown in economic activities such as import-export and FDI attraction. As a result, it will be challenging to achieve the State Bank’s credit growth target of >16%. The silver lining in this situation lies in measures to boost capital supply to the economy and further reduce market interest rates, similar to previous crisis periods.

Retail Consumption: Retail consumption is expected to remain stable, with income and purchasing power intact. Competition among substitute products is not too intense for essential consumer goods, while non-essential sectors continue to see differentiation across industries.

The paper industry is indirectly impacted negatively as 40% of paper consumption comes from exporting enterprises, and the industry continues to face oversupply issues.

Thailand’s Corporate Giants Eye $10 Billion Investments in Vietnam, Prime Minister Underlines Key Attraction.

Thailand’s leading corporations are committed to their long-term presence and expansion in Vietnam. With a steadfast dedication to the country, these corporations are poised to strengthen their foothold and contribute significantly to Vietnam’s economic landscape.

“Upcoming Dividend Dates: Don’t Miss Out on the 100% Cash Payout!”

There are 46 businesses offering cash dividends, with the highest being an impressive 100% and the lowest a modest 1%.